End-to-end supply chain visibility is commonly understood as the ability to see shipments move from origin to destination. For returnable assets, this definition is incomplete and often misleading.

Reusable Transport Items such as pallets, roll cages, and specialized carriers do not follow a linear journey.

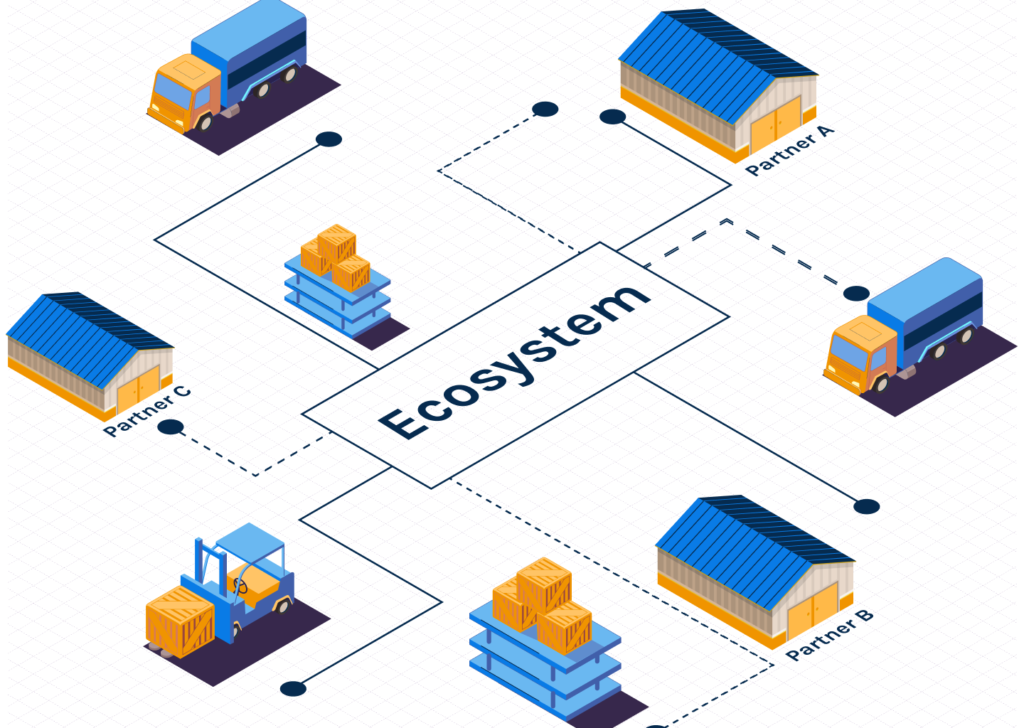

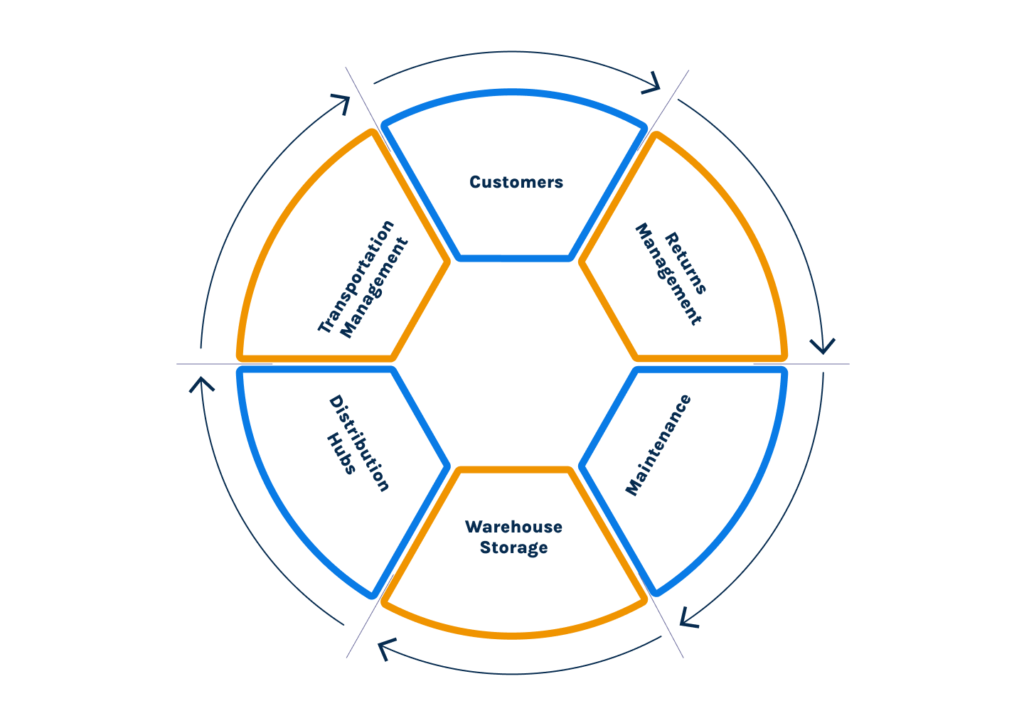

They circulate continuously across warehouses, transport lanes, customer locations, partner yards, and cross-border networks. Visibility, in this context, cannot stop at shipment milestones. It