Data fragmentation in returnable asset management is typically seen as a technology failure, but often turns out to be a structural consequence of how modern logistics networks are built. Returnable assets move continuously between shippers, warehouses, carriers, 3PLs, pooling partners, and customer sites, but the data that describes those movements remains trapped inside partner-owned systems, designed for internal execution rather than shared visibility.

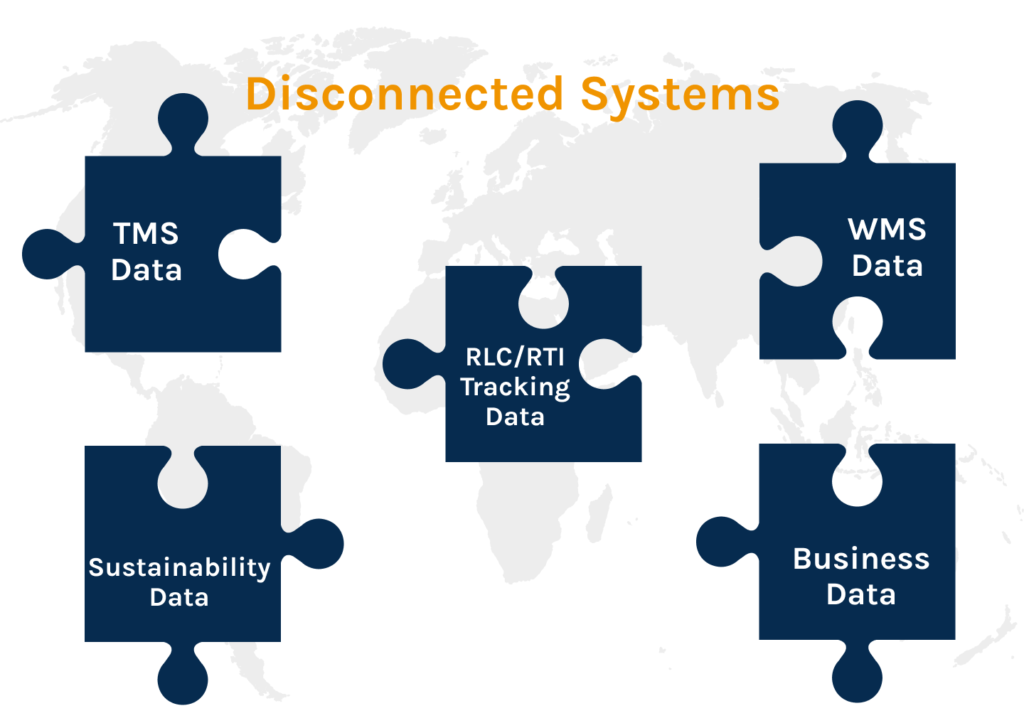

Each partner typically runs their own WMS, TMS, ERP, or asset-tracking workflow. As a result, asset events are logged independently, often using different identifiers, timestamps, and definitions. Over time, logistics integration becomes fragmented. Instead of a continuous asset lifecycle, organizations are left stitching together partial records to understand where assets are, how long they stay idle, or who last had custody.

This challenge is amplified at handover points. Research from McKinsey highlights that mid-mile and last-mile logistics handovers are among the largest sources of waste and inefficiency in supply chains precisely because data does not transfer cleanly between parties. When RLCs/RTIs change hands faster than systems exchange data, delays, misclassification, and manual reconciliation become inevitable.

For returnable asset tracking, these gaps directly translate into loss, underutilization, and poor accountability.

Unlike shipments, which complete a single journey, pallets, containers, and roll cages must be tracked across dozens or hundreds of movements. Because when asset data remains fragmented across partner systems, organizations lose the ability to measure dwell time, reuse efficiency, or return compliance accurately. In practice, data fragmentation emerges as an architectural problem caused by disconnected systems and unaligned data ownership across partners.

Without a shared layer to normalize, contextualize, and govern returnable asset data, organizations remain reactive, relying on manual reconciliation rather than achieving true end-to-end visibility.

Impact of Data Fragmentation on Returnable Asset Networks

The first casualty of data fragmentation in logistics is operational clarity. Logistics teams lose the ability to answer basic questions about their returnable asset fleets: where assets are, how long they remain idle, when they are due to return, or which partner last had custody. When teams cannot trust utilization or turnaround metrics, they compensate by procuring additional pallets, containers, or roll cages to protect service levels. Over time, this defensive behavior and decision bottlenecks drive RLC/RTI fleet overinvestment while still failing to eliminate shortages at critical locations.

Data fragmentation also weakens accountability across multi-partner environments. In fragmented systems, custody transfers are often inferred rather than recorded definitively. When assets are delayed, damaged, or lost, responsibility becomes difficult to assign. Poor data continuity between partners is a major contributor to hidden inefficiencies, particularly in asset-heavy supply chains where delays and miscommunication compound across handoff points.

