Your returnable assets fleet is the biggest drain on your capital.

Yeah. You heard that right.

Not your operations team, nor the vendors who overprice at times to make up their margins, not even the ever-changing regulations that add even more complexity to supply chain operations.

It is the plastic pallets, the roll cages and the extremely crucial non-powered carriers that you need to deliver goods from one place to another. This bunch is the biggest leakage in your capital budgeting every year.

And that’s the case for almost every other org which uses returnable assets to fulfill their delivery commitments.

Lack of poor visibility and improper use of asset tracking technology creates significant challenges in returnable asset management which in turn lead to multiple ways it hurts your business and eventually drains your capital.

Let’s look at how these returnable asset management challenges build a gaping hole through your finances.

(Here are some other challenges that logistics teams face with returnable asset management)

Four big capital holes from returnable asset management challenges

Managing a fleet of returnable assets without real-time visibility creates a compounding financial drain that manifests in four distinct ways.

Overinvestment in returnable assets fleet

Organizations are frequently forced into massive overinvestment, maintaining oversized “buffer fleets” to compensate for assets that vanish into the “invisibility zone” of the supply chain.

While assets are engineered for extended physical lifetime, the lack of accountability often slashes its effective operational life to just a few months. This results in a cycle where companies replace 30%-50% of their fleet annually, turning what should be a durable asset into a recurring capital leakage.

Emergency asset rentals for deliveries

When these buffer stocks still fail to meet peak demand, companies incur emergency expenditures by falling back on temporary rentals or pallet workarounds.

These manual interventions carry heavy hidden costs, including extra handling at distribution centers and inefficient reverse logistics, which quietly erode profitability on every shipment.

Sustainability & compliance risk

Poor asset control now introduces a significant sustainability and compliance risk. As the EU tightens frameworks around packaging waste and reuse, the inability to account for lost assets is shifting from an operational nuisance to a legal and reputational liability.

Failing to track these returnable items can lead to ESG reporting gaps and potential penalties as “reuse” becomes a mandated business practice.

SLA breaches and customer attrition

These internal inefficiencies inevitably lead to SLA breaches and customer attrition. In the high-frequency world of food distribution, there is zero tolerance for disruption.

When the right carriers aren’t available at the right time, deliveries are delayed and service levels drop. Ultimately, the cost of a missing asset isn’t just the replacement price – it’s the lost revenue and damaged partnerships that follow a broken delivery promise.

The Anatomy of a Finance Drain in Logistics Asset Fleet

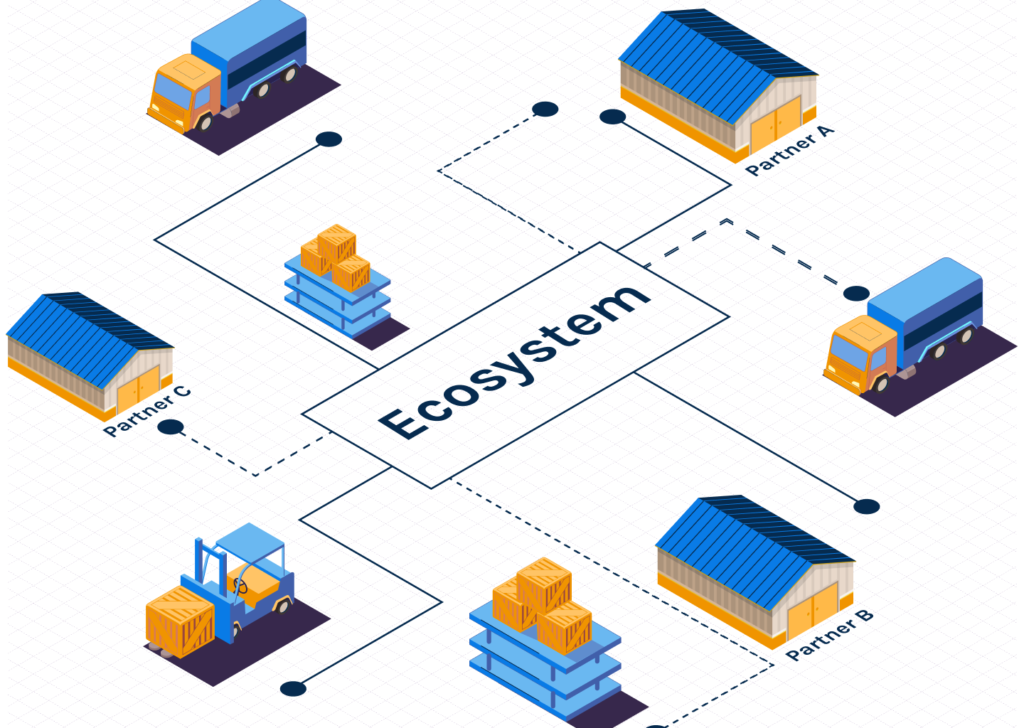

To understand how these capital holes manifest in the real world, let’s look at a typical food distribution operator in the Nordics.

