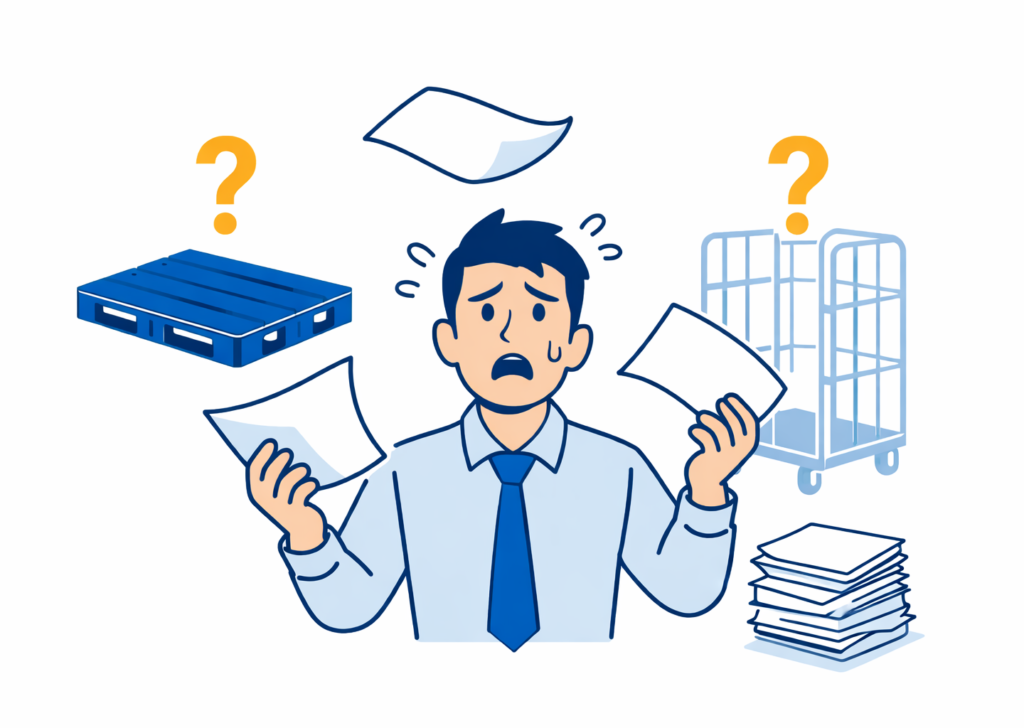

Manual handling of assets is often associated with physical movement: lifting, scanning, loading, and unloading.

In logistics operations, however, manual handling extends far beyond the warehouse floor.

It includes spreadsheet-based reconciliation, partner confirmations over email, manual validation of geo location tracking data, and cross-checking GPS tracking reports against shipment schedules.

