Every supply chain operation sits on an infrastructure of returnable assets. Among all the different types of returnable transport items (RTIs), plastic pallets form the bloodstream of logistics, powering distribution lines across multiple industries. Global pallet circulation exceeds billions, with hundreds of millions in active rotation. Yet, despite the scale and change of material, pallets remain one of the most loss- and damage-prone assets in logistics.

Plastic pallets replaced wooden ones for a reason. They offer dimensional accuracy that works perfectly with ASRS systems, simplifies maintenance and conveyor automation, and eliminates common issues associated with wooden pallets. A 2018 study found that on average plastic pallets can complete 200 cycles per lifetime, compared to just 11 typical wood units.

From a sustainability perspective, longer lifespans and closed-loop recyclability give plastic pallets an edge in carbon efficiency. A recent lifespan study of plastic pallets found the mean time to failure among polyethylene (PE) plastic pallets was around 9.6 years, and among polypropylene (PP) pallets, approximately 3.2 years, highlighting material- and management-dependent longevity.

But plastic doesn’t mean it is indestructible. Because these pallets are harder to repair than wood, damage in handling zones and returns directly affects service life. In high-turnover 3PL and warehouse environments, poor tracking or late recoveries often mean perfectly reusable pallets are written off simply because their location is unknown.

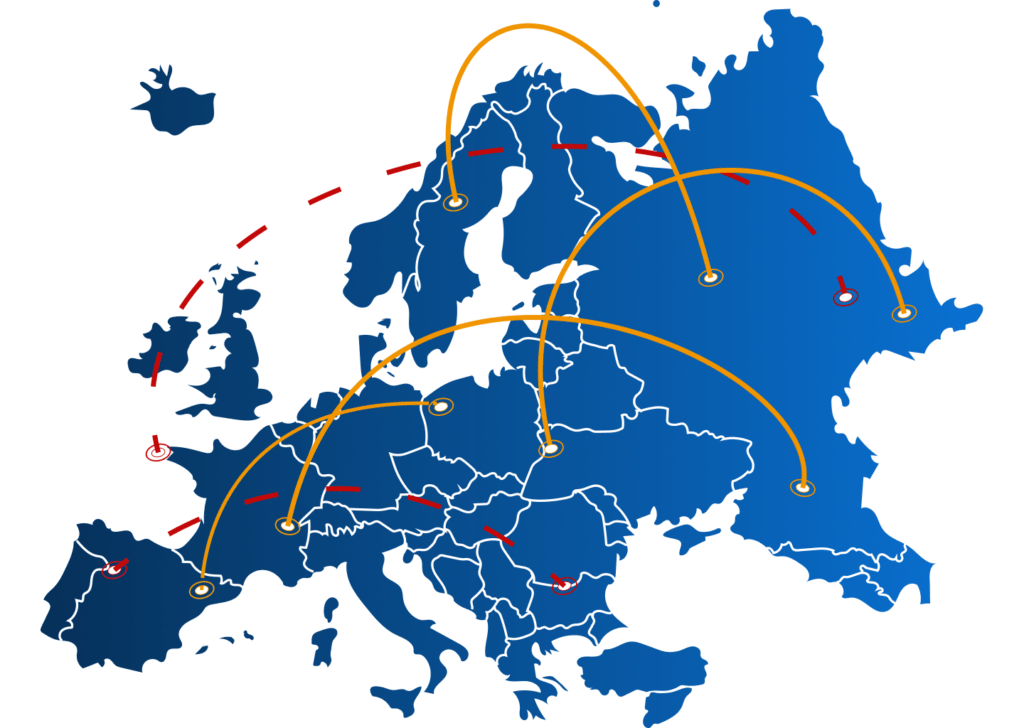

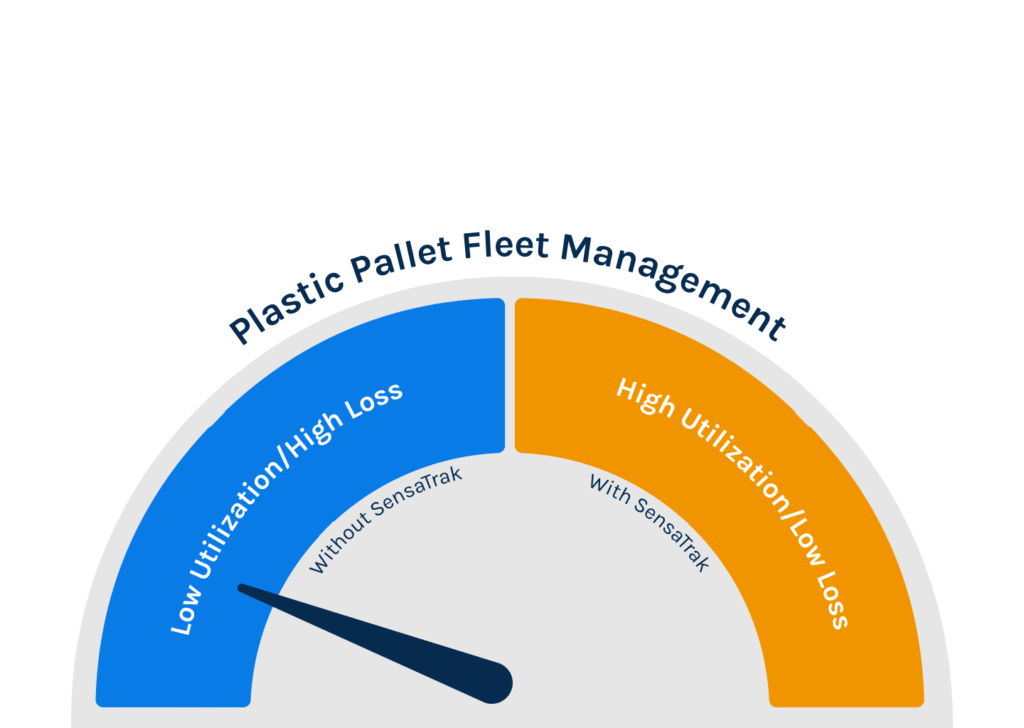