must reflect how each asset moves, pauses, gets handled, reused, and reintroduced into operations over multiple cycles.

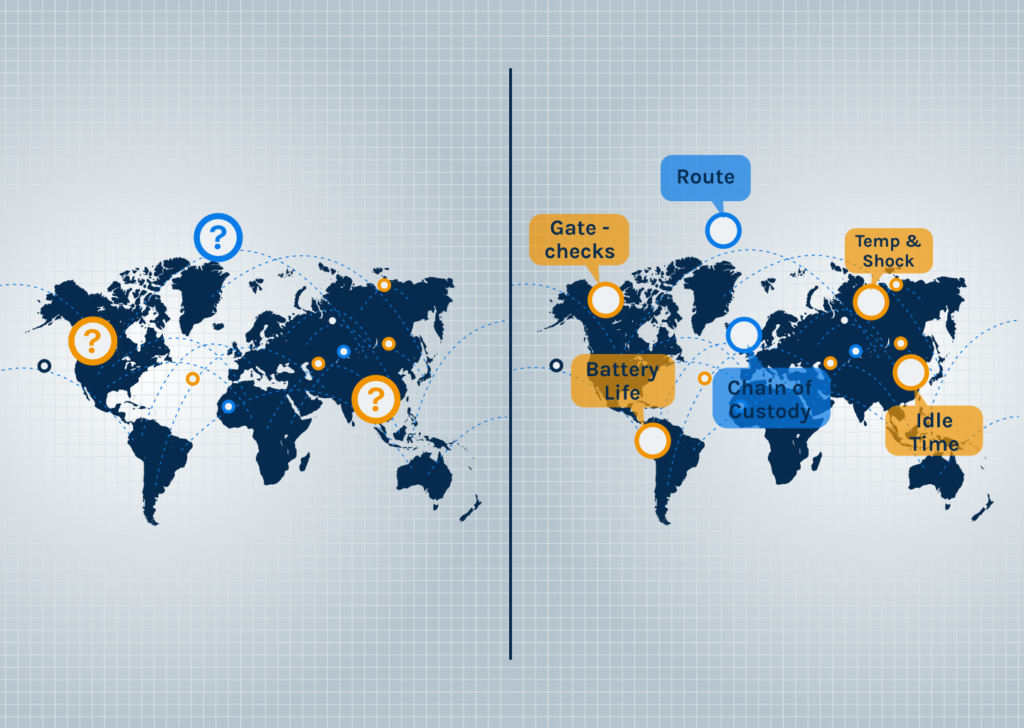

While that’s true, it also becomes critical to take returnable asset visibility beyond vanilla location tracking, which is the current norm in the industry.

True end-to-end visibility for returnable asset management requires a continuous view of each asset’s lifecycle. This includes where the asset is, who is responsible for it, how long it stays at each location, and whether its condition supports continued reuse.

