The logistics networks in Europe is deeper and much more complex than ever before.

Be it the logistics powerhouses of Germany and the Netherlands or the vital trade corridors of France and Spain, or the high-efficiency markets of the Nordics, the 3PL market is undergoing a tremendous change.

As 3PL logistics network in these prominent European centers evolve to handle the massive volume of omnichannel returns and new circular supply chain mandates, the pressure on returnable asset management has reached a critical point.

In these high-frequency environments, where goods move seamlessly from the Port of Rotterdam to distribution hubs in Stockholm or Madrid, roll cages, plastic pallets, and specialized carriers are the indispensable lifeblood of the system.

Yet, they are frequently treated as low-value, disposable items rather than the high-utility capital they represent.

With razor-thin margins and a zero-tolerance policy for disruption, the “invisibility” of these assets leads to a predictable and painful outcome: staggering annual losses, inefficient operational workarounds, and rising costs that erodes profitability.

For a typical large-scale operator, this lack of accountability can lead to sometimes replacing up to 50% of an entire fleet annually, transforming what should be a durable asset into a recurring capital drain.

This “middle mile” gets lost amongst the optimization priorities that concern only the first and the last mile for these networks.

But achieving true logistics visibility across these expansive international networks is no longer merely about fixing operations or a simple technology upgrade.

It needs a complete re-thinking of how we manage the “middle mile” and valuable assets that power this mile.

However, even though various asset tracking technology options exist today, the industry still struggles with a significant “visibility gap.”

Many current tools offer only fragmented snapshots of an asset’s journey, failing to provide full, real-time visibility into the complex, multi-stakeholder networks where assets move.

Without a comprehensive technical solution that tracks movement across every node of the supply chain, the “middle mile” remains a massive black hole.

But there is something that 3PL providers across Europe can explore.

Let’s come to that in a bit.

The “Middle-Mile” Accountability Gap

For most 3PL providers, the middle mile is getting trickier every day.

While first-mile pickup and last-mile delivery are tightly monitored, the movement of returnable assets between manufacturers, regional hubs, cross-docks, and retail distribution points often remains poorly instrumented.

Research on middle-mile logistics repeatedly highlights this segment as a critical enabler of supply chain resilience, yet also the least controlled in practice. As networks scale across countries and partners, this gap becomes structural rather than incidental.

The issue is not a lack of effort. It is a lack of accountability infrastructure. During middle-mile movements, assets change hands frequently, pass through temporary storage, and sit idle at consolidation points.

These transitions are rarely captured with the same rigor as shipment milestones. As a result, returnable assets such as plastic pallets, roll cages, and specialized carriers slowly detach from digital records, even though they continue to circulate physically within the network.

Chain of Custody: Point Where Assets Disappear

Returnable assets most often vanish at handoff points. When goods move from manufacturers to 3PL hubs, from hubs to regional depots, or from depots to retailers, custody becomes shared and responsibility diffused.

Each party assumes the asset is still “in the system,” while no single party has complete visibility into where it actually is. Over time, this creates a gray zone where assets are neither lost nor available, but functionally unusable.

This lack of clear chain-of-custody visibility forces 3PL logistics teams to rely on assumptions and manual reconciliation.

Assets delayed at one hub create shortages elsewhere. Temporary workarounds become permanent practices.

Emergency asset purchases fill the gaps, masking the underlying problem rather than fixing it. What appears as a capacity issue is often a visibility failure rooted squarely in the middle mile.

Inventory Red Flag: Accuracy Below 95 Percent

One of the clearest warning signs of middle-mile visibility failure is inventory accuracy.

Industry benchmarks consistently show that 3PL providers struggling to maintain inventory accuracy above 95 percent are often dealing with weak receiving verification and incomplete tracking of returnable items.

This is especially true for reusable assets, which are frequently excluded from standard inbound and outbound checks.

When returnable assets are not verified during receiving, discrepancies compound quickly. Pallets and roll cages counted at dispatch fail to appear at the next node. Shrinkage is written off as “normal variance.”

Over time, these small inconsistencies aggregate into large capital losses.

Flex Logistics’ analysis of underperforming 3PL operations points to poor visibility and verification processes as early indicators of broader operational inefficiency, not isolated inventory issues.

For European 3PL providers operating under tight margins and increasing regulatory scrutiny, this is no longer sustainable.

The middle mile cannot remain a blind spot.

Without stronger logistics visibility and modern asset tracking technology applied specifically to returnable asset management, 3PL networks will continue to absorb losses that are both preventable and measurable.

How To Know If Your 3PL Operations Have a Visibility Gap?

Many 3PL operators assume they have adequate visibility because shipment tracking, inventory reports, and reconciliation processes exist.

These following checkpoints can help you determine where structural gaps may exist in your 3PL operations:

Asset-Level Accountability

- Can you identify the last confirmed custody change for an individual pallet or carrier?

- Is that confirmation time-stamped and tied to a responsible party?

- Does the data persist across multiple reuse loops?

Dwell Time & Yard Control

- Can you measure how long assets remain at specific facilities?

- Do you receive alerts when dwell time exceeds defined thresholds?

- Is yard-level movement captured, or only gate-level movement?

Cross-Border Transitions

- Does asset data remain continuous when crossing EU borders?

- Are subcontracted legs integrated into your visibility framework?

- Can you trace asset movement across partner facilities without manual reconciliation?

Condition & Handling Context

- If temperature, shock, or handling events occur, are they tied to a specific location and timestamp?

- Can you correlate damage claims with actual movement patterns?

Reconciliation Speed

- How long does it take to detect a missing asset?

