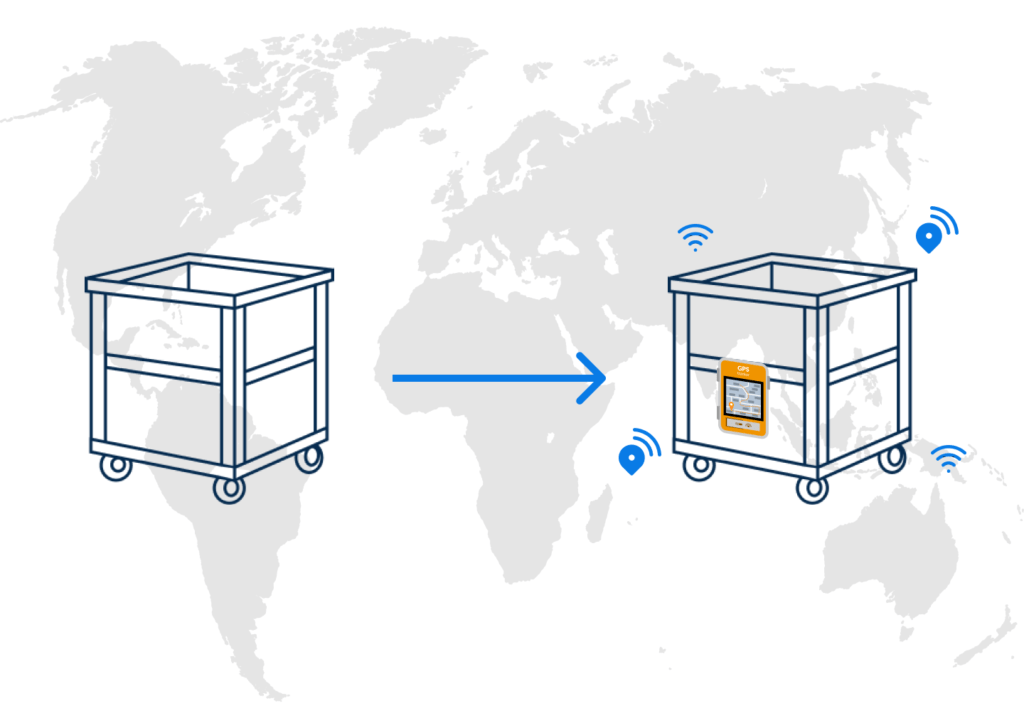

Returnable assets tracking platforms have evolved significantly.

Location insights are now precise, alerts are configurable and customizable, and IoT in warehouse management environments now capture movement, dwell time, shock, and temperature events across asset pools.

Yet, many operators still struggle to realize meaningful ROI from these systems.

And the issue is not tracking accuracy.

The real issue is the disconnect between asset-level intelligence and the systems that power business decisions.

Asset flow tracking platforms generate daily operational insights: assets exceeding dwell thresholds, unexpected custody changes, route deviations, or leakage patterns across lanes.

However, this intelligence often sits outside the ERP, WMS, or TMS systems that drive procurement, inventory planning, and financial reconciliation. Teams spend days aligning tracking data with system records before they can assess impact.

By then, the window for timely intervention has narrowed.

To be fair, many asset tracking and management solutions do provide ERP or WMS integrations at some level.

However, in practice, these connections are often limited to static exports or one-way data pushes.

Initial testing may appear successful, but over time workflow misalignment and schema gaps introduce friction.

In other cases, robust integration is available but priced high enough that manual reconciliation seems more practical.

That’s why logistics leadership teams are often wary of the real ROI that these platforms generate.

High-end IoT in warehouse management or across reusable asset pools is not the end of returnable assets tracking challenges.

It is, in fact, the beginning of a much elaborate process to make returnable assets tracking more efficient and “meaningful”.

Without structured, bi-directional integration into ERP, WMS, and TMS systems, tracking data often creates a parallel system diminishing the operational efficiencies.

Instead of accelerating decisions, it adds another layer for teams to interpret manually.

Improving ROI on returnable assets tracking depends less on collecting more data and more on ensuring that asset intelligence flows directly into the systems where operational and financial decisions are made.

In this blog, we’ll tell you tell what you should expect out of your asset flow tracking platforms in terms of integration and why that’s a huge addition to your asset tracking RoI.

Why ERP, WMS, and TMS Systems Don’t Really Capture Asset Insights

Enterprise systems such as ERP, WMS, and TMS were not originally designed to manage the full lifecycle of reusable physical assets. They were built to manage transactions, inventory states, transportation events, and financial accountability.

An ERP system primarily stores structured master data, inventory balances, procurement records, financial transactions, and ownership status.

It answers questions such as how many pallets are available in the system, what has been invoiced, what has been received, and what is contractually expected.