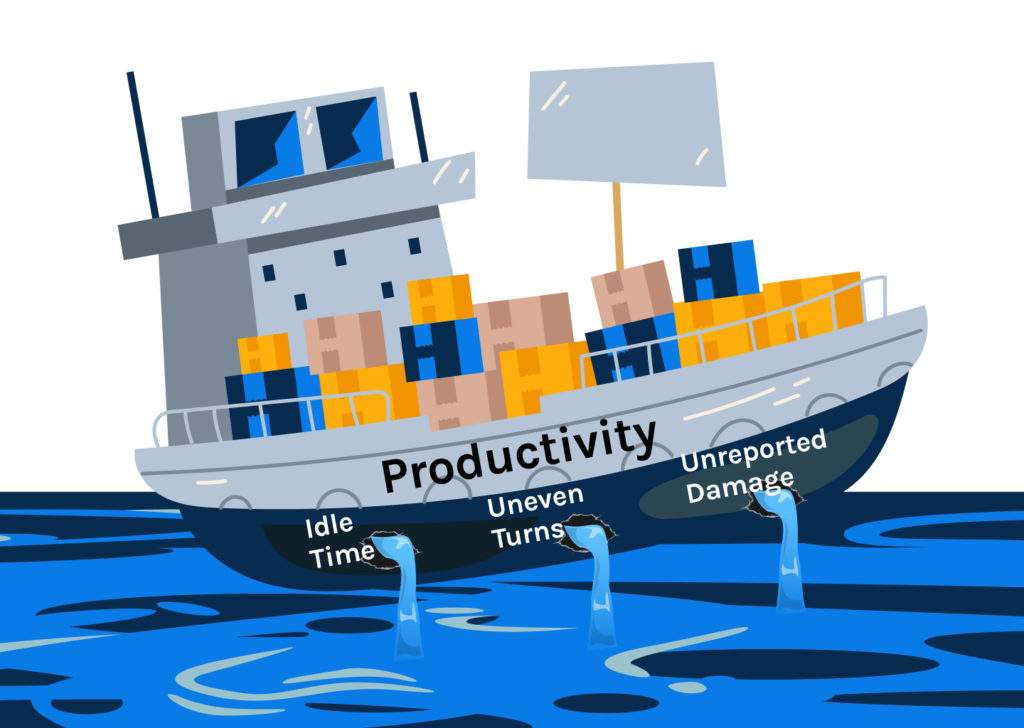

Without this level of insight, organizations struggle to detect issues such as prolonged idle time, repeated late returns, or degradation that compromises usability. A lot of the logistics blind spots are the result of lack of data on dwell times and other asset movement metrics.

In practice, most logistics networks rely on multiple systems to track assets. WMS, TMS, ERP platforms, and partner portals each capture fragments of asset data. These systems are built for their own operational purposes and rarely align asset information into a unified lifecycle view.

And these systems are hardly enough for appropriate management of returnable assets across several locations and lanes. Therefore, they end up being managed on excel sheets by a lot of teams.

As a result, many organizations believe they have visibility while still dealing with unexplained losses, idle inventory, uneven utilization, and overinvestment.

As reuse cycles increase and networks expand across partners and geographies, the absence of integrated asset-level visibility limits the effectiveness of planning, analytics, and compliance reporting.