Every missing or damaged unit eats into already tight logistics margins, and attrition rates in some networks exceed 10-15 percent annually, mostly because assets slip through untracked partner sites or sit idle in reverse loops.

In this blog, we examine how plastic pallets become a persistent management issue without observability and how a shift in approach to returnable asset management will help separate efficient, sustainable supply chain networks from those constantly absorbing losses.

Implementing Returnable Assets Visibility Measures That Work for Plastic Pallets Management

Managing plastic pallets at scale requires a layered technology stack that mirrors how these assets actually move through the supply chain: fast, across multiple systems, with frequent custody changes and long periods where no human touches them.

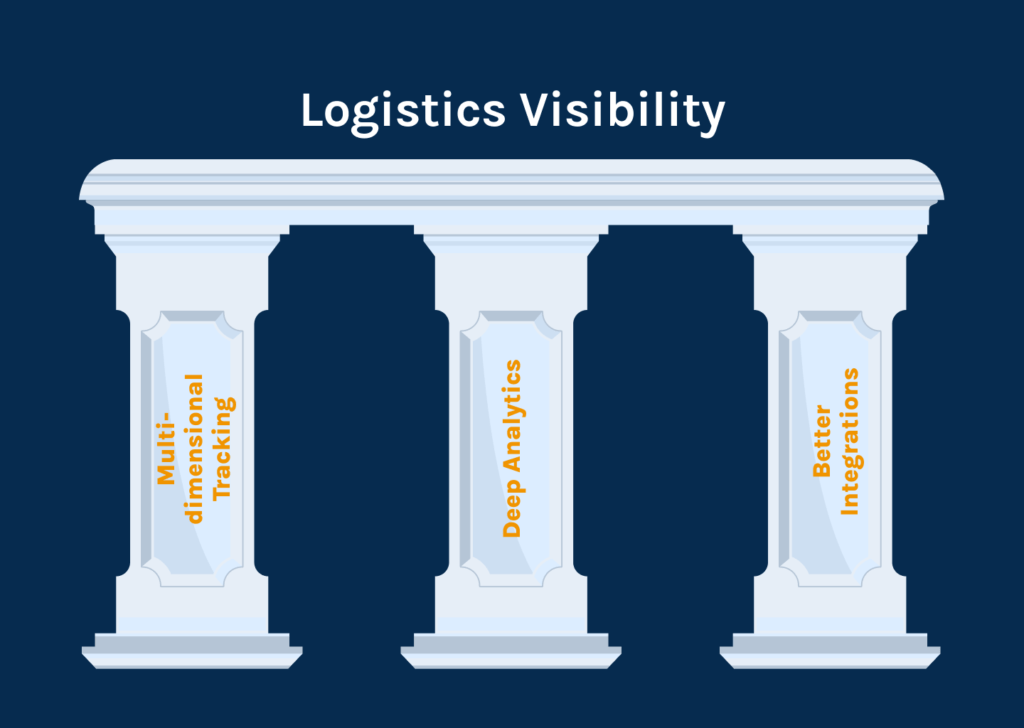

Plastic pallets deliver their full economic and sustainability value only when organizations can see where they are, how they move, and when they return. Better visibility architecture within returnable asset management solutions allows supply chains to lower loss rates and improve pallet-utilization efficiency.

Whether through RFID/UHF, BLE tags, or serialized barcodes, each plastic pallet should have a persistent digital identity that follows it across warehouse, yard, and customer sites. RLC/RTI fleets with per-asset identification maintain significantly lower loss rates, often below 5%, compared with 10–15% in untracked networks.

This eliminates the visibility gap where pallets go missing between checkpoints, typically the highest attrition point in 3PL or pooling models. For example, blue-chip FMCG and beverage companies using BLE/UWB indoors report a 20–30% reduction in search time and better cycle-time predictability.

