For many logistics and 3PL operations, returnable assets costs are treated as an annual inevitability.

Each year, a portion of pallets, roll cages, and specialized carriers get replaced due to loss, damage, or unexplained shrinkage. And this expense goes out of your income statement without much analysis.

In some networks, this replacement ratio reaches 30 to 40 percent of the total asset pool, translating into millions of euros in recurring expenditure.

What makes this particularly challenging is that these costs rarely appear suddenly. They pile up with daily or weekly emergency purchases and recurring inventory audits that highlight the missing assets for the shipments lined up.

They accumulate gradually through lost assets in transit, unverified custody transitions at client locations, manual reconciliation errors, and delayed detection cycles.

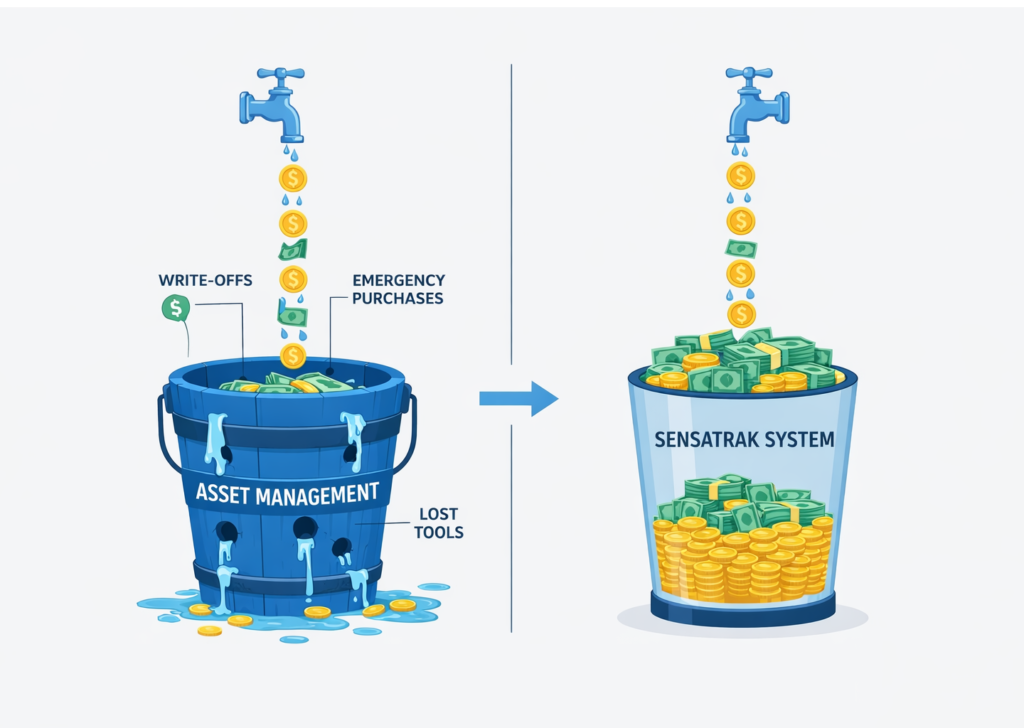

Even when asset tracking technology such as roll cages tracking systems, RLC trackers, GPS tracking, and other location based technology is deployed, many organizations continue to experience significant leakage.

The issue is not a lack of geo-location visibility. It is a lack of financial control over asset circulation.

Asset flow tracking platforms often provide real-time location data, but without structured lifecycle intelligence and integration into financial planning processes, that data does not automatically reduce replacement budgets.

CFOs reviewing annual fleet replenishment requests are left managing recurring capital expenditure without clear insight into whether asset losses are truly unavoidable or structurally preventable.

Reducing returnable assets costs requires more than knowing where assets are.

It requires identifying the specific financial levers that influence asset yield, detection speed, procurement stability, accountability, and long-term sustainability exposure.

In this blog, we break down five structural solutions that directly impact returnable assets costs – and explain why addressing them systematically changes the economics of asset tracking and management.

