Companies of all sizes are increasingly relying on third-party logistics (3PL) services to manage complexity, scale operations, and reduce capital expenditure. Outsourcing logistics functions allows businesses to leverage 3PL returnable asset tracking, specialized expertise, infrastructure, and technology without the burden of maintaining in-house warehouses, teams managing returnable asset fleets, and tracking systems.

Logistics providers are classified by the level of service they offer. 3PL service providers, e.g., DHL and FedEx, offer end-to-end logistics services, including warehousing, transportation, and inventory management, often handling multiple clients’ operations and enabling scalable, outsourced supply chain management.

This model allows businesses to delegate operational complexity, optimize returnable asset fleet utilization, and focus internal resources on core functions, making them highly relevant for organizations managing large pools of returnable assets. A 2024 logistics-leasing analysis notes that 3PLs have increased their share of warehouse-leasing demand by over 10 percentage points since 2019 in Europe, while in the U.S. 3PL warehouse leasing activity has accounted for more than 30% of bulk transactions.

Companies opt for 3PL solutions to reduce complexity, maintain returnable asset availability, and ensure operational efficiency, especially when managing large pools of returnable assets such as pallets, roll cages, and reusable containers. Which has led to 3PL returnable assets becoming a cornerstone of modern supply chains, offering companies scalable infrastructure, specialized warehousing, and flexible transportation options without the need to invest heavily in their own operations. A recent market analysis shows that the global 3PL market size was USD 1,065 billion in 2023, with a projected growth to USD 2,546 billion by 2032.