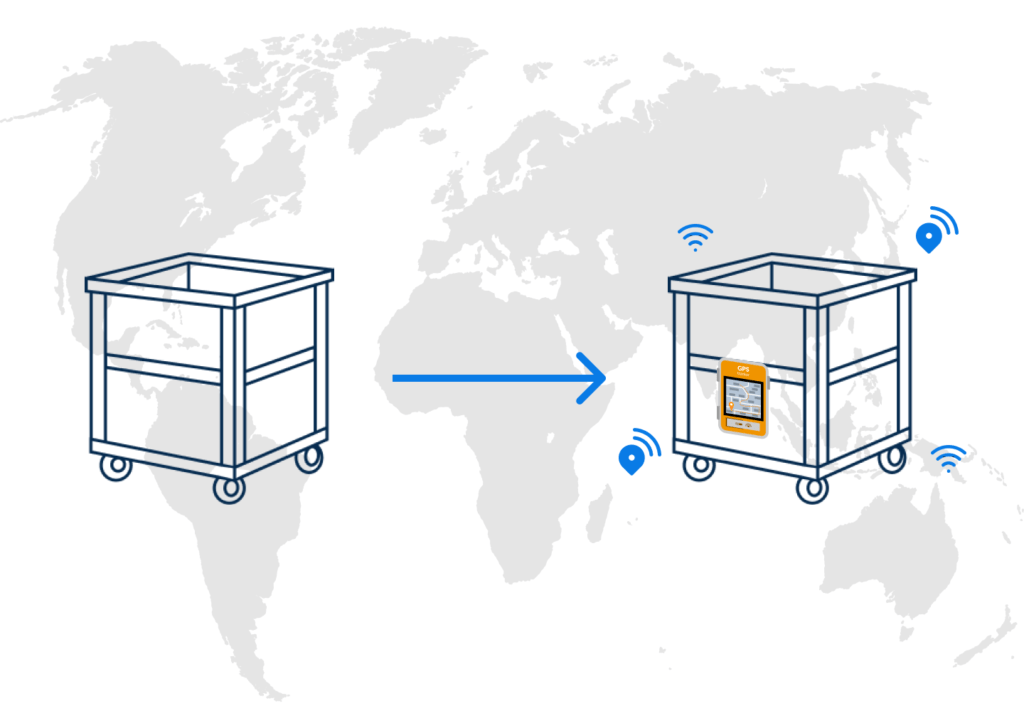

Many logistics operators today invest in asset flow tracking platforms and location-based technology to gain real-time visibility.

GPS tracking and geo location tracking have become standard tools in modern supply chains. On the surface, these technologies promise reduced loss, improved circulation, and tighter operational control.

Yet, in a surprising number of operations, core asset workflows remain manual.

- Excel sheets still sit alongside tracking dashboards.

- Teams manually verify whether a pallet shown at a specific location has actually been received.

- Custody changes are confirmed through calls or partner portals.

- Tracking data is downloaded, reformatted, and reconciled before it becomes actionable.

The technology may be advanced, but the process around it remains dependent on human intervention.

The result is not just process inefficiency but also massive financial exposure.

Relying exclusively on geo location tracking or GPS tracking without structured lifecycle management can create a false sense of control.

You know where an asset was last reported.

You do not necessarily know its condition, its custody integrity, or whether it re-entered circulation correctly. When manual handling fills these gaps, inconsistencies multiply.

Such organizations face a very difficult situation.

They invest heavily in trackers and asset tracking platforms, yet continue to experience weekly asset losses, disputes, and operational friction. Instead of eliminating manual handling of assets, technology is layered on top of it.

Understanding the financial burden of manual handling requires looking beyond physical labor.

It requires examining how much operational energy is spent reconciling data, validating movements, and correcting errors that structured systems should prevent in the first place.

What Are The Costs of Manual Handling in Returnable Asset Operations?

The financial burden of manual handling of assets rarely becomes obvious to logistics teams.

After talking to multiple heads of operations in these organizations, I’ve realized that it only becomes apparent when your asset fleet purchase bills pile up at the end of the year.

This tendency to rely on manual processes spreads quietly across teams, processes, and decision cycles. Even in operations that deploy GPS tracking and geo location tracking technologies, manual reconciliation remains embedded in daily workflows.

Here are the four types of financial impact from manual returnable assets management:

- Operational inefficiency

Asset flow tracking platforms may generate precise location data, but someone still needs to validate that information against shipment schedules, inventory records, and partner confirmations.

Teams often maintain parallel spreadsheets to reconcile what the tracking system reports with what ERP or WMS records indicate.

This creates duplication of effort and slows response time. Instead of acting on asset intelligence immediately, teams spend hours verifying whether the data can be trusted.

As asset volumes increase, this reconciliation effort scales proportionally, increasing headcount requirements rather than reducing them.

- Condition blindness & potential damage

GPS tracking and location based technology can confirm where an asset is, but they do not inherently confirm how it has been handled.

Custody transitions are frequently recorded manually within partner systems, leaving gaps in assiginig accountability. If damage occurs during transit or storage and there is no automated capture of handling conditions, the issue is often discovered only when the asset is reused or when a client reports a failure.

Without structured asset history, planning for replacements or maintenance becomes reactive rather than predictive.

- SLA breach risk

When asset lifecycle data depends on manual confirmation, organizations lack precise insight into circulation timing.

You may know that an asset left a facility, but not whether it arrived, was processed correctly, or re-entered the pool on schedule. This uncertainty affects delivery commitments and contractual obligations.

Missed reuse cycles, delayed returns, and unexplained dwell periods increase the likelihood of service-level breaches, particularly in high-volume networks.

- Sustainability & compliance risk

Returnable assets are central to circular supply chain strategies, yet reuse claims require evidence.

When asset movements and custody changes are validated manually, the resulting data trail is fragmented.

