Let’s start with the caveat that returnable asset fleet overinvestment looks different for every logistics and supply chain team. It further depends on how a logistics operation defines its safety buffer vis-a-vis its returnable asset fleet management.

Returnable assets fleet overinvestment can be defined as buying or maintaining more returnable assets than their operational workflow actually needs in an ideal scenario, where there are no losses.

So, while these reusable carriers, plastic pallets, roll cages, and containers are the lifeblood of logistics operations, they quietly become one of the biggest sources of overspending.

At first, this overcapacity looks like prudence. A few extra pallets, crates, or cages ensure business continuity when customer demand spikes or returns get delayed. Over time though, this practice typically balloons and becomes a structural inefficiency. According to this report, 43% of small businesses do not keep track of their inventory at all, leaving them vulnerable to stock-outs, persistent overstock, and uncertain projections.

Of the companies that do monitor, only 18% invest in specialized returnable asset management solutions, while 24% rely on simple tools.

What’s more, returnable asset fleet overinvestment can be mistaken as a symptom of growth.

An expanded returnable assets fleet consumes capital, inflate storage and maintenance costs, and undermine sustainability commitments. It’s not always a result of poor planning; often, it’s a byproduct of uncertainty, lack of visibility, or fragmented coordination across the supply chain.

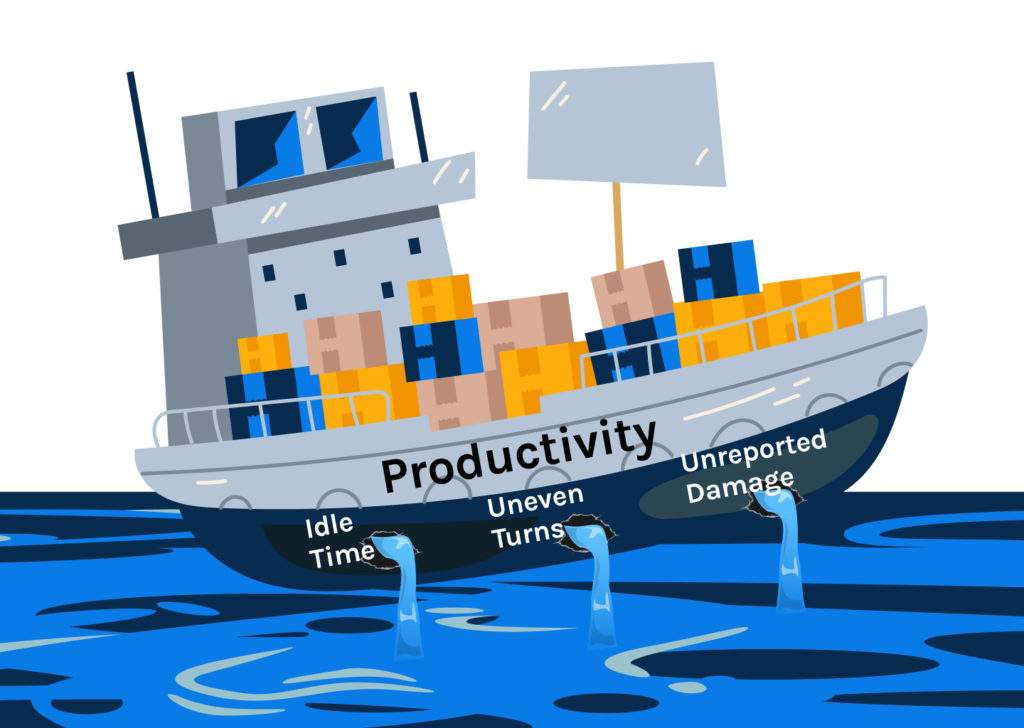

In reality, returnable asset fleet overinvestment looks like:

- Returnable assets that sit idle at different sites for weeks.

- Pallets, roll cages, or containers being stored at incorrect locations.

- Reusable carriers that remain unreturned long after delivery.

- Warehouses stocking surplus carriers in case of shortages.

These are everyday scenarios, but they translate into millions in tied-up capital, lead to compliance lapses, and even more returnable asset procurement to plug operational gaps. Returnable asset fleet overinvestment, therefore, needs to be treated as an invisible inefficiency that arises from the question, “Do we have enough assets?” without answering, “Do we know where our assets are, how long they’ve been there, and when they’re coming back?”

