Returnable assets, also referred to as Reusable Transport Items (RTIs), form the operational backbone of the logistics industry. If these assets stop moving from point A to point B, large parts of the global supply chain would slow down or come to a halt.

Their timely movement, availability, and physical condition directly determine whether goods can move efficiently from factory to yard, from yard to ship, from ship to depot, from depot to warehouse, and finally to distribution centers and end customers. In many logistics networks, RTIs are not just supporting equipment; they are critical enablers of day-to-day operations.

Despite their importance, returnable assets, particularly plastic pallets often create the greatest friction in logistics operations. These challenges of returnable assets are not limited to the fact that they are harder to manage or that they go missing over time.

Poor visibility and weak control over RTIs introduce persistent cost pressures, complicate sustainability efforts, and directly impact delivery performance and service level agreements. When assets are unavailable or in the wrong condition at the wrong time, the effects ripple across planning, procurement, and customer commitments.

Assets such as plastic pallets and roll cages are used in large volumes across supply chains, which makes them particularly vulnerable to damage, misplacement, and unplanned loss. In parallel, specialized carriers and containers used in regulated or sensitive industries are significantly more expensive and often subject to stricter handling and compliance requirements.

When these assets are delayed, damaged, or written off, the financial and operational impact is magnified. Teams are forced to compensate through emergency procurement, manual coordination, or conservative over-stocking, all of which add cost without improving control.

This blog is written for logistics teams that work with returnable assets every day and feel the operational strain firsthand.

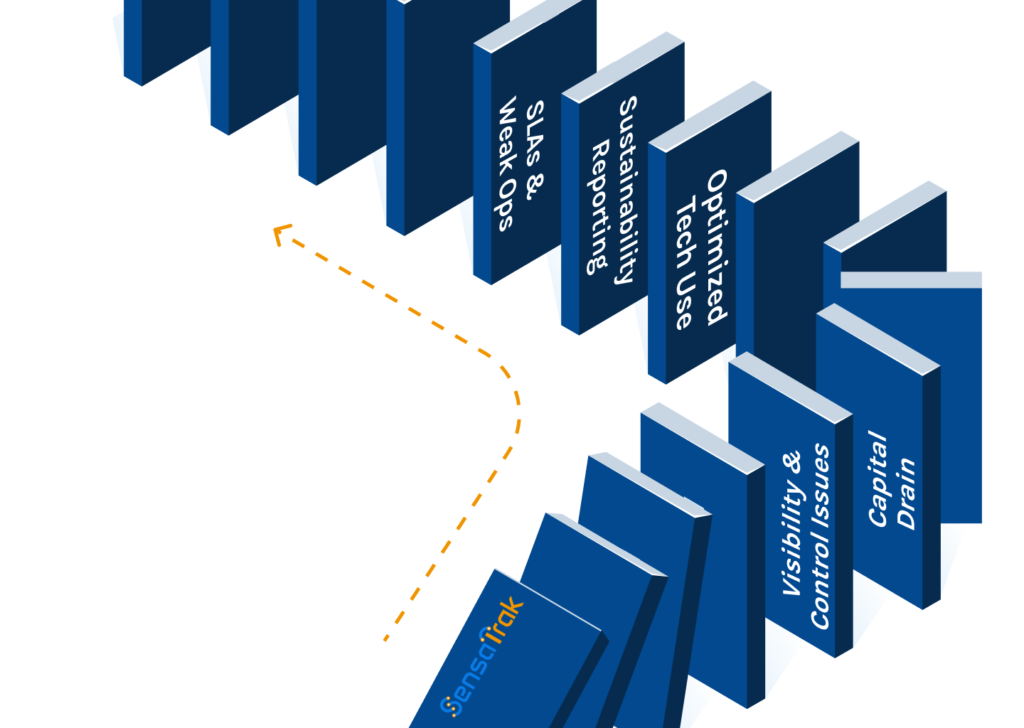

It examines five structural challenges that consistently affect returnable asset operations, from visibility and cost management to technology limitations, compliance pressures, and service delivery.

Understanding these challenges clearly is essential before any meaningful improvement in returnable asset performance can be achieved.

What Are The Major Challenges of Returnable Assets?

#1: Limited Visibility and Control Over Returnable Assets

The first and most persistent challenge in returnable asset operations is the lack of consistent visibility and control across the logistics network. While shipment visibility often gets attention, reusable transport items such as pallets, crates, and containers rarely enjoy the same level of tracking once they leave controlled facilities.

That’s because most supply chains struggle with fragmented data systems, inconsistent real-time tracking, and limited collaboration across partners – all of which inhibit full visibility into where assets are, how long they remain idle, and who is responsible for them at any given point. This isn’t unique to RTIs: fragmented data and poor real-time tracking are well-recognized barriers to achieving meaningful end-to-end visibility in logistics operations.