Snapshot

- Replacement ratios above 25% usually indicate circulation inefficiency

- Detection lag compounds capital loss across reuse cycles

- Emergency procurement inflates per-unit asset cost

- Weak partner data integration increases write-offs

- Lifecycle analytics reduces capital volatility and ESG exposure

1. Increase Asset Yield Before Expanding the Pool

One of the most common responses to asset shortages is expansion. When operations report that pallets or roll cages are unavailable at key facilities, the immediate solution often involves approving additional procurement.

Over time, this pattern becomes embedded in annual budgeting cycles. Replacement and expansion are treated as routine capital expenditure.

However, asset shortages are not always caused by insufficient volume. In many cases, they stem from inefficient circulation.

Asset yield – the number of productive reuse cycles completed per asset per year – is rarely measured with precision.

Without structured asset tracking technology that captures dwell time, custody transitions, and lane-level movement patterns, underutilization remains hidden.

Assets may spend extended periods idle at specific facilities or within partner networks, creating artificial scarcity in other parts of the system. The organization responds by increasing the pool rather than improving circulation.

For CFOs, this represents trapped capital.

Every additional asset purchased increases working capital exposure, storage costs, insurance, and long-term replacement obligations.

If 30 percent of the pool is replaced annually while a portion of the remaining assets underperform in terms of reuse cycles, capital efficiency deteriorates quickly.

Asset flow tracking platforms, when structured around lifecycle analytics rather than simple GPS tracking, can quantify actual reuse frequency, identify persistent dwell bottlenecks, and expose lane-specific leakage.

This allows leadership to distinguish between true volume-driven expansion and circulation-driven inefficiency.

Improving asset yield before approving additional purchases directly reduces returnable assets costs by maximizing the return on already deployed capital.

It shifts the financial conversation from “how many more assets do we need?” to “how efficiently are our existing assets performing?”

2. Shorten Loss Detection Cycles to Prevent Compounded Leakage

It is honestly quite obvious but not considered too often.

An asset that is misplaced, improperly logged at a partner location, or delayed beyond its expected circulation window does not immediately appear as a financial write-off.

It gradually disappears into operational uncertainty because teams realize later that a particular asset is missing.

Returnable assets, in reality, are considered mere means to deliver shipments, and they are treated just that way.

Weeks – or even months – may pass before the discrepancy is formally detected during reconciliation cycles or annual reviews.

By that point, the asset has completed zero productive reuse cycles and may have already triggered secondary consequences such as emergency purchases or buffer expansion.

For CFOs, the duration between loss occurrence and loss detection is critical.

The longer an asset remains unaccounted for, the more its financial impact compounds.

It stops generating operational value, increases perceived scarcity within the network, and distorts procurement planning.

When detection occurs late, there is no other option but to add the replacement budget to your expense sheet.

Traditional GPS tracking or location based technology can indicate where an asset was last seen, but without structured lifecycle analytics, abnormal dwell patterns and custody inconsistencies may not be flagged early enough to influence decisions.

Asset flow tracking platforms that measure time-based thresholds, detect deviation from expected circulation cycles, and integrate these signals into reporting frameworks reduce detection latency significantly.

Shortening the detection cycle limits the compounding effect of shrinkage.

It enables intervention before assets are permanently written off, improves recovery opportunities, and reduces the percentage of the pool that must be replaced annually.

Even modest improvements in detection speed can materially lower returnable assets costs when scaled across large fleets of pallets, roll cages tracking systems, or RLC trackers.

Reducing time-to-detection transforms asset loss from a year-end surprise into a manageable operational variable.

From a financial standpoint, that shift alone can reshape the trajectory of annual replacement expenditure.

3. Eliminate Emergency Replenishment Premiums

One of the most expensive components of returnable assets costs is not standard replenishment. It is emergency replenishment.

When asset shortages are identified late, procurement teams are forced to react rather than plan.

This typically results in higher per-unit manufacturing costs, expedited transport fees, and operational disruption within warehouses and yards.

In some cases, premium freight is used to restore minimum asset levels quickly enough to protect service commitments.

From a financial perspective, this creates volatility.

Budget forecasts assume steady replacement cycles, yet reactive purchasing introduces spikes that distort cost per asset and strain capital allocation planning.

The CFO is then asked to approve incremental spend outside the original replenishment assumptions.