Apart from positional tracking, custody-transfer logging also ensures plastic pallets are not misplaced when they are moving through the different zones. This model, used widely in pallet pooling and RTI-intensive industries like pharma cold chain, enables:

- Faster recovery of overdue pallets

- Evidence-based SLA enforcement

- Identification of loss-prone routes and locations

It removes the need for manual chain of custody records during handovers, which are more error-prone. Custody analytics are also critical for compliance frameworks (EPR, CSRD, PPWR) that require demonstrated reuse cycles and return performance.

High-performing plastic pallet fleets also treat dwell times as a KPI. This helps logistics teams systematically reduce unproductive pallet time by managing return windows proactively. This is important because even modest dwell optimization (1–2 days faster return cycle) can reduce fleet size requirements by 10–15%.

Finally, the requirement of integration to enable returnable asset fleet observability. All logistics operations today are dependent on multiple processes and subsystems running simultaneously. ERP for finance and procurement, WMS for warehousing, TMS for transport, multiple third-party services, etc. Each of these systems should talk to one another, exchanging data seamlessly across departments and partners, but they are often misconfigured, leading to data silos, which cause daily disruptions.

True interoperability requires consistent data models, open connectivity, and operational alignment that ensures every asset-related event is captured once and understood everywhere.

It demands technical alignment, data governance, and incremental adoption supported by the right architecture and expertise. A centralized logistics observability platform, like SensaTrak, aggregates all that information, correlating asset data, network events, and system health through a unified approach. Once standardized, any system can interpret and act on that data, enabling end-to-end visibility.

SensaTrak’s Unified Approach to Returnable Assets Management

Supply chain operations struggle because their returnable asset data doesn’t connect, contextualize, or drive action. SensaTrak closes this gap through a platform-first approach that unifies tracker telemetry, real-time visibility, and predictive analytics.

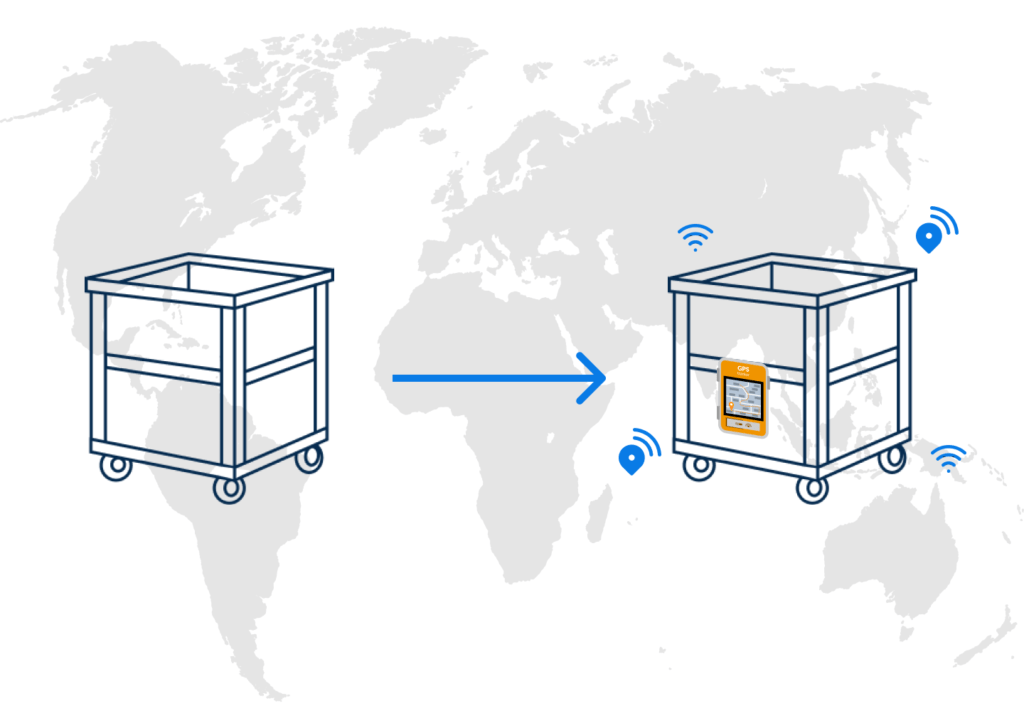

Our trackers fit directly onto existing plastic pallets, roll cages, and containers, ensuring continuous monitoring across warehouses, transit routes, partner sites, and reverse loops. The platform integrates existing WMS, TMS, and ERP systems with minimal operational downtime and builds predictive models from historical movement patterns to stay ahead of disruptions.

Beyond visibility, SensaTrak’s modular approach gives logistics teams the control required to right-size fleets, prevent overinvestment, avoid theft, and extend returnable asset life. The analytics engine, along with AI/ML integrations, reconciles movement, condition, and asset availability data into a single utilization view.

This enables organizations to maintain accurate active-fleet counts, reduce unnecessary replacement purchases, and demonstrate quantifiable sustainability performance. Through this approach, we deliver a leaner, more accountable, and more resilient returnable asset fleet operation built on continuous observability.