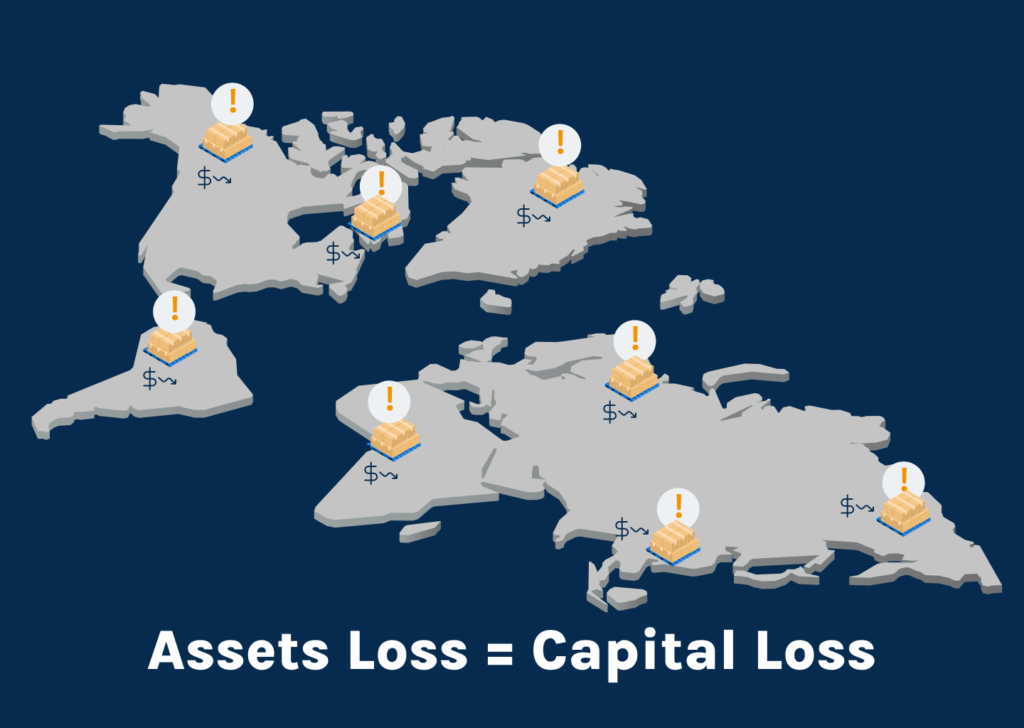

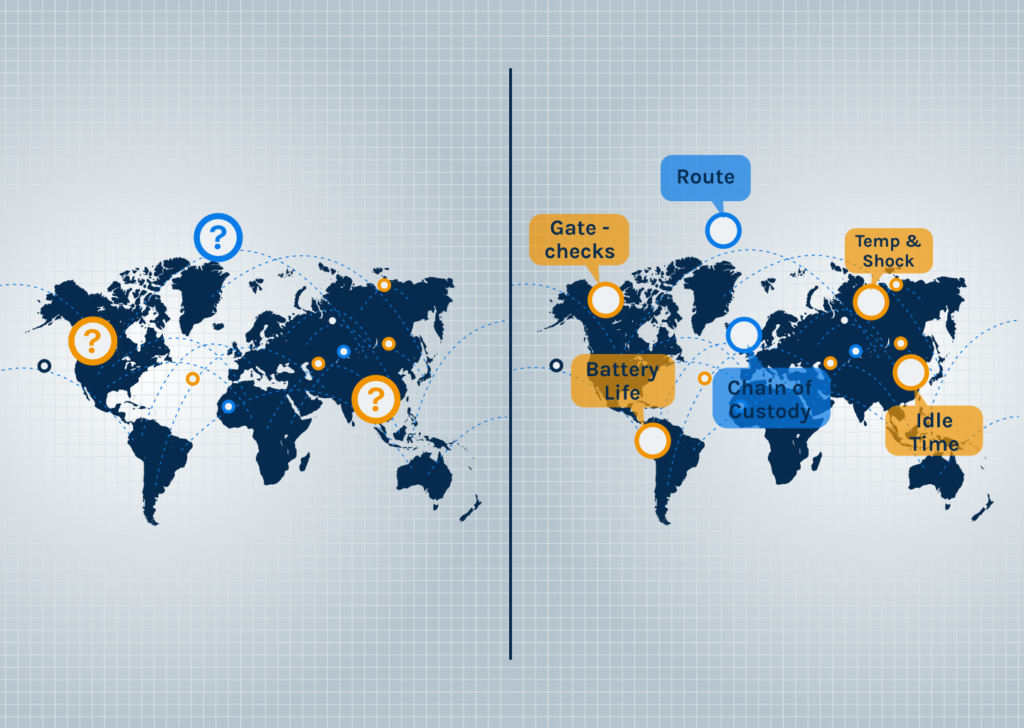

However, this introduces challenges for 3PL providers: increasing client diversity, rising SKU variability, more complex return cycles, pressure to deliver real-time visibility across every movement zone, and particularly maintaining visibility and control over returnable assets. The lack of unified data and system integration across all these moving parts of different systems often leads to fragmented visibility, inconsistent asset tracking, delayed returns, and operational blind spots, limiting 3PL services’ ability to preempt disruptions. This makes 3PL returnable asset tracking essential. Real-time visibility of asset location, condition, idle time, and utilization is now a competitive differentiator for 3PLs looking to reduce losses, improve SLA compliance, and strengthen customer retention.

Why 3PL Services Struggle with Visibility & Returnable Asset Control

While 3PL services offer scalability and operational flexibility for clients, the internal complexity they create for 3PL providers is often underestimated. The diversity of 3PL operating models means providers must support very different workflows depending on their service category.

- Financial- and information-based 3PLs must maintain deep data accuracy and audit reliability.

- Transportation-based 3PLs must synchronize constant movement across trucking, ocean, and air freight networks.

- Warehouse-focused 3PLs must handle storage, picking, and dispatch with high turnover.

- Full-service 3PLs must integrate all of the above across multiple geographies and client types.

Each of these models involves different asset types, return cycles, and operational expectations, yet 3PLs are required to deliver consistent visibility across them all. This multi-client, multi-workflow environment often results in fragmented data, inconsistent tracking processes, and delays in updating asset status, making it difficult for 3PL providers to maintain real-time control of pallets, specialized containers, and roll cages.

Reverse logistics creates an additional burden. Assets move through partner sites, customer locations, consolidation hubs, and cross-docking points, each with varying degrees of scanning discipline and system maturity. Without integrated 3PL returnable asset tracking, teams are left relying on manual reconciliation, emails, or spreadsheets. This leads to avoidable asset losses, prolonged dwell times, idle fleet buildup, and increased operational costs for the 3PL itself.

System fragmentation is another critical challenge. When WMS, TMS, ERP, and RTI management systems are not integrated or when clients use different systems entirely, 3PL operators struggle to maintain consistent tracking and lifecycle visibility. This limits analytics capabilities, weakens predictive insights, and creates operational blind spots. The result is reduced efficiency, higher overhead, and greater exposure to SLA failures or compliance risks.

Finally, 3PLs’ returnable assets inherit visibility gaps from their clients. Many client organizations lack in-house expertise in integrations or observability, which results in misaligned processes, inconsistent data capture, and incomplete asset information flowing into the 3PL’s system. Although 3PLs manage day-to-day operations, they often cannot provide end-to-end visibility without full alignment of client workflows, system integrations, and reverse-logistics protocols, creating a persistent visibility gap on both sides.