It does not continuously capture how long a pallet remained idle in a yard, how many reuse loops it has completed, or whether it experienced abnormal handling during transit.

A warehouse management system focuses on in-facility movement. It tracks bin locations, picking sequences, inbound and outbound confirmations, and stock accuracy within defined boundaries.

Once an asset leaves the dock, the WMS typically considers the event complete. Yard dwell time, cross-site circulation, or unstructured handling events are often outside its real-time scope.

A transportation management system manages route planning, carrier performance, freight execution, and delivery milestones.

It records shipment-level events and confirmations but rarely tracks the lifecycle of the physical carrier or pallet beyond the shipment it is attached to.

This is where asset flow tracking platforms operate differently.

Returnable assets tracking systems generate asset-centric intelligence.

They detect dwell beyond thresholds, unexpected custody transitions, movement patterns across lanes, shock or temperature deviations, and reuse frequency.

These signals are not transactional in nature. They are behavioral.

The problem is not that ERP, WMS, or TMS systems are insufficient.

The problem is that they operate on event-based logic, while asset tracking and management platforms operate on lifecycle logic. When these two logics remain separate, teams are forced to manually translate asset-level signals into system-level decisions.

For example, a pallet exceeding dwell thresholds is not automatically reflected as a procurement risk in ERP.

A history of route deviations detected by IoT in warehouse management systems does not automatically adjust inventory projections.

A custody mismatch identified by an asset tracking platform does not directly update contractual performance metrics in TMS.

Without structured integration, asset intelligence is made to exist separately from the operational systems.

This structural separation is precisely where returnable assets tracking ROI begins to weaken.

The value of insights depends on how quickly they influence decisions in core systems. If that influence requires manual reconciliation, email chains, or periodic reporting, the financial and operational benefit diminishes over time.

What Seamless Integration Means for Returnable Assets Tracking

In logistics environments, integration is often reduced to the presence of an API or the ability to export data into another system.

In practice, seamless integration is not just about the APIs or the data movement, it’s more about good, real-time and unhindered communication between systems.

And all of that without any manual intervention.

For returnable assets tracking to generate measurable ROI, integration must be structured, bidirectional, and operationally aligned.

So, essentially this is what should happen between your ERP or warehouse management systems or transportation management systems and the asset tracking platforms.

First, asset-level events should influence inventory logic inside your systems. When dwell thresholds are exceeded or asset leakage patterns emerge in a specific lane, procurement projections and buffer planning should adjust accordingly.

Integration should allow asset intelligence to inform stock availability and replenishment logic, rather than requiring separate reconciliation exercises.

Second, your systems should reflect real asset behavior beyond dock confirmations.

If IoT in warehouse management detects abnormal dwell time or repeated idle cycles in a yard, that signal should inform yard allocation strategies, asset rotation policies, or internal handling protocols.

Integration should allow asset flow tracking platforms to enhance facility-level decision making rather than operate as parallel dashboards.

Third, your systems should incorporate custody and movement anomalies into performance monitoring.

Route deviations, repeated custody mismatches, or unexplained cycle delays should be traceable within the system analytics, allowing contract performance reviews to rely on structured data rather than manual evidence gathering.

Seamless integration also implies continuity. Asset tracking and management data should persist across reuse cycles, maintaining a single lifecycle history instead of resetting at each shipment.

When integration only pushes isolated events into ERP or WMS, lifecycle visibility is fragmented and analytical value declines.

Most importantly, seamless integration reduces decision latency. When asset intelligence flows directly into the systems that drive procurement, warehouse planning, and transportation oversight, teams can act on deviations in near real time.

Without this alignment, tracking insights remain useless, requiring manual interpretation before any operational change occurs.

In practical terms, integration determines whether returnable assets tracking improves operational control or simply adds another layer of monitoring.

The difference between the two is not the quality of IoT or the precision of alerts. It is whether asset insights directly influence the systems where financial and operational decisions are executed.

The ROI Multiplier: How Integration Changes Financial Outcomes

The financial return on returnable assets tracking is often evaluated in isolation, based on reduced loss rates or improved asset visibility.

While those improvements are valuable, they do not represent the full economic impact of a well-integrated system.

The real multiplier effect appears when asset intelligence directly influences procurement, warehouse planning, and transportation decisions inside ERP, WMS, and TMS environments.

- Improving speed of fault detection

Assets exceeding dwell thresholds can trigger immediate review instead of waiting for periodic reconciliation.

Earlier detection reduces the number of reuse cycles an asset completes before a deviation is addressed. This directly lowers replacement rates and prevents major issues to compound eventually.

- Reducing buffer dependency

Many 3PL and logistics operators increase asset pools not because demand has risen, but because confidence in circulation data is limited.