In this blog, we explore how returnable asset fleet overinvestment happens, the operational and sustainability costs it creates, and how organizations can correct courses using real-time tracking, predictive analytics, and proactive fleet management.

What Causes This Overinvestment in Returnable Assets Fleet?

Returnable assets fleet overinvestment occurs slowly, driven by inefficiencies and uncertainties.

According to this McKinsey survey, loss of returnable assets fleet causes between US $65 billion and US $95 billion in lost revenue at delivery points between shippers, dispatchers, third-party logistics providers (3PLs), and carriers. Long cycles, missing assets, fragmented data, uncoordinated maintenance, and reactionary decision-making force logistics teams to pad asset fleets as insurance.

Below are some of the most common reasons that push organizations to expand returnable asset fleets unnecessarily.

Recovery Failure & Inefficient Maintenance Cycles

Returnable assets utilization and cycle time variability is the strongest determinant of required fleet size because longer return cycles force organizations to buy more carriers simply to maintain throughput. When assets stay idle in yards, distribution centers, or customer docks for longer than expected, the effective utilization rate drops, leading to unnecessary procurement.

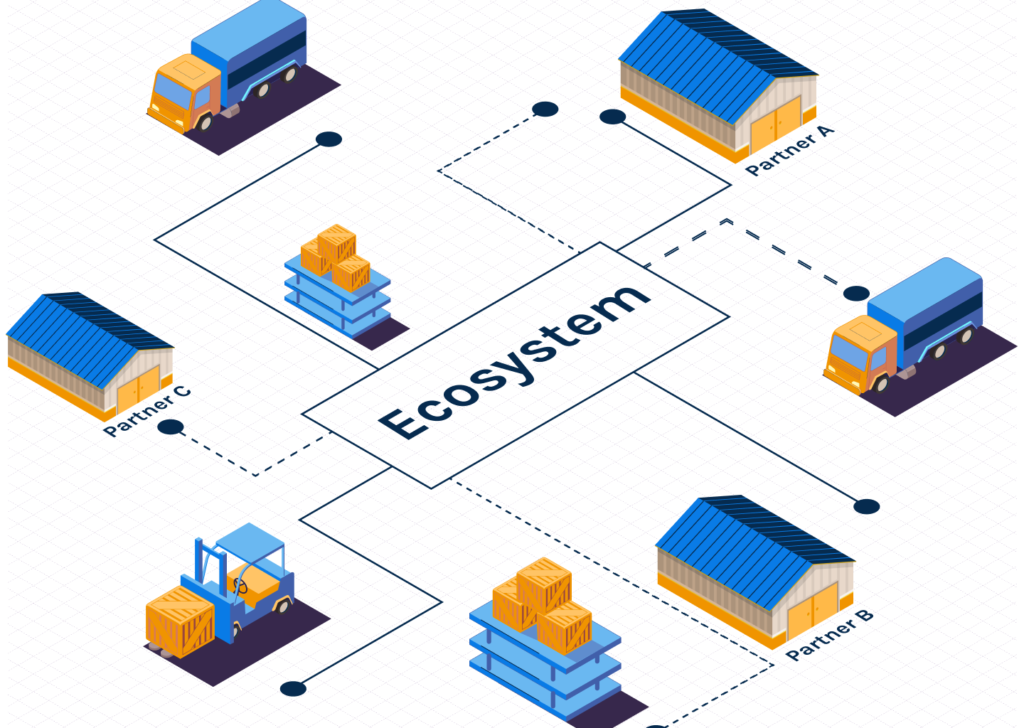

Every additional hand-off between sites, partners, or 3PLs adds days to the asset cycle, and multi-tier supply chains stretch turnaround times and inflate fleet requirements. Idle inventory also clogs maintenance queues. Poor scheduling, lack of spare parts visibility, or delayed inspection processes also take reusable carriers out of rotation unnecessarily.