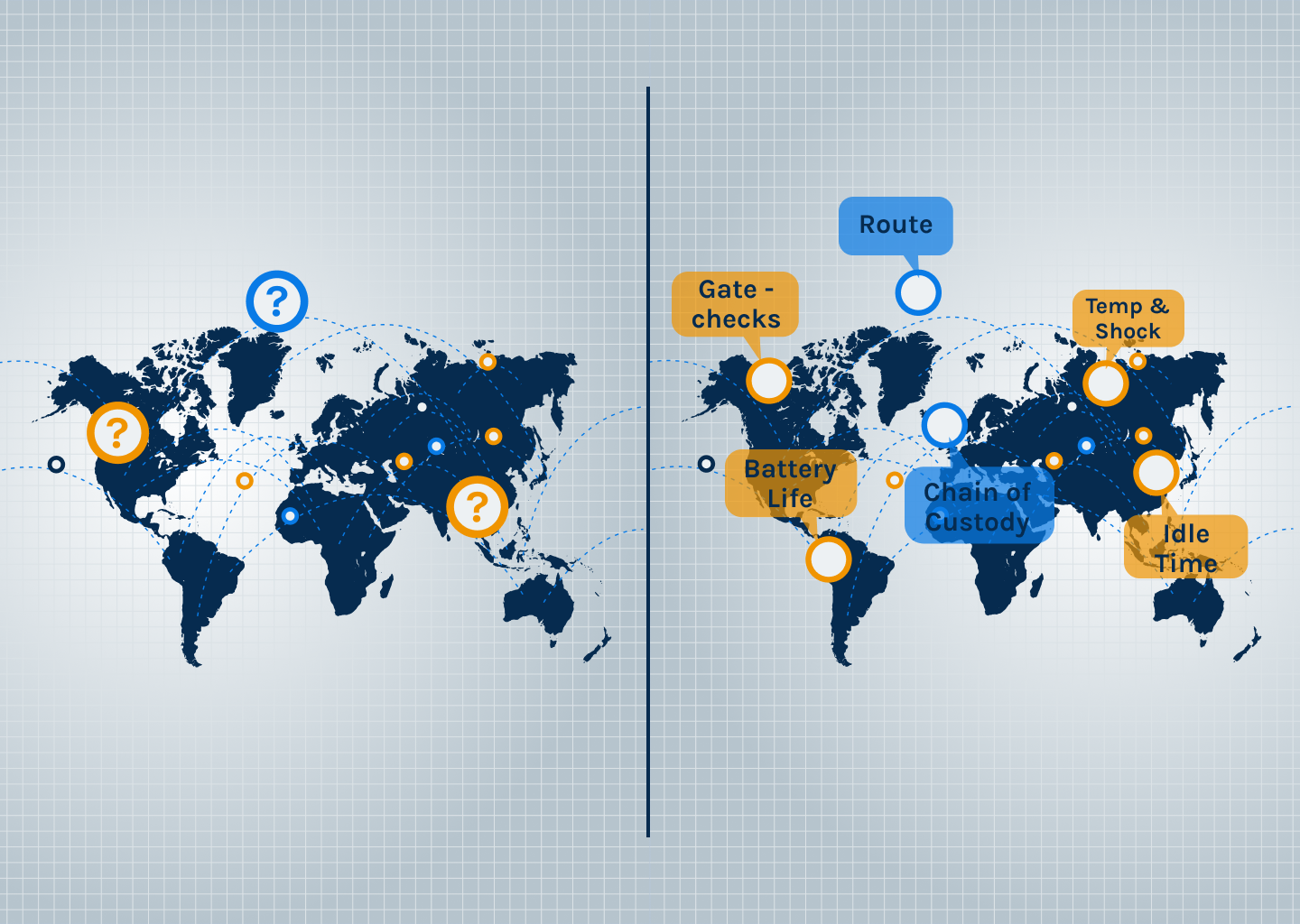

What is often labeled as an asset tracking gap is, in reality, a visibility problem rooted in fragmented data and incomplete lifecycle context. This challenge becomes even more pronounced in multi-partner logistics ecosystems where asset ownership and accountability are distributed.

End-to-end supply chain visibility for RTIs means treating each asset as a continuously observable entity across all systems and stakeholders.

This forms the foundation for effective returnable asset management and is becoming increasingly important for circular supply chain models, where proof of reuse, lifecycle performance, and loss reduction must be supported by reliable data rather than assumptions. This shift will define what operational visibility will mean under the new sustainability regulations.

Understanding End-to-End Supply Chain Visibility for Returnable Assets

Most logistics organizations already use some form of asset tracking solution. The breakdown occurs because these tools are designed to capture isolated events, not to explain asset behavior across an entire lifecycle.

Location updates, scan events, and movement logs provide point-in-time information. They confirm that an asset was seen at a particular place, but they rarely explain why the asset remained there, how it was handled, or whether it was suitable for continued reuse. This limitation becomes visible in operations that rely heavily on closed or open pooling models, where asset responsibility shifts frequently, and expectations differ.

