Specialized carriers move goods that tolerate very little ambiguity. Unlike plastic pallets or roll cages, specialized carriers are designed to protect products from temperature excursions, humidity exposure, shock, vibration, and contamination.

Pharmaceuticals, chemicals, and regulated materials need to arrive within defined temperature ranges, handling thresholds, and exposure limits.

Thereby, the value of specialized carriers lies in their ability to preserve product integrity across long, multi-party supply chains. And that makes asset condition monitoring for these RTIs a foundational requirement.

Market data shows sustained growth (projected market size of USD 598.08 billion by 2035) in temperature-controlled and condition-sensitive logistics, driven largely by pharmaceuticals, chemicals, FMCG, and biologics. For 3PL providers operating at scale, asset condition monitoring is fundamental to managing cost, risk, and accountability.

But the sector is still plagued by consistent operational gaps, which often become systemic and lead to catastrophic failures.

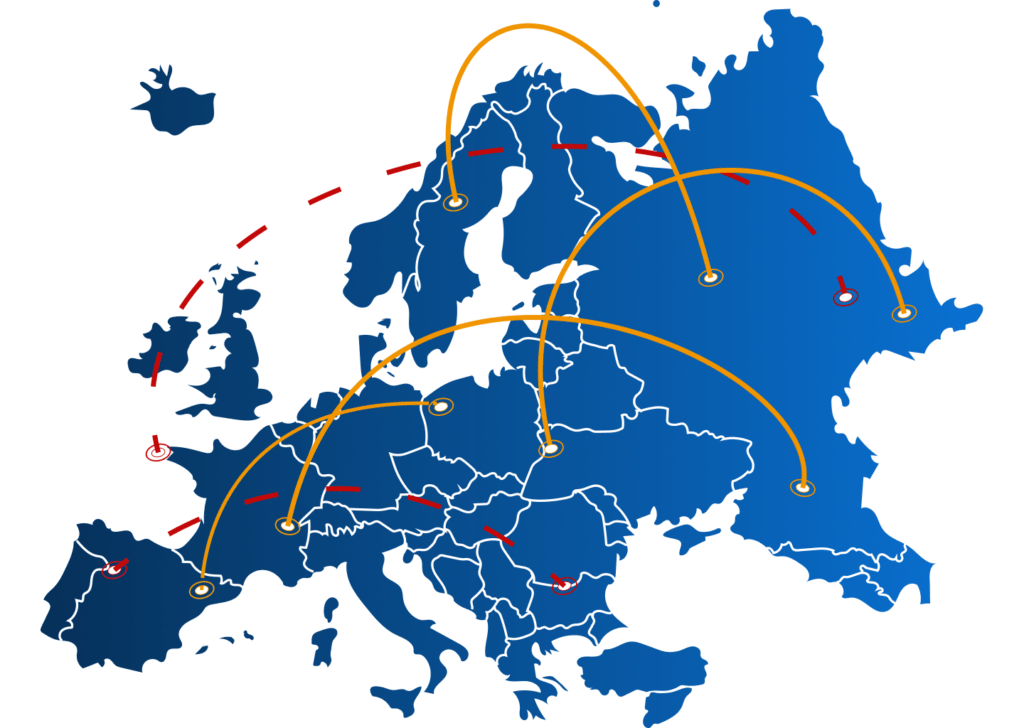

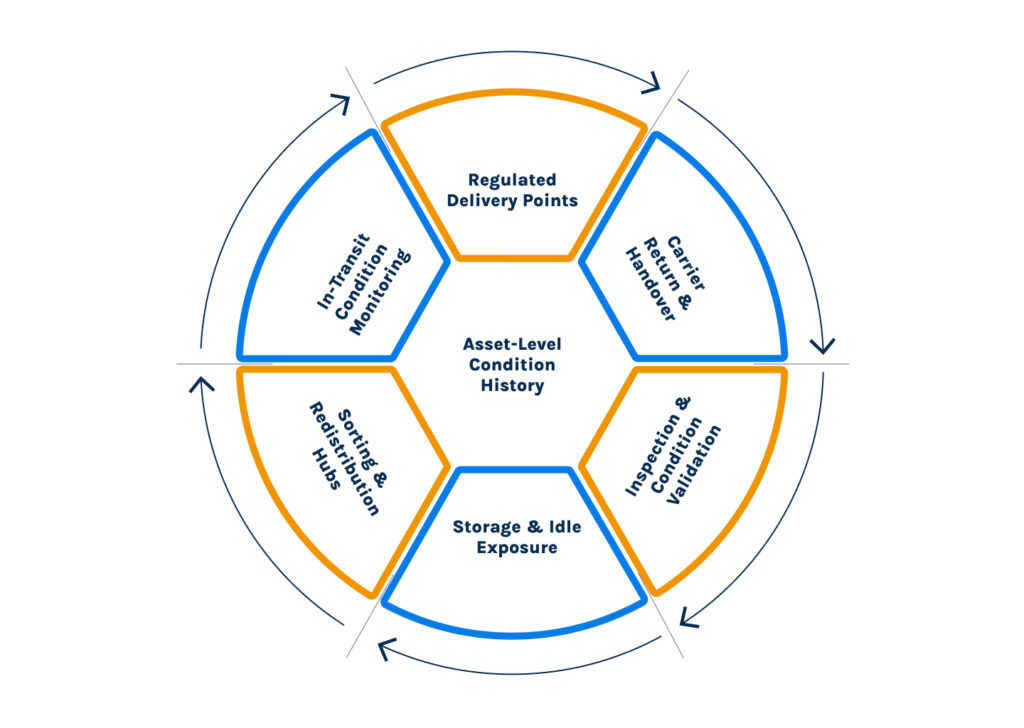

Industry research shows that temperature excursions and delays remain one of the primary causes of product spoilage and rejection in chemical and pharma chains. Logistics teams understand cold chain monitoring and compliance, but what is less discussed is where asset condition monitoring failures actually occur, i.e., during handovers, idle dwell time, yard storage, facility transitions, and repeated reuse cycles of the carriers themselves.

As supply chains become more circular and compliance-heavy, condition monitoring has shifted from being a quality safeguard to an operational requirement. Temperature and handling data now influence asset reuse decisions, audit outcomes, and sustainability reporting. This is especially visible in pharmaceutical logistics and chemical supply chains, where condition deviations often invalidate otherwise successful deliveries.

Asset Condition Monitoring: What It Covers Now & Where It Fails

Without continuous asset condition monitoring, logistics teams lack the evidence needed to prove compliance, enforce accountability across partners, or decide when a carrier should be repaired or retired. This is why specialized carriers represent a disproportionately high-risk category in pharmaceutical logistics and chemical supply chains, and why asset condition monitoring must be treated as a core control layer.

Current track and trace systems for specialized carriers mostly rely on static telemetry: temperature control, humidity exposure, shock events, vibration, and time spent outside defined thresholds. This does not account for the continuous telemetry and subsequent analysis required for effective asset condition monitoring.

Operational failures surface in three consistent ways.

First, asset loss and premature retirement increase. Carriers are written off because historical condition data cannot prove compliance or safe reuse.

Second, incident investigations slow down. Without continuous condition telemetry, teams reconstruct events manually, relying on logs, averages, or incomplete sensor snapshots.

Third, compliance and sustainability reporting become tougher. Regulatory frameworks such as the EU Packaging and Packaging Waste Regulation explicitly link reuse, traceability, and asset accountability. Reporting without asset-level condition data introduces estimation risk that auditors challenge.