Asset Loss & Fleet Shrinkage

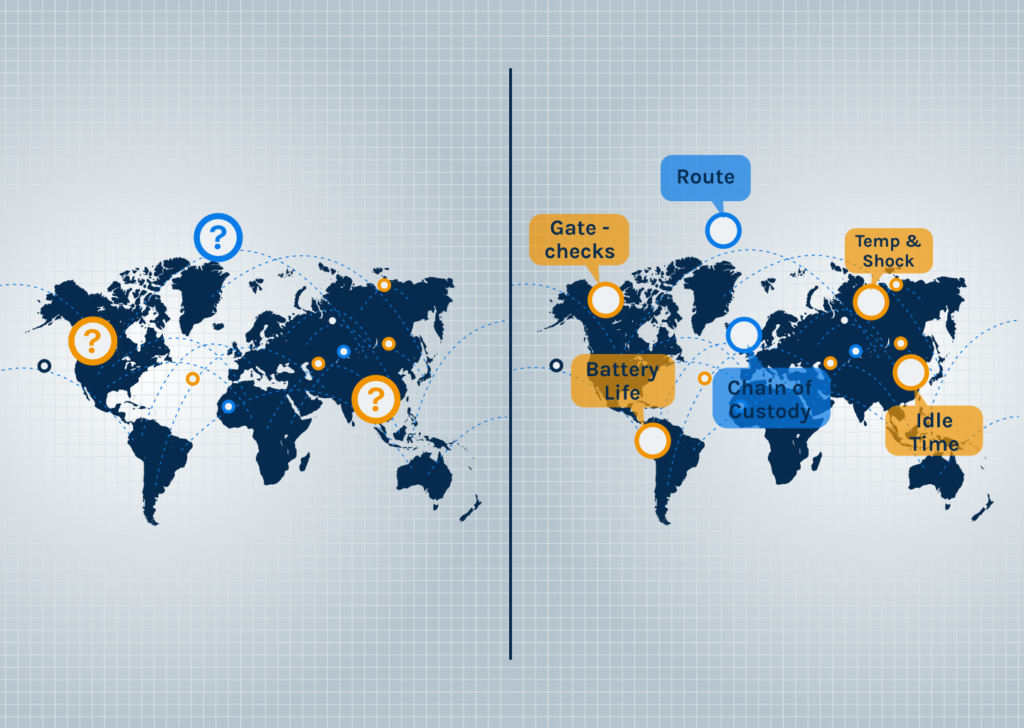

When tracking systems can’t recover returnable assets fleet, teams compensate by purchasing new units. Plastic pallets, roll cages, and containers routinely go missing in multi-party networks because chain of custody accountability is vague, or tracking alerts are configured improperly.

In pallet pooling and rental operations, loss rates of 8–10% annually are common, particularly when handover documentations and recovery systems are manual. The result is an ever-expanding fleet size, with the real issue, lack of asset visibility, left unresolved.

For instance, a logistics team managing around 15,000 returnable assets may have to replace up to 30% of its fleet annually due to not knowing where their reusable carriers are and when they are coming back. This annual returnable asset fleet overinvestment can be mitigated with a unified logistics solution like SensaTrak.

Over-Buffering & Fragmented Systems

Economic uncertainty, geopolitical developments, and extreme weather patterns make supply chain reliability harder to forecast. 94% of the companies surveyed by ElectroIQ, reported a negative impact on their revenue because of supply chain disruptions. Returnable asset buffers, intended to mitigate the factors mentioned above and ensure continuity, creates an oversupply of assets in the absence of integrated systems that inform all the teams within a logistics operation.

Many enterprises run their asset data through disconnected WMS, TMS, and ERP systems. Without an integrated telemetry or analytics layer, fleet visibility becomes fragmented and blinds logistics teams to the real returnable assets’ utilization picture, which typically leads to oversizing during annual procurement reviews.