This leads to prolonged disputes between shippers, 3PLs, pooling providers, and customers, increasing administrative overhead and eroding trust. From an analytics standpoint, fragmented data limits both insight and foresight. Inconsistent timestamps, data duplication, missing events, and siloed datasets prevent analytics platforms from building reliable baselines for utilization, dwell time, or lifecycle performance.

As Gartner’s research highlights, logistics organizations increasingly struggle to extract value from their data because KPI reporting is fragmented across systems, undermining decision-making and slowing digital transformation. This directly impacts the ability to forecast asset demand, plan maintenance, or optimize return loops.

The impact of data fragmentation extends beyond efficiency into compliance and sustainability. Fragmented asset data makes it difficult to produce reliable records for reuse cycles, loss rates, or lifecycle tracking, all of which are increasingly required for ESG disclosures and regulations such as PPWR. When reporting depends on manual consolidation from multiple partners, data accuracy suffers and audit readiness declines. Predictive analytics and AI integrations cannot compensate for fragmented inputs; without clean, contextualized asset data, optimization and sustainability compliance initiatives stall before they deliver measurable value.

Observability vs. Tracking: What Multi-Partner Asset Networks Need

Most logistics organizations attempt to solve data fragmentation through common asset tracking and data integration methods: point-to-point system connections, EDI feeds, partner portals, or periodic data exports. While these approaches appear sufficient during pilots or limited deployments, they begin to fail as soon as returnable asset networks expand across more partners, locations, and asset types.

The core limitation is architectural. Point integrations connect systems in isolation, but they do not create a shared, end-to-end view of asset activity. Each system continues to operate with its own data model, event definitions, and update frequency.

Another reason for logistics integration failure is governance. In multi-partner environments, no single organization owns the full returnable asset lifecycle or the data standards that describe it. Each partner prioritizes its internal KPIs, leading to inconsistent event definitions, missing fields, and conflicting timestamps. As returnable assets cross organizational boundaries, integration logic becomes brittle, expensive to maintain, and increasingly difficult to scale. Instead of reducing data fragmentation, integrations often multiply it.

Logistics networks already have some form of tracking in place. Despite this, teams still struggle to explain why assets are delayed, where utilization breaks down, or which partner interactions cause repeated losses. This gap exists because tracking answers where something is, while observability explains how, why, and under what conditions assets move through the network.

Observability addresses this by stitching together asset signals across systems, partners, and locations into a coherent lifecycle view. It introduces three critical capabilities that traditional tracking lacks. First, it normalizes data across partners by aligning timestamps, identifiers, and event definitions. Second, it enriches raw signals with operational context such as custody status, asset condition, dwell thresholds, and SLA expectations. Third, it enables analytics to detect patterns rather than isolated incidents.

In multi-partner networks, solving data fragmentation requires an observability layer that sits above them, correlating asset data across organizational boundaries and delivering a shared, trusted view of asset behavior. Observability enables logistics teams to move from reactive exception handling to proactive control by identifying systemic issues such as recurring return delays, underutilized asset pools, or partner-specific loss patterns.

How SensaTrak Reduces Data Fragmentation Without Replacing Existing Systems

SensaTrak is designed specifically to function as an observability layer that connects fragmented data streams without disrupting existing operational workflows, ingests asset data from multiple tracking technologies, and integrates with partner systems to give you a unified view of your supply chain operations.

Whether asset events originate from RFID gates, BLE beacons, GPS/LTE trackers, or partner-provided feeds, our platform normalizes these inputs into a consistent asset-event model. This allows plastic pallets, containers, and roll cages to retain a single identity across warehouses, transit lanes, 3PL facilities, and customer sites, even when underlying systems use different identifiers or timestamps.

Beyond ingestion, SensaTrak contextualizes returnable asset data. This context is critical in multi-partner environments where responsibility shifts frequently. Instead of inferring accountability after an issue occurs, logistics teams gain a clear, timestamped view of asset handovers and behavior across the network.

The analytics layer then converts this unified data into actionable insight. Rather than showing isolated location pings, SensaTrak highlights patterns such as recurring return delays, underutilized asset pools, partner-specific loss trends, and excessive dwell at specific nodes.

Importantly, our approach avoids forcing partners into rigid integrations or shared system ownership. SensaTrak does not replace partner tools or dictate how they operate. Instead, it provides a neutral layer where asset data can be aligned, governed, and analyzed collectively.

By reducing data fragmentation at the asset level, SensaTrak allows logistics networks to move from fragmented tracking toward shared observability. The result is not just better visibility but a foundation for accountability, predictive optimization, and compliance-ready reporting.