- Is detection proactive, or only discovered during periodic audits?

- Can disputes be resolved with data, or do they rely on statements?

If multiple answers to these questions depend on manual checks, delayed reporting, or cross-team escalation, you have a more operational visibility gap than just technological.

Why is this a Sustainability and Compliance Risk for 3PL providers in Europe?

Returnable assets sit at the center of circular supply chain models. Plastic pallets, roll cages, and specialized carriers are designed to reduce single-use packaging and minimize waste.

But when these assets cannot be reliably tracked through the middle mile, their sustainability value gets eroded quickly.

Assets that go missing are replaced. Replacement drives additional manufacturing, additional transport, and additional waste – undermining the very sustainability goals they were meant to support.

From a compliance perspective, poor visibility creates another layer of risk.

European regulations and retailer mandates increasingly require proof of reuse, traceability, and responsible asset handling.

When 3PL logistics networks cannot demonstrate where returnable assets are, how often they circulate, or how losses are being controlled, sustainability reporting becomes an estimate rather than evidence.

This weakens audit readiness and puts pressure on 3PLs to justify asset write-offs that may no longer be acceptable as “business as usual.”

Low visibility also complicates responsibility.

In multi-partner networks, it becomes difficult to determine whether asset losses occur at manufacturer handoff points, during hub consolidation, or at retailer locations.

Without clear data, there is lack of accountability in the system. Compliance teams are left managing risk reactively, while operations teams absorb the cost of replacement and workarounds.

For 3PL providers operating across borders, this challenge gets even bigger.

Assets move between countries, regulatory regimes, and reporting frameworks.

Without strong logistics visibility and modern asset tracking technology applied to returnable asset management, sustainability commitments remain disconnected from operational reality.

As sustainability and compliance expectations continue to rise across Europe, the cost of low visibility is no longer hidden.

It becomes evident in audit pressure, retailer relationships, and long-term margin erosion.

Addressing this risk requires treating returnable asset visibility as a core operational capability embedded into daily 3PL logistics workflows.

(Read our earlier blog on how current returnable assets management practices create compliance risk under EU sustainability regulations.)

How Can 3PL Provider Get Better At Asset Visibility?

3PL providers need a system that treats returnable assets as operational infrastructure and core assets.

This is where real visibility begins to separate itself from surface-level tracking.

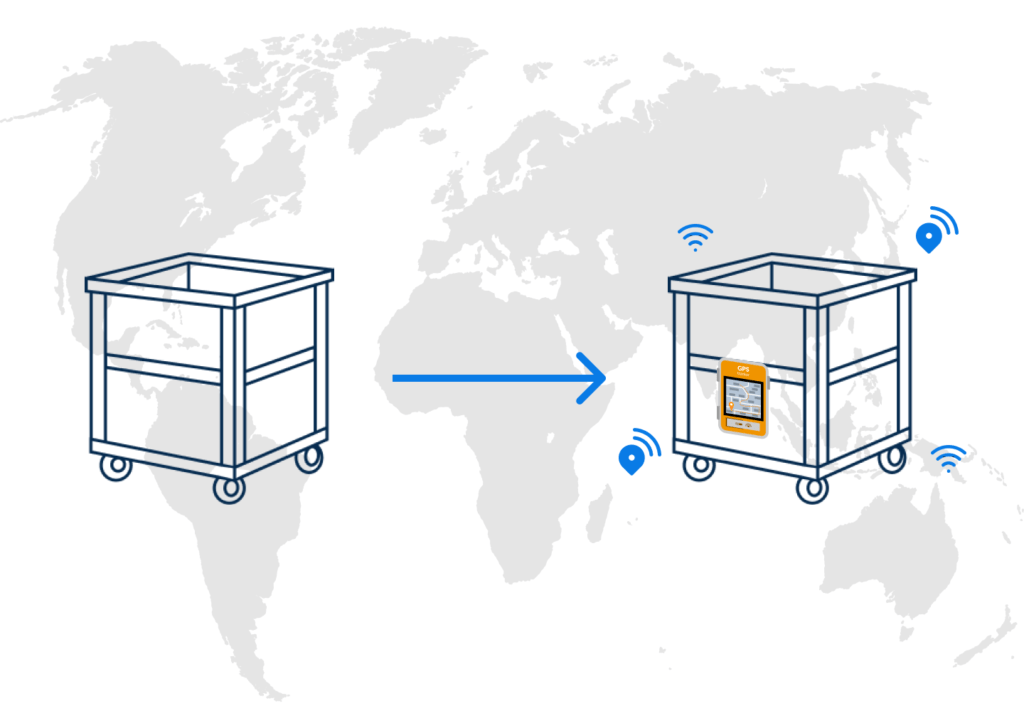

SensaTrak approaches returnable asset management as a lifecycle problem.

Our asset tracking technology is designed to function across the environments where 3PL operations actually break down: warehouses, yards, cross-docks, transport corridors, and customer locations.

Instead of relying on a single signal type, visibility is maintained across indoor and outdoor movements, idle periods, and custody transitions that define the middle mile.

Asset movement, dwell time, and circulation patterns are continuously analyzed to highlight where assets slow down, disappear, or fall out of rotation.

Further, this visibility is operationalized through integration. Asset data is connected to existing logistics systems so that there is little lag between insights and decision making.

SensaTrak supports high-performance logistics operations across major regional hubs.

3PL Stockholm | 3PL France | 3PL España | 3PL Italy | 3PL Denmark | 3PL Germany | 3PL 3PL Logistica | 3PL Logistikk | 3PL Warehouse | 3PL