Consider a company running a steady-state fleet of 15,000 roll cages to serve approximately 1,500 stores. This operation involves roughly 230,000 shipments per year, moving on a high-frequency schedule where deliveries happen every second day.

In this environment, margins are notoriously thin and there is zero tolerance for disruption.

The Reality of “Capital Leakage”

A high-quality roll cage is designed for a physical lifespan of 36 months or more, but the operational reality is much shorter.

Because there is no objective handoff record or automated accountability once a cage leaves the distribution center, assets are frequently lost, misplaced, or forgotten at store sites. In many cases, the effective lifespan drops to just 6-12 months.

The result is a staggering 50% annual replacement rate. At a unit cost of 1,500 SEK per roll cage, this creates a direct annual replacement cost of 11.25 MSEK.

This exaggerates the fact that it’s never evaluated clearly if the assets size of 15,000 is even needed to do the volumes of shipments they do. The annual replacement cost is exaggerated by this lack of visibility and uncertainty of asset lifecycle.

This is the first kind of capital leakage – money overspent simply to maintain the status quo.

The “Emergency Workaround” Cost

The financial drain doesn’t stop at excessive and exaggerated replacement costs. When cages aren’t available due to poor visibility, the operation defaults to renting pallets & cages on a temporary basis. This pivot creates a ripple effect of hidden operational costs:

- Extra financial drain: Avg EUR 3-4 per day for renting at least 1,000 assets on a rolling basis over the year. (600-800k EUR per year or 6M-8M SEK)

- Extra Handling: Manual labor increases at both the distribution center and the store level.

- Logistics Inefficiency: Reverse logistics become disorganized, and store-side congestion increases.

- Identifiable Leakage: Even if only 10% of shipments are affected, a conservative estimate of 100 SEK in incremental cost per shipment adds another 2.3 MSEK in annual inefficiency.

Other Costs

Beyond the immediate operational “firefighting,” there are several strategic costs that erode the long-term health of the business.

- Sustainability & Compliance Costs: European regulatory frameworks regarding packaging waste and reuse are increasing pressure on retailers and distributors. Not knowing where assets are or how they were lost creates a significant sustainability and compliance risk, hence chances of penalties & fines.

- Compliance Reporting Overhead: Organizations often spend excessive labor on manual audits, partner disputes, and ESG reporting overhead because they lack an automated, objective handoff record.

- SLA Breaches and Customer Churn: In a sector with zero tolerance for disruption, the unavailability of assets leads to service degradation. When delivery commitments are consistently missed due to equipment shortages, the result is partner disputes and, eventually, customer attrition and lost revenue.

When these factors are combined, the identifiable annual leakage for a typical fleet of 15,000 cages quickly exceeds 13.5 MSEK, even before accounting for the heavy annual cost of temporary rentals.