Across most operations, asset location data lives in disparate systems – WMS, TMS, ERP, partner portals – each capturing isolated snapshots rather than a continuous lifecycle view. Additionally, most of the asset tracking solutions only track location & basic metrics and don’t really give complete visibility into the asset movement & lifecycle.

The result is that logistics teams are forced to reconcile spreadsheets, rely on periodic audits, and make planning decisions based on incomplete information. Without unified visibility, control remains elusive: teams cannot enforce accountability across partners, detect bottlenecks early, or optimize reuse cycles.

#2: Overinvestment and Poor ROI from Returnable Assets

When visibility breaks down, overinvestment in returnable assets becomes the default response.

Logistics teams compensate for uncertainty by buying more plastic pallets, roll cages, and specialized carriers than they actually need, simply to avoid disruptions. These buffers help teams respond to usual deliveries when assets go missing or come back with unknown delays.

The ROI calculation from returnable assets further becomes a hard call because of the premature write-offs. Assets are written-off way before their actual expected lifecycle – because they are just not found.

This makes returnable assets a capital sink rather than a reusable resource, tying up working capital while masking the real causes of shortages, delays, and idling inventory.

#3: Technology That Tracks Location, Not Asset Reality

Most logistics teams already use some form of asset tracking solutions. The problem is that this technology is largely built around location updates, not around how assets actually behave in operations.

Basic GPS pings, scan events, or gate reads confirm that an asset was seen at a place and time. They do not explain how long the asset stayed there, how it was handled, whether it was reused, damaged, or waiting idle, or why it failed to return on time. As a result, teams can see movement but cannot understand performance.

This gap becomes more visible in complex networks. Assets move through warehouses, yards, transport lanes, subcontractors, and customer sites, often switching custody multiple times. Tracking systems capture isolated events inside specific systems, but they fail to connect those events into a continuous lifecycle view of the asset.

Without context around dwell time, condition, and handling, tracking data remains operationally shallow. Logistics teams are left reacting to exceptions instead of preventing them, and technology investments fail to deliver the control and accountability they were expected to provide.

#4: Compliance, Sustainability, and Reporting Pressure

Returnable assets now sit directly in the path of global sustainability and compliance requirements. Regulations such as the EU Packaging and Packaging Waste Regulation (PPWR), Extended Producer Responsibility (EPR) frameworks, and similar reuse-focused mandates across regions increasingly expect logistics teams to demonstrate reuse, lifecycle performance, and loss reduction with evidence, not assumptions.

In practice, most organizations struggle to produce this data. Asset movements are fragmented across systems, reuse cycles are not consistently measured, and condition data is rarely captured at scale. Reporting is often assembled manually after the fact, making compliance slow, costly, and reactive, especially for assets that move across multiple partners, regions, and cross-border networks.

When reliable asset-level data is missing, sustainability reporting is merely guesswork. Reuse rates are inferred, losses are written off without clear attribution, and compliance teams operate with incomplete records.

As regulatory scrutiny increases under PPWR, EPR, and circular economy mandates, the lack of auditable visibility over returnable assets turns into both an operational risk and a financial liability.

#5: SLAs, Operational Efficiency, and Customer Delivery

Good service delivery in logistics are tightly linked to the availability and condition of returnable assets. When plastic pallets, roll cages, or specialized carriers are delayed, damaged, or unavailable, the impact shows up evidently in SLA failures in terms of missed dispatches, slower turnarounds, and broken delivery commitments.

Usually, teams do not know which assets are available, where they are held up, or whether they are fit for reuse. This forces last-minute workarounds such as expedited shipments, asset substitutions, or manual coordination across teams and partners, all of which reduce operational efficiency.

From the customer’s perspective, the cause is irrelevant.

Late deliveries, inconsistent service, and unpredictable availability erode trust, regardless of whether the issue originated from a missing pallet or a delayed truck.

Without clear visibility and control over returnable assets, logistics teams absorb the cost of inefficiency while customers experience the outcome as poor service.

How SensaTrak Addresses These Challenges

At SensaTrak, we look at returnable asset management through an observability and AI lens rather than basic location tracking.

Our analytics dashboards create a continuous, asset-level view that connects movement, custody, dwell time, condition, and utilization across the network, helping logistics teams replace assumptions with operational evidence.

By combining tracking hardware with a centralized analytics platform, SensaTrak unifies fragmented asset data and supports better control, clearer ROI, compliance-ready reporting, and more reliable service levels.

The next five blogs in this series will break down how each of these challenges is addressed in detail.