Proving asset circularity or demonstrating controlled reuse becomes difficult. In regulated environments, the absence of structured, auditable records can undermine sustainability reporting and weaken audit readiness.

Manual handling of assets amplifies risk across financial planning, operational control, service reliability, and compliance integrity.

When layered on top of GPS tracking and geo location tracking tools without structured integration and lifecycle intelligence, it can erode the very ROI those technologies were meant to deliver.

GPS Tracking Can’t Eliminate Manual Handling

GPS tracking and geo location tracking have transformed logistics visibility over the past decade.

Location based technology allows operators to identify where assets are positioned across facilities, yards, and transport routes with increasing precision. For many organizations, this was the first major step away from fully manual asset oversight.

However, location visibility is only one dimension of returnable assets tracking.

Knowing where an asset is located does not automatically clarify how it moved, who had custody, how long it remained idle, or whether it was handled within acceptable conditions.

GPS tracking systems typically generate positional updates tied to time and coordinates.

They do not inherently validate custody transitions, reconcile asset IDs across partner systems, or confirm lifecycle continuity across reuse loops.

This creates a structural gap.

When geo location tracking indicates that a pallet is present at a partner facility, teams still need to verify whether it has been formally received, processed, and logged into that partner’s operational system.

If the asset appears stationary for longer than expected, someone must manually determine whether this represents normal dwell, a missed scan, a delayed shipment, or a loss event. Without lifecycle logic layered on top of location data, interpretation remains manual.

Another limitation lies in event isolation.

GPS tracking may confirm a route deviation, but without integration into ERP, WMS, or TMS workflows, that deviation does not automatically influence procurement planning, SLA monitoring, or contractual accountability.

Teams download reports, compare timestamps, and manually assess whether operational thresholds were breached. The technology identifies anomalies, but humans decide what they mean and how they affect operations.

In high-volume networks, this interpretation burden scales rapidly.

As asset pools grow and reuse cycles accelerate, the number of location events increases proportionally.

If those events are not structured into asset lifecycle intelligence, the reliance on manual reconciliation grows alongside the technology investment.

The result is that organizations invest in advanced asset flow tracking platforms and location based technology, yet manual handling persists because the system stops at geo location rather than extending into structured asset lifecycle management.

Eliminating manual handling requires more than knowing where assets are.

It requires converting location data into integrated, decision-ready intelligence that aligns with operational systems and reuse logic.

The Need For Structured Asset Lifecycle Management

If manual handling of assets persists even after deploying GPS tracking and geo location tracking, the issue is not visibility. It is the absence of structured lifecycle management.

Structured lifecycle management begins with treating each returnable asset as a continuously tracked operational entity rather than a shipment attachment.

Instead of viewing tracking events as isolated location updates, the system maintains persistent asset identities across reuse cycles.

Each movement, dwell period, custody transition, and condition event is recorded as part of a single lifecycle history.

This approach requires much more than location based technology. It requires correlation.

- Dwell events must be measured against defined service thresholds.

- Custody transitions must align with facility codes, shipment references, and partner identifiers.

- Movement anomalies must be evaluated in the context of planned routes and expected reuse patterns.

When these elements are structured together, tracking data becomes decision-grade rather than observational.

Lifecycle management also reduces interpretation dependency.

Instead of teams manually determining whether a stationary asset represents loss, delay, or normal yard dwell, the system evaluates thresholds automatically.

So, you don’t need to reconcile spreadsheets to confirm reuse frequency, but just refer to the available historical trends from the asset lifecycle.

Instead of validating custody through partner emails, accountability is tied to time-stamped asset records.

Most importantly, lifecycle logic connects asset behavior to operational impact.

Repeated dwell breaches in a specific lane can inform procurement timing. Persistent custody mismatches can highlight structural issues within partner networks. Abnormal reuse frequency can expose leakage before it compounds.

When returnable assets tracking moves from pure geo location visibility to structured lifecycle intelligence, manual handling reduces naturally. The system begins to explain asset behavior rather than simply report coordinates.

For logistics leadership teams evaluating their current asset flow tracking platforms, the critical question is not whether location data exists, but whether lifecycle intelligence is influencing operational decisions.

If you suspect that manual reconciliation is still carrying more weight than your tracking system should allow, it may be time to reassess how structured your asset lifecycle management truly is.