Most logistics operations still rely on event-based tracking rather than continuous asset condition monitoring. GPS devices, vehicle telematics, and facility-level sensors provide useful information about location or ambient conditions, but they do not capture what happens inside specialized carriers.

This creates a structural blind spot: temperature stability, shock exposure, humidity ingress, or seal degradation at the individual carrier level is not correlated and analyzed, even though these are the factors that directly affect product safety in pharmaceutical logistics and the chemical supply chain.

Another limitation is data fragmentation across systems. Movement data may live in TMS platforms, warehouse events in WMS, temperature logs in standalone cold-chain tools, and maintenance records in spreadsheets. Logistics teams struggle to correlate operational data across these systems, limiting their ability to detect risk patterns or prove compliance during audits.

Without integration at the individual carrier level, organizations cannot connect condition data with asset age, route history, or reuse cycles, which undermines both risk management and regulatory reporting. To address this, industry analysts are pointing toward a data-driven shift in performance management. Gartner predicts that by 2028, 25 percent of logistics KPI reporting will be supported by generative AI.

But this transition depends on structured, continuous telemetry. AI systems cannot reason over fragmented or episodic data. AI-driven cargo condition monitoring research highlights that most failures stem from compound events rather than single-parameter breaches.

For 3PLs catering to chemical and pharma supply chains, the challenge is managing condition compliance across thousands of reusable carriers, multiple customers, and regulatory standards, which requires consistency that manual processes cannot sustain. And it cannot be overcome without the ability to observe and collect every datapoint on individual returnable assets.

Observability’s Role in Pharmaceutical Logistics & Chemical Supply Chains

Existing pharma supply chains and chemical supply chains are poorly aligned with emerging sustainability and reuse mandates. Tracking that stops at location or shipment completion cannot demonstrate that specialized carriers remain fit for reuse. This is why many compliant-on-paper operations still experience repeated excursions, SLA breaches, and audit friction: the technology stack was never designed to observe the carrier as a reusable, degrading asset.

Observability principles shift asset condition monitoring from passive tracking to behavioral understanding. Instead of limited knowledge, like whether an asset complied at a single moment, an observability-led approach for returnable asset management helps logistics teams see how each asset behaves across checkpoints, handovers, and maintenance cycles throughout its lifespan.

AI/ML and predictive analytics build on this foundation. By learning from historical condition patterns, systems can flag carriers that show early signs of degradation or recurring excursions before failures occur. This aligns with broader logistics technology trends identified for 2026, where predictive insights, AI-supported decision-making, and asset-level visibility converge to reduce operational risk.

Unified, structured telemetry and an integrated system also simplify compliance and sustainability reporting. Asset-level condition data provides defensible evidence for reuse, lifecycle management, and ESG disclosures without the need for manual reconciliation.