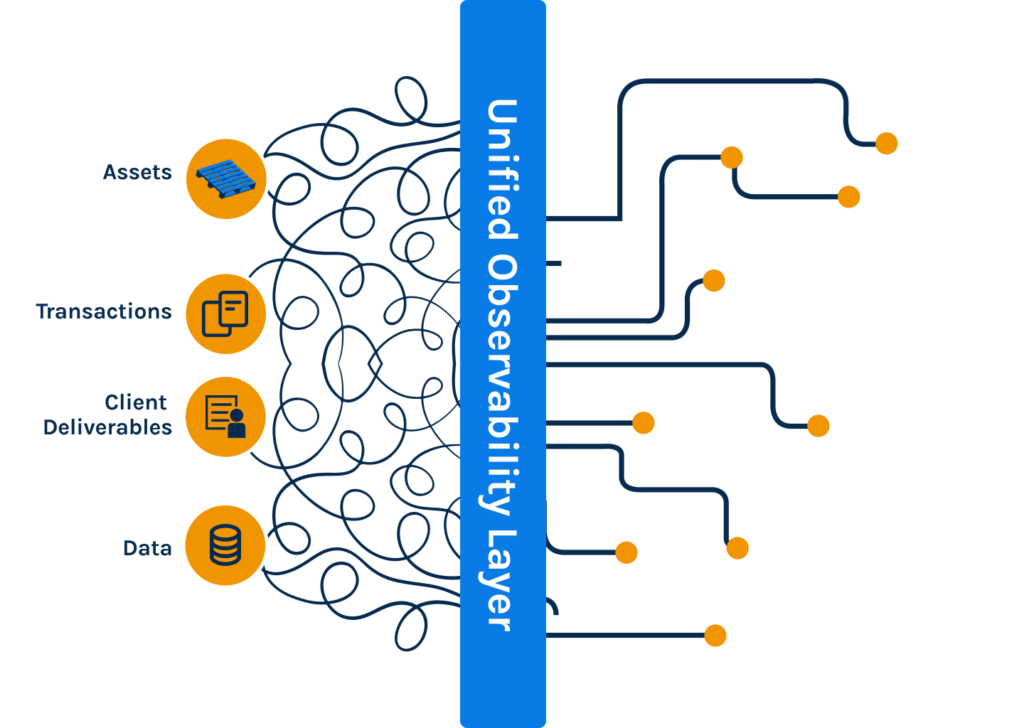

The Ideal Scenario: An Analytics Platform That Aligns Client & 3PL Data

For 3PL service providers, the ideal returnable asset management setup is one where internal operations and each client’s systems function as a unified observability layer. To achieve this, 3PL solutions need an analytics platform that consolidates tracking data across all clients, warehouses, distribution hubs, and transit flows while supporting multi-technology telemetry and condition sensors.

Such a system ensures that pallets, containers, and roll cages remain visible across the entire network of client operations. Beyond simple location data, integrated analytics empower 3PL teams to detect idle assets, optimize return cycles, identify bottlenecks across partner or customer sites, and anticipate maintenance needs. This level of insight allows 3PL providers to reduce fleet overprovisioning, prevent loss, and improve asset performance across every client’s engagement without disrupting existing workflows.

Governance and compliance also become significantly more manageable when the analytics platform handles automated logging of return cycles, asset condition updates, and custody transfers. For 3PL services, this means they can deliver audit-ready reporting aligned with ESG, PPWR, CSRD, and EPR frameworks, directly supporting clients’ sustainability commitments while strengthening the 3PL’s service value. A unified observability platform not only improves operational control but also differentiates 3PL providers as transparency-first partners capable of delivering data-driven supply chain reliability.

How SensaTrak Strengthens 3PL Returnable Asset Tracking

SensaTrak elevates 3PL services by giving providers a unified observability layer built specifically for managing returnable assets across diverse clients, workflows, and movement zones. Instead of relying on fragmented client data or inconsistent manual scanning, SensaTrak consolidates everything into a single platform, providing 3PL teams with continuous, reliable visibility into pallet, container, and roll-cage movement across every site they manage.

Our platform delivers predictive analytics and AI-driven insights that highlight idle returnable assets, delayed returns, damage risks, and utilization inefficiencies. This enables operators to proactively correct bottlenecks, optimize rotation cycles, reduce asset losses, and maintain high service performance across all customer engagements. With accurate asset-lifecycle intelligence, 3PLs can right-size fleets, avoid overprovisioning, and improve asset longevity, directly reducing operational costs.

SensaTrak also simplifies compliance and sustainability reporting for 3PLs. Every return, condition update, and custody transfer is automatically logged, creating audit-ready traceability that supports clients’ ESG, PPWR, CSRD, and EPR obligations. This transparency becomes a competitive advantage, positioning 3PL providers as data-rich partners capable of delivering sustainable, compliant, and accountable logistics services.