The root cause is just plain visibility lag.

When asset tracking technology is limited to GPS tracking or basic roll cages tracking without predictive lifecycle analytics, asset shortages are discovered only after availability has already fallen below operational thresholds.

There is no forward-looking signal indicating imbalance between facilities, lanes, or partner networks.

Structured asset flow tracking platforms can identify circulation slowdowns, abnormal dwell concentrations, and lane-specific imbalances before they translate into physical shortages.

When integrated into planning workflows, this intelligence allows procurement to adjust production schedules gradually instead of issuing urgent purchase orders.

Reducing emergency replenishment does more than lower immediate costs.

It stabilizes annual capital expenditure, improves cost predictability, and reduces the hidden premiums embedded in reactive supply chain decisions.

Over time, this smoothing effect can materially reduce the overall returnable assets costs absorbed within logistics operations.

4. Establish Partner-Level Integration and a Single Source of Asset Truth

In distributed logistics networks, returnable assets move from warehouse to carrier, from carrier to client location, and back into circulation through subcontracted routes. Each transition introduces a potential break in structured accountability.

When partner systems operate independently, asset custody is recorded in silos. If these records are not aligned through a shared data index or synchronized identifiers, discrepancies become difficult to resolve.

At year-end, unresolved mismatches are written off as shrinkage and absorbed into returnable assets costs.

This is preventable.

Reducing asset loss requires partner-level integration built around common asset identifiers, synchronized facility codes, and real-time hand-off confirmation.

Asset flow tracking platforms should not merely report position; they should anchor custody transitions to time-stamped, system-recognized events that are visible across participating entities.

For CFOs, this shifts loss from an assumed operational expense to a measurable and, in some cases, recoverable variance.

Even incremental improvements in partner accountability reduce write-offs across large asset fleets, particularly in roll cages tracking environments and RLC tracker deployments where multi-party movement is common.

More importantly, a shared asset intelligence framework improves behavioral discipline across the network.

Over time, this reduces structural leakage and improves capital preservation across pooled asset operations.

5. Align Asset Efficiency with ESG and Long-Term Capital Planning

Returnable asset management is no longer just an operational matter. It sits at the intersection of capital allocation, sustainability commitments, and regulatory scrutiny. Every pallet, roll cage, or reusable load carrier that is prematurely replaced triggers new manufacturing, additional transport, and incremental carbon exposure.

When annual replacement ratios reach 30 to 40 percent of the total pool, the financial impact is immediate. The sustainability impact is cumulative.

For CFOs, this creates dual exposure. On one side, there is recurring capital expenditure tied to returnable assets costs.

On the other, there is increasing expectation from regulators, investors, and customers to demonstrate measurable circularity and responsible asset utilization.

Without structured reuse analytics, organizations cannot clearly measure how many cycles each asset completes, how long assets remain idle, or how circulation performance varies across lanes and partner networks.

Lifecycle intelligence changes that equation.

It allows organizations to identify underperforming asset categories, optimize replacement timing, and reduce unnecessary churn.

Over time, improved reuse performance lowers procurement volume, stabilizes depreciation schedules, and strengthens audit defensibility around sustainability claims. Asset efficiency becomes a capital preservation strategy rather than an operational afterthought.

For CFOs managing both financial discipline and ESG accountability, structured lifecycle management provides a unified framework: fewer replacements, lower capital volatility, and defensible circularity metrics.

Bringing Financial Control Back to Your Returnable Asset Fleet

Each of the five levers targets a specific driver of returnable assets costs. Together, they form a structured financial control framework for reusable asset pools.

Asset tracking technology such as roll cages tracking, RLC trackers, GPS tracking, and other location based technology provides visibility.

However, visibility alone does not reduce capital expenditure.

Returnable assets tracking delivers measurable impact only when asset intelligence influences procurement decisions, partner enforcement, reuse performance, and financial planning cycles.

SensaTrak is designed around this principle.

By combining lifecycle analytics, structured partner integration, and decision-ready asset flow tracking platforms, the focus shifts from monitoring movement to controlling capital exposure.

If replacement budgets continue to rise despite tracking investments, it may be time to reassess how financially aligned your asset management strategy truly is.