How SensaTrak Approaches Specialized Carrier Monitoring Differently

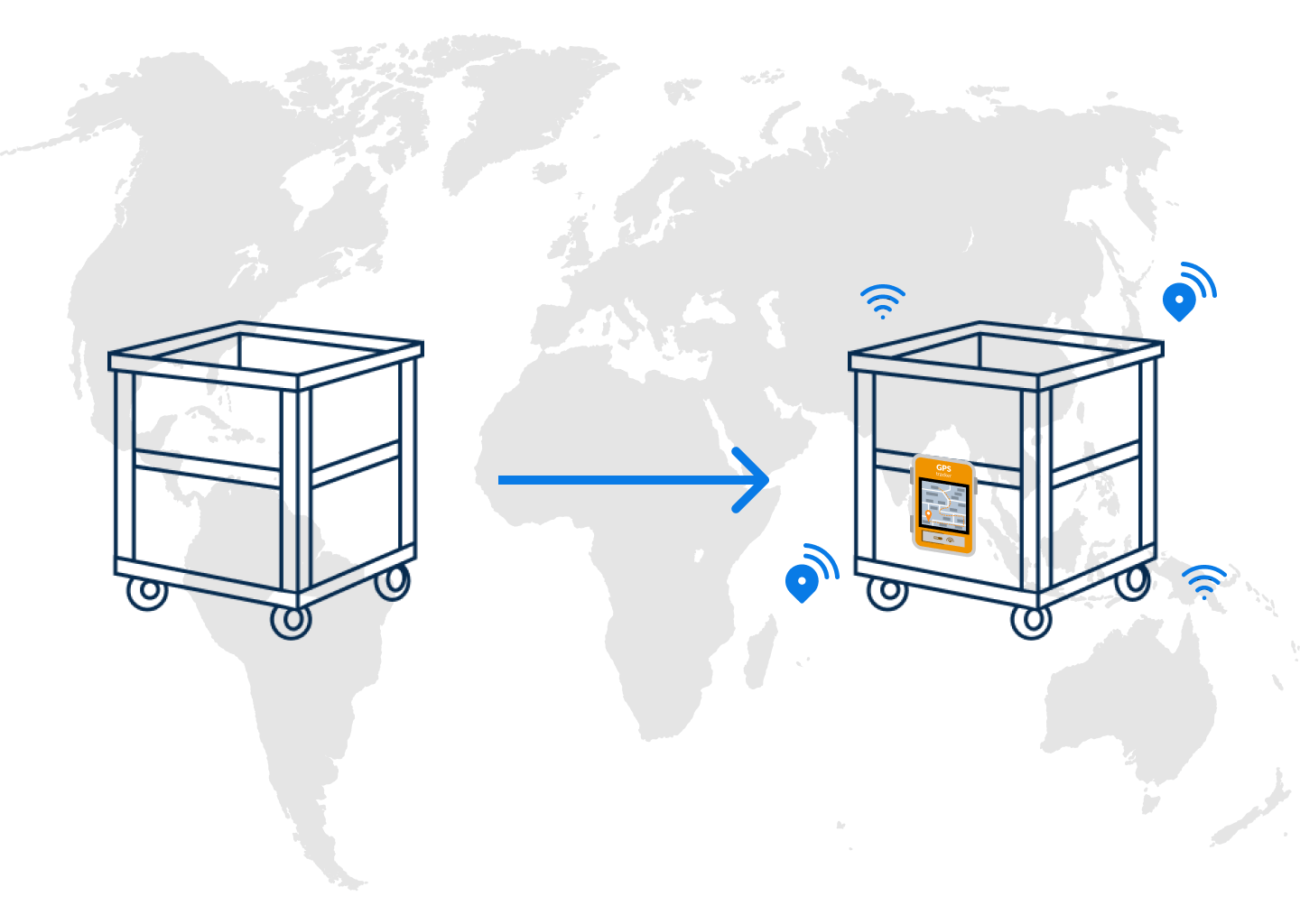

SensaTrak’s approach focuses on each carrier itself: where it moves, how it is handled, and how its condition evolves across reuse cycles. By combining carrier-embedded sensors, real-time data ingestion, and an analytics layer aligned with compliance and reuse requirements, SensaTrak enables teams to identify risk points, prove regulatory adherence, and make informed reuse decisions from the very first cycle.

The differentiator is continuity. Each asset, especially specialized carriers, builds a persistent condition history across trips, customers, and facilities. This enables us to identify recurring exposure risks tied to specific routes, locations, or handling processes. When this telemetry feeds directly into our AI-driven predictive analytics platform, your team moves from checkpoint confirmations to asset intelligence, and condition monitoring becomes proactive.

If you are evaluating how to strengthen pharmaceutical logistics or chemical supply chains with compliance-ready visibility, SensaTrak’s experts can help you design and deploy a focused pilot program in weeks, not months. Get in touch with the SensaTrak team to assess your specialized carrier fleet, align monitoring with regulatory expectations, and move from reactive issue resolution to controlled, scalable reuse.