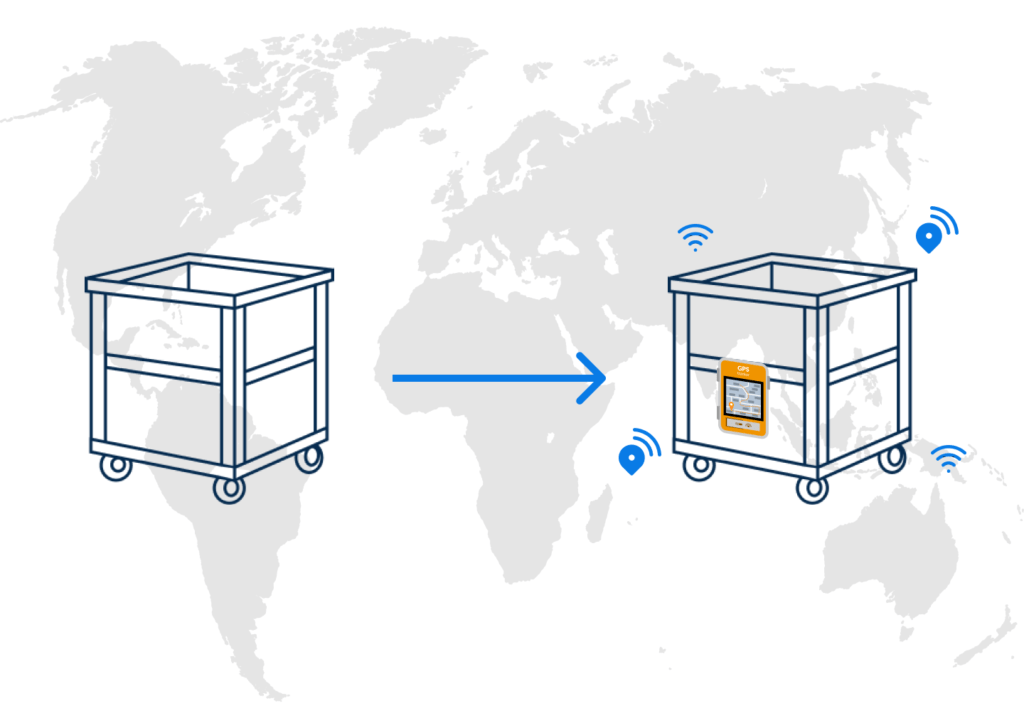

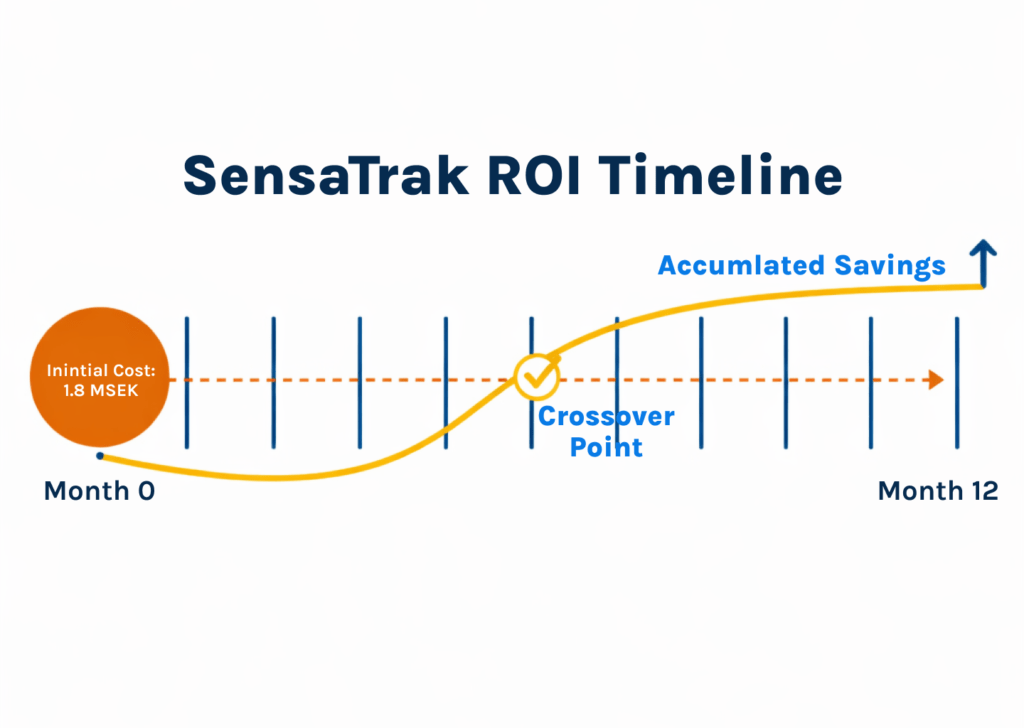

Turning Losses into Control: The SensaTrak ROI

The transition from uncontrolled capital loss to a well-managed fleet begins by relying on good data & insights than just guesses.

SensaTrak’s approach moves away from complex CapEx and depreciation models, treating asset tracking as a pure subscription-based operational expense.

For a fleet of 15,000 units, this financial control mechanism costs approximately 1.8 MSEK per year – a fraction of the millions currently lost to leakage and emergency rentals.

Why the Investment Pays for Itself

The business case for tracking is defensive and fast acting. By introducing objective handoff records and automated accountability, organizations can significantly reduce the 30%-50% annual replacement rate currently accepted as “part of the business”.

Even under conservative assumptions that only account for hard, defensible savings—such as reduced roll cage replacement and decreased pallet fallback usage—the system becomes self-financing within the first year.

12-Month Net Benefit Scenarios

Once visibility is established, the net financial impact (after the cost of tracking) demonstrates a rapid return on investment:

- Conservative (25% Loss Reduction): Achieving basic visibility results in a net benefit of +1.6 MSEK in the first year.

- Mature (50% Loss Reduction): As processes and accountability mature, the net benefit climbs to +5.0 MSEK.

- Best Practice (75% Loss Reduction): With data-driven operations, the net benefit reaches +8.4 MSEK within the first 12 months.

The Strategic Takeaway

Tracking and monitoring is a lot more than just basic operational optimization. It’s a financial control mechanism that hits straight at the foundation of any business’ survival.

The current state of things implies that the costs of asset loss are real, recurring, and a tremendous financial hole for logistics organizations.

By shifting to better assets visibility with SensaTrak, logistics providers stop “buying” their way out of shortages and start “managing” their way into profitability.

In an industry where margins are tight, turning a double-digit million SEK leakage into a net gain is a strategic necessity.