When asset flow tracking platforms are connected to core inventory systems, leadership gains clearer visibility into actual availability. This allows buffer inventory to be optimized rather than inflated as a protective measure.

Even modest reductions in unnecessary asset purchases can materially improve capital efficiency across large asset pools.

- Speeding dispute resolution

When asset tracking and management data flows directly into transportation and performance systems, custody history and movement patterns become structured evidence rather than manually assembled narratives.

Claims can be validated faster, internal investigations shrink in duration, and contractual accountability improves.

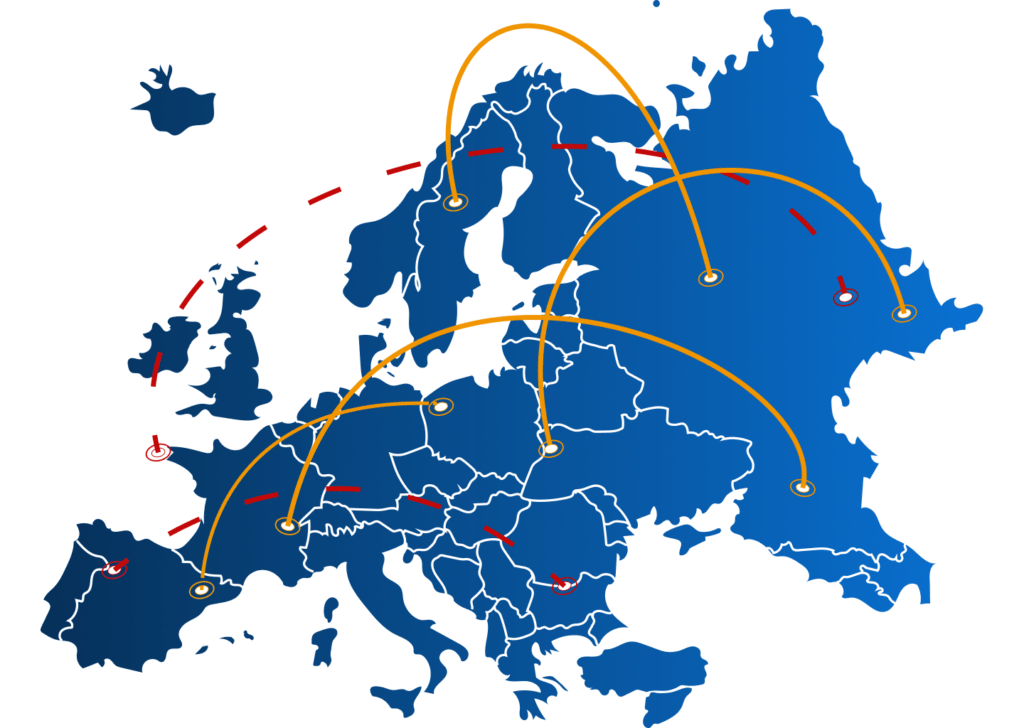

The operational savings here are often indirect but substantial, particularly in networks with frequent cross-border movement.

- Improving workforce efficiency

Without integration, teams spend time reconciling tracking reports with ERP or WMS records, aligning schemas, validating timestamps, and confirming discrepancies across departments.

When asset intelligence updates core systems automatically, that reconciliation burden decreases. The reduction in manual coordination may not appear immediately in financial statements, but it directly improves operational throughput and reduces friction across teams.

- Supporting better decision making

Ultimately, integration transforms returnable assets tracking from a monitoring tool into a decision-support mechanism.

Instead of generating insights that require interpretation and translation, it enables asset intelligence to influence financial planning, procurement timing, warehouse operations, and carrier performance evaluation in real time.

That shift – from observational data to operational control – is where you really see the full RoI from these asset flow tracking systems.

How SensaTrak Approaches ERP, WMS, and TMS Integration

SensaTrak’s integration model is built around structured, event-driven synchronization rather than simple data exports.

Asset-level telemetry – such as dwell breaches, custody transitions, movement anomalies, and condition deviations – is normalized to align with ERP master data, facility hierarchies, shipment references, and asset IDs.

This prevents schema conflicts and ensures that tracking data can directly reconcile with inventory, procurement, and financial records.

Integration supports bidirectional API communication.

Asset events can trigger updates inside ERP, WMS, or TMS workflows, while core system data – such as location codes, carrier identifiers, and asset classifications – feeds back into the tracking layer to maintain referential integrity across reuse cycles.

Instead of operating as a parallel monitoring layer, SensaTrak embeds returnable assets tracking intelligence directly into transactional systems.

As we have explained earlier, when asset data influences procurement timing, warehouse allocation logic, and transportation performance evaluation in near real time, your team gains tremendous operational control.

That shift is what ultimately determines the real returns from your investment in asset flow tracking systems like SensaTrak.

If you want to evaluate how integration is impacting your returnable assets tracking ROI today: