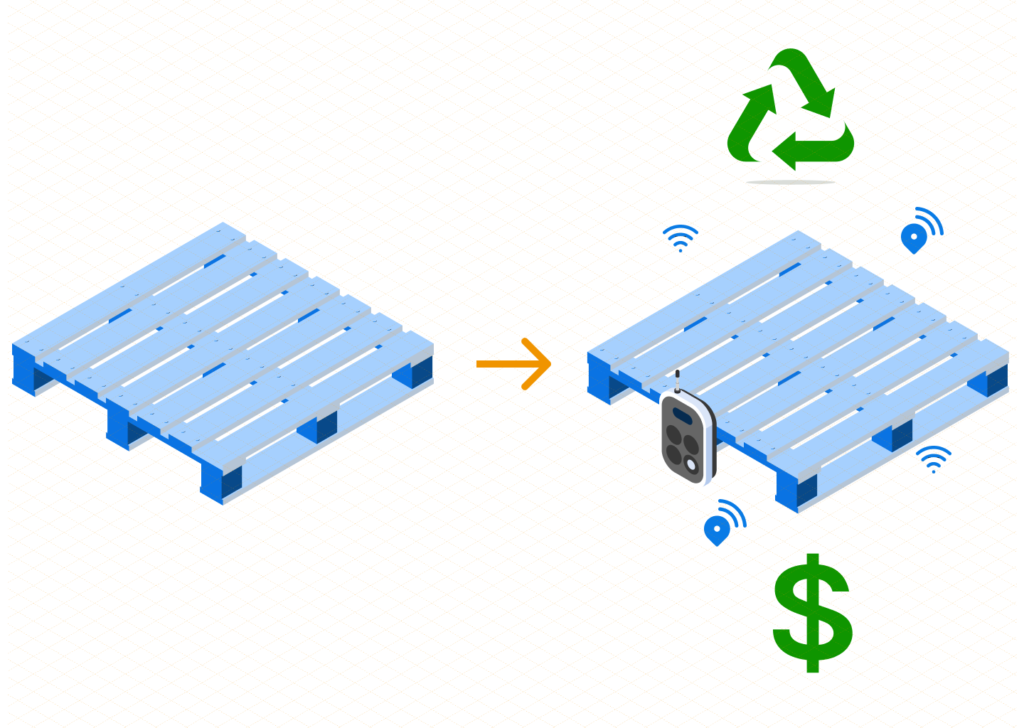

Plastic pallets were introduced into logistics networks as an upgrade for durability. They are stronger than wooden alternatives, reusable across multiple cycles, and central to modern pooling systems.

Over time, however, many organizations have discovered that durability alone does not guarantee control.

Plastic pallets do not disappear overnight; they leak gradually across transit routes, client facilities, subcontracted networks, and yard environments. The losses accumulate quietly, until annual replacement budgets begin to reflect the impact.

For operations teams, this leakage translates into shortages, emergency redistribution, and recurring procurement approvals.

For CFOs, it appears as a steady rise in returnable asset expenditure. In some networks, replacement rates for plastic pallets reach 20 to 40 percent annually, representing millions of euros in avoidable capital erosion.

The challenge extends beyond cost.

Under evolving sustainability regulations in the European Union, including the EU PPWR framework, organizations are expected to demonstrate measurable reuse, traceability, and circularity. Plastic pallets sit at the center of these expectations.

If movement history, custody transitions, and reuse cycles cannot be documented with precision, sustainability reporting becomes estimation rather than evidence.

Plastic pallet optimization is therefore not simply about preventing loss. It is about strengthening operational discipline, protecting capital investment, and aligning asset management with sustainability compliance.

Understanding where is the leakage, and how to structurally prevent it, requires moving beyond location visibility toward lifecycle intelligence and partner-level accountability.

In this blog, we examine how plastic pallet leakage impacts both operational efficiency and sustainability performance, and outline the structural measures required to optimize plastic pallet management in high-volume logistics environments.

Snapshot: Plastic Pallet Leakage Signals

- Annual replacement ratio above 20–30%

- Dwell at client sites exceeding return windows

- Custody transitions without time-stamped validation

- Manual reconciliation across partner systems

- Sustainability claims without asset-level traceability

Where Do Plastic Pallet Leakages Occur

Plastic pallet losses rarely originate from a single failure point. They accumulate across multiple transition zones within a logistics network.

Because plastic pallets are durable and reusable, organizations often assume that physical longevity equates to lifecycle control.

In reality, leakage tends to occur at predictable operational friction points.

The first and most common zone of leakage is extended dwell at client facilities.

Plastic pallets delivered with goods are often retained beyond agreed return windows, either due to internal handling delays, limited storage discipline, or lack of structured return triggers.

Without time-based monitoring, extended dwell gradually turns into untraceable retention.

The second zone appears during custody transitions between carriers, subcontractors, and warehouse operators. While shipments may be logged accurately, pallet-level accountability is frequently recorded manually or within separate partner systems.

If data structures are not aligned, discrepancies between dispatch confirmation and receipt validation create ambiguity. Over time, these ambiguities convert into assumed loss.

A third source of leakage arises within yard environments. Plastic pallets may circulate within large facilities without structured scan events tied to asset identity. Movement is operationally there & evident but not digitally recorded at the pallet level.

When inventory reconciliation finally occurs, missing units are attributed to operational noise rather than structural inefficiency.

Damage-related leakage forms another dimension.

Plastic pallets subjected to excessive handling, shock, or improper stacking may degrade gradually. Without lifecycle monitoring, damaged pallets re-enter circulation and fail later in the cycle, triggering replacement without clear attribution of cause.

These leakage zones reveal a consistent pattern. The issue is not the absence of movement visibility. It is the absence of structured lifecycle control across dwell, custody, and condition events.

Plastic pallet optimization therefore requires understanding the full asset journey – from deployment and circulation to return and reuse – rather than focusing solely on transport tracking.

Without this lifecycle perspective, the leakage with plastic pallets remains distributed across operational layers and difficult to quantify with precision.

The Financial Impact of Plastic Pallets Losses & Leakage

Plastic pallets are perhaps a higher capital investment than traditional wooden pallets. But then their durability, hygiene advantages, and suitability for closed-loop systems make them attractive for high-volume logistics networks.

However, when leakage rates rise beyond controlled thresholds, this financial advantage of higher lifecycle value and better reuse starts to diminish.

Replacement cost is the most visible impact.

In networks where 20 to 40 percent of plastic pallets are replaced annually, procurement budgets inflate steadily.

What often begins as incremental replenishment eventually becomes a recurring capital cycle that is treated as unavoidable.

Yet, a significant portion of this expenditure is driven not by true end-of-life wear, but by extended dwell, unverified custody transitions, and undetected losses.

Beyond direct replacement, leakage introduces secondary financial strain through:

- Emergency redistribution of pallets between facilities increases transport costs.

- Expedited manufacturing orders inflate per-unit pricing.

- Yard congestion caused by imbalanced circulation reduces throughput efficiency.

Each of these costs compounds quietly within operational budgets.

There is also a working capital dimension.

Excess pallets are often purchased to buffer against uncertainty in return flows.

When circulation performance is unclear, organizations expand their asset pools to avoid service disruption. This increases capital lock-in, insurance exposure, and long-term depreciation without necessarily improving utilization rates.

Taken together, plastic pallet leakage transforms what should be a reusable asset strategy into a recurring cost burden.

The problem is not the durability of the pallet itself. It is the absence of structured lifecycle control that ensures each unit completes its intended reuse cycles before replacement.

“Plastic pallet leakage is a silent source of capital erosion for your business.”

For CFOs and operations leaders, the financial case is straightforward. Reducing leakage is not only about minimizing shrinkage.

It is about restoring return on investment across the entire plastic pallet fleet.

Sustainability and EU PPWR: Why Traceability Is No Longer Optional

Plastic pallets are central to the European Union’s broader shift toward circular packaging systems.

Under evolving sustainability regulations, including the EU Packaging and Packaging Waste Regulation (EU PPWR), organizations are expected to demonstrate measurable reuse, reduced waste generation, and transparent lifecycle management of packaging materials.

Reusable transport items, including plastic pallets, are directly affected by these expectations.

The regulatory focus is no longer limited to reducing single-use materials. It increasingly emphasizes verifiable reuse performance and documented circulation.

For logistics operators and asset poolers, this means that sustainability claims must be supported by structured data rather than assumptions. It is not sufficient to state that plastic pallets are reusable.

The organization must be able to demonstrate how many reuse cycles occur, how long assets remain in circulation, and how efficiently they return to the pool.

Plastic pallets leakage disrupts this narrative.

The way plastic pallets are handled at partner locations, or at handoffs makes it extremely difficult to trace reuse rates or verify whether any asset is currently in circulation or not.

Replacement of lost pallets (through more manufacturing) increases resource consumption and transport emissions, undermining the environmental advantage that reusable pallets are meant to provide.

From a compliance perspective, fragmented records create exposure. If asset movements and reuse cycles are not traceable through structured data, any amount of sustainability & compliance reporting are just hogwash.

As regulatory scrutiny increases, this gap between operational reality and documented proof becomes harder to justify.

“Circularity without any proof creates a huge regulatory pitfall.”

Plastic pallet optimization, therefore, is not just needed for efficiency but for enabling compliance as well.

Structured lifecycle management ensures that each pallet’s journey – from deployment to return – can be documented and audited. This strengthens ESG defensibility while simultaneously reducing replacement-driven emissions and capital waste.

In the current regulatory climate, operational discipline and sustainability compliance are no longer separate objectives.

They converge at the point where asset lifecycle data becomes measurable, traceable, and enforceable.

From Losses and Uncertainty to Lifecycle Control

Plastic pallets were designed to improve durability, hygiene, and circularity within modern logistics networks.

Yet durability alone does not guarantee efficiency.

This leakage that accumulates across the network in the form of dwell delays, fragmented custody records, and inconsistent partner integration makes plastic pallets go from truly reusable assets to recurring capital drain.

The financial impact is measurable. Replacement ratios rise, working capital expands, and emergency redistribution becomes routine.

At the same time, your sustainability claims become weaker when reuse cycles cannot be documented with precision.

All of this demands structured lifecycle intelligence: time-based dwell analytics, synchronized partner data, real-time hand-off validation, and continuous reuse measurement.

When asset flow tracking platforms move from location visibility to lifecycle governance, leakage declines, capital efficiency improves, and sustainability metrics become defensible.

Logistics operators need to understand that today, operational efficiency and regulatory compliance are no longer parallel goals.

They ought to be pursued together, and they intersect where every plastic pallet has a documented lifecycle, clear accountability, and measurable reuse performance.

If plastic pallets are a material component of your asset pool and your sustainability reporting, you’ve got a structural issue to solve.

But do you know what makes solving this structural issue easier?