Technologies & Data Practices To Prevent Returnable Assets Fleet Overinvestment

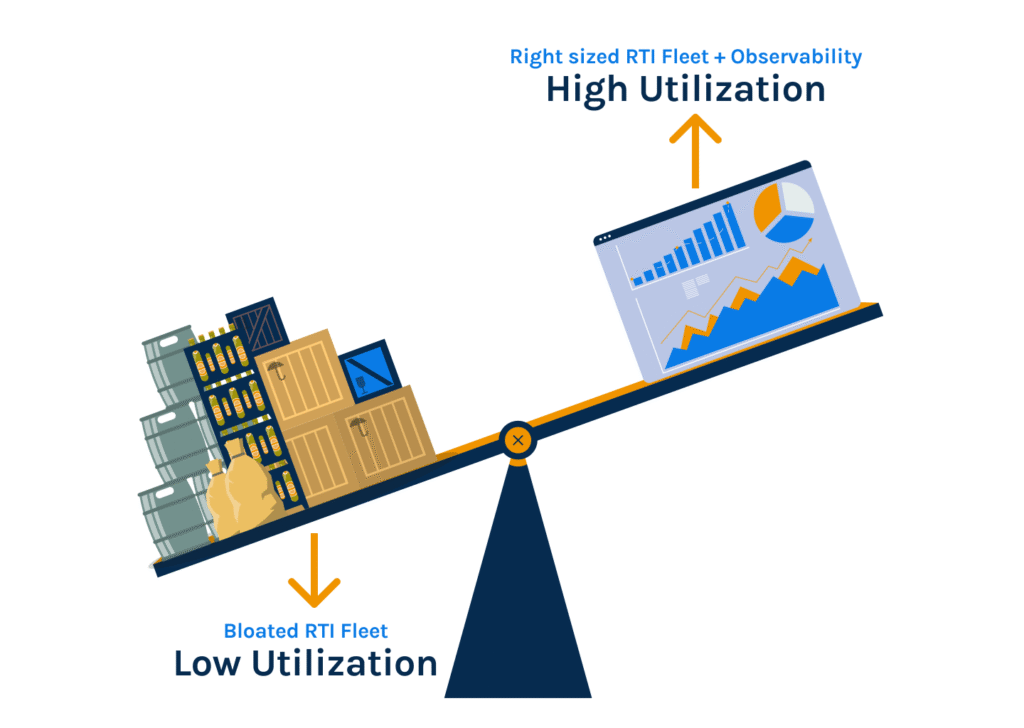

The right mix of assets tracking technology, analytics, and integration practices helps logistics teams see how assets move, where they dwell, and when they need repair or replacement. Together, they form the foundation of a right-sized, data-driven returnable asset management solution where efficiency is achieved not by adding more reusable carriers, but by managing existing ones intelligently.

RFID tags, LTE/GPS trackers, and other tracking technologies provide real-time visibility across warehouses, transit routes, and partner sites. And integrating warehouse, transport, and enterprise systems into a single observability layer eliminates duplication and error. But while these systems transform asset tracking through continuous telemetry, raw location data and condition monitoring only tell part of the story

Analytics platforms and AI models interpret this data to reveal inefficiencies like damaged assets, underperforming routes, or partners with recurring delays. Which means you’re using the same data to predict what will happen next, from maintenance needs to future availability. These early warnings shorten asset cycle times and prevent overstocking.

Another strategy to prevent returnable asset fleet overinvestment is to avail asset-sharing and pooling networks that distribute utilization more evenly. Pooling allows assets to circulate faster, minimizes idle stock, and accommodates sudden demand surges. Still, if the returnables you rent don’t integrate with the ones you own, data silos and manual reporting processes are bound to slow down logistics teams. That’s where a unified approach to tracking and predictive analytics can help you enable observability for every RLC/RTI in your operation.

How SensaTrak Helps in Precise Asset Tracking & Monitoring

For most supply chain operations, the problem is that their returnable assets data doesn’t connect, contextualize, or drive action. SensaTrak’s platform-first approach is designed precisely to close that gap. It turns fragmented asset data into real-time visibility, predictive insight, and operational control required to right-size and prevent returnable asset fleet overinvestment.

Without overhauling current systems, our modular approach enables companies of any size to grow RLC/RTI fleet visibility, avoid asset theft, maximize asset performance, and demonstrate quantifiable sustainability.

Our trackers seamlessly fit your existing plastic pallets, roll cages, or containers, ensuring continuous asset visibility across every movement zone. The SensaTrak platform plugs into existing WMS, TMS, and ERP systems, creating a unified observability layer for all returnable assets. This data is then processed by the analytics engine, which highlights idle assets, quantifies return delays, and helps build prediction models based on historical performance.

This integration enables organizations to reconcile movement, condition, and availability data, delivering an accurate picture of active utilization at any given time, which directly translates into fewer replacement purchases and a more efficient returnable asset fleet.

If you’d like to know more about how SensaTrak can help with managing your returnable assets fleet management & operations, connect with us here!