These gaps are the most evident at handover points. As returnable assets move between shippers, warehouses, carriers, 3PLs, pooling providers, and customer sites, responsibility changes hands.

Each stakeholder records asset activity in their own systems, using different identifiers and timestamps. The physical flow of assets remains continuous, but the digital record fragments at every transition. This is a core challenge for cross-border asset pools that require extreme visibility and monitoring.

Another structural limitation lies in the way tracking solutions operate within system boundaries. Warehouse systems focus on internal movements, transport systems capture transit events, and ERP platforms record inventory states. Each system is accurate within its scope, but none explain what happens to assets between these environments.

Over time, organizations accumulate dashboards without improving understanding. This gap is especially problematic for 3PL networks in Europe and globally, where assets circulate across national and organizational boundaries.

Visibility issues are further reinforced by aggregated reporting. KPIs are often presented at fleet or site level, masking individual asset behavior. Assets may appear available on dashboards while experiencing prolonged dwell times, repeated mishandling, or uneven utilization. These blind spots contribute directly to pallet theft, silent losses, and accountability failures, reinforcing the need for better asset visibility to reduce asset losses.

From a circular supply chain perspective, these breakdowns have broader implications. Reuse performance cannot be reliably measured without understanding asset cycles, condition, and loss rates. This challenge is particularly acute in food and cold-chain operations, where temperature, hygiene, and handling directly affect compliance and product safety.

Observability and the Shift to Returnable Asset Lifecycle Intelligence

End-to-end visibility for returnable assets cannot be achieved through tracking alone. What logistics operations increasingly require is observability: the ability to understand asset behavior across time, systems, and partners rather than viewing isolated data points.

Observability focuses on correlating movement, custody, condition, dwell time, and utilization into a single lifecycle record.

This allows teams to move beyond knowing where an asset was last seen and toward understanding how it was used, how it was handled, and where performance breaks down.

Observability enables temperature and condition monitoring which are critical for specialized carriers, used heavily in sensitive and highly regulated industries.

The evolution from vanilla monitoring & tracking to observability matters because returnable assets behave fundamentally differently from shipments.

A shipment completes a journey and exits the system. A returnable asset re-enters the system repeatedly, often under different operating conditions.

Each reuse cycle introduces variability in handling quality, shock exposure, and partner performance. Without linking these cycles together, organizations cannot explain inefficiencies or enforce accountability. Accountability becomes easier when you can track handling errors or shocks or tampering at specific points of time.

As logistics networks face increasing pressure from sustainability regulations, customer SLAs, and compliance requirements, visibility must extend beyond movement.

Pharma, chemicals, and food logistics require asset-level evidence of handling, condition, and reuse. These industries have tremendous asset visibility challenges, and compliance depends on capturing more than just location data.

Observability shifts returnable asset visibility from static tracking to operational intelligence.

It enables logistics teams to identify bottlenecks, enforce responsibility, improve reuse performance, and support compliance reporting with asset-level data. This is precisely why asset visibility will matter more for logistics teams in 2026, as regulatory and operational expectations continue to rise.

Wrapping it up

End-to-end supply chain visibility for RTIs is not about adding more tracking points or dashboards. It is about building a continuous, asset-level view that reflects how returnable assets actually move, dwell, and perform across complex logistics networks.

Without this foundation, returnable asset management remains reactive. Losses are accepted as unavoidable; overinvestment becomes routine, and compliance efforts rely on estimates rather than evidence.

With true lifecycle visibility, logistics teams gain the ability to manage returnable assets as operational infrastructure rather than expendable inventory. This ability is particularly relevant for warehouse and yard teams who need more efficiency in operations and better asset management.

As returnable asset programs grow in scale and importance, visibility will increasingly define cost control, service reliability, and regulatory readiness.

With SensaTrak, gaining complete end-to-end visibility for all your returnable assets becomes easier. We don’t just enable better visibility but more proactive decision making to prevent unforeseen losses.

The connected cluster articles that follow in this series will examine how this visibility translates into practical outcomes across technology, accountability, compliance, and operational efficiency.