“The problem begins after the pilot.”

We’ve heard that from 90% of the logistics and supply chain companies. Supply chain pilot programs have become the default way to test new technologies. Returnable asset tracking pilot programs and supply chain risk management pilot programs are routinely launched to validate feasibility, demonstrate quick wins, and build internal momentum.

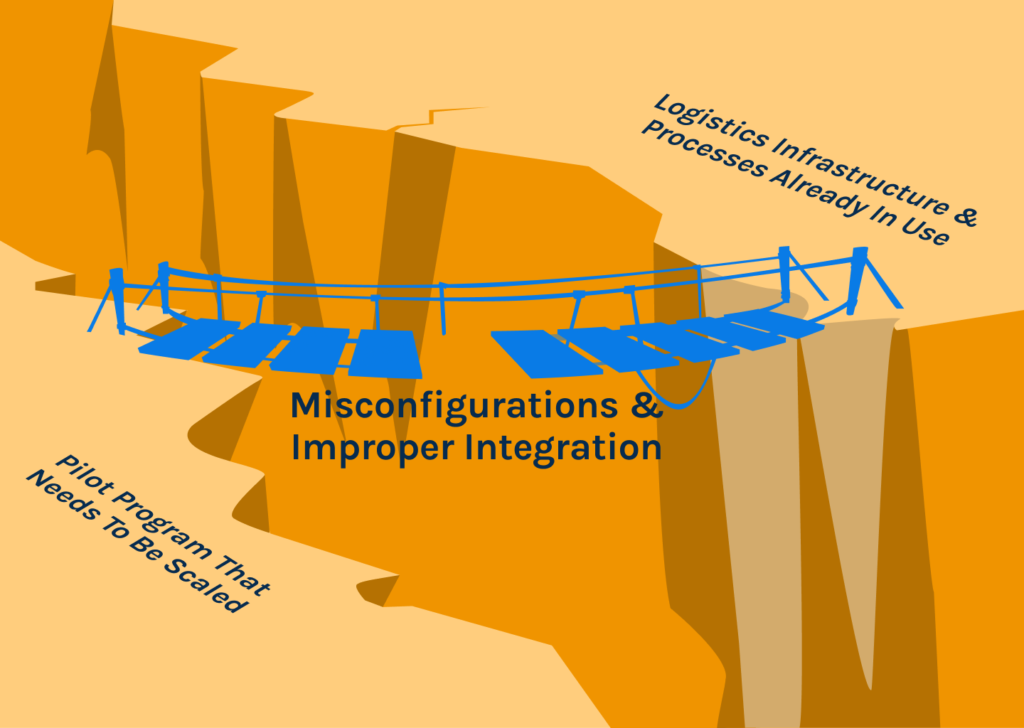

When organizations attempt to scale a pilot program across multiple facilities, transport lanes, partners, and return flows, they face performance degradation. Data becomes inconsistent, integrations weaken, operational discipline varies by site, and teams lose confidence in the outputs. What worked in a controlled environment buckles under real-world complexity.

This pattern mirrors a broader trend in logistics transformations: Gartner reports that 76% of logistics transformation initiatives fail to meet critical performance metrics, even though logistics leaders are increasingly prioritizing digital initiatives. For returnable assets in particular, the gap between pilot success and operational reality is costly. Pallets, crates, roll cages, and carriers move through fragmented ecosystems involving 3PLs, customer sites, and reverse logistics loops.

When tracking data fails to align with WMS, TMS, ERP, and maintenance workflows, organizations struggle to turn visibility into action, resulting in stalled programs, underutilized technology, and abandoned investments in returnable asset management. On paper, these pilots typically succeed because the technologies being tested are not themselves flawed. This blog examines why supply chain pilot programs fail to scale and also outlines how a platform-first, observability-driven approach enables these programs to transition into future-ready, enterprise-grade systems that support RTI/RTP fleet sizing, risk management, predictive analytics, and sustainability.

The Cost of Failed Supply Chain Pilots in Logistics

When proposed solutions fail after the pilot phase, the impact goes far beyond a stalled technology initiative. The most immediate cost is lost confidence. Once operations teams experience inconsistent data, false alerts, or missing asset records, they stop relying on the system altogether. At that point, even accurate data is ignored, and decision-making reverts to manual workarounds such as spreadsheets, emails, and periodic audits.

There is also the direct financial cost. Organizations often size returnable asset fleets conservatively when visibility is unreliable, leading to over-purchasing pallets, roll cages, and carriers to hedge against uncertainty.

Then there’s the strategic cost tied to risk and compliance because any supply chain pilot programs are initiated to improve risk management, resilience, or sustainability reporting. When tracking data cannot be reconciled with core systems, organizations lack the evidence needed to support compliance claims, audit requirements, or ESG disclosures related to returnable asset management. What began as a secure supply chain pilot program ultimately leaves teams exposed to regulatory, customer, and reputational risk.

And perhaps the most damaging consequence is opportunity cost. Failed supply chain pilot programs create skepticism toward future digital initiatives. Leadership becomes hesitant to fund new tracking or analytics projects, even when the underlying need remains unresolved. In this way, a poorly scaled logistics pilot program can slow broader transformation efforts across the supply chain.

Why Most Supply Chain Pilot Programs Don’t Survive Scale

Logistics pilot programs rarely account for scale, integration depth, governance, and long-term observability. They are designed to validate technology, not to withstand operational complexity.

During a pilot, asset movement is predictable, partners are cooperative, and data volumes are manageable. Once the same pilot program is rolled out across multiple warehouses, transport lanes, customer sites, and 3PL partners, the assumptions that held during the pilot begin to break.

One of the first points of failure is integration depth. Pilots often run parallel to core systems instead of being embedded within them. Tracking data may appear on a standalone dashboard but fails to synchronize reliably with WMS, TMS, ERP, maintenance systems, or partner portals. As scale increases, mismatches between physical asset movement and system records multiply, eroding trust in the data. A secure supply chain pilot program gives way to another isolated system that operations teams struggle to reconcile.

Operational discipline also deteriorates at scale. For instance, returnable asset management depends on consistent handling practices: scanning at handoff points, maintaining devices, enforcing return protocols, and validating exceptions. In a pilot, these steps are closely supervised. In real-world deployments, they span multiple teams, shifts, and external partners. Variations in process execution lead to blind spots, delayed updates, and false loss signals, undermining the value of the tracking initiative.

Another overlooked factor is organizational readiness. For instance, many supply chain risk management pilot programs assume that once visibility exists, action will follow. In practice, teams lack the expertise, governance frameworks, escalation workflows, analytical capacity to act on the data, and post-event playbooks.

Gartner’s survey of logistics leaders last year highlights this gap, showing that only 22% of the respondents were prioritizing upskilling and retaining talent. Turning telemetry into decisions demands expertise in data interpretation, system alignment, and supply chain operations. Without that human and analytical layer, pilot programs, when scaled, will fail to generate outcomes.

Finally, most supply chain pilot programs underestimate the ongoing effort required to keep tracking systems reliable. Battery management, device health monitoring, firmware updates, exception handling, and data quality checks are rarely planned beyond the pilot phase. Without ownership, knowledge transfer, and an observability approach to tracking infrastructure itself, performance degrades quietly until the system is no longer trusted.

SensaTrak’s Solution to the Scale Problem

SensaTrak approaches deploying pilot programs with the assumption that scale is the default state, not a future phase. Instead of treating the pilot as a point solution, SensaTrak takes a platform-first stance that embeds observability into daily logistics operations from day one, along with the physical devices for your returnable assets.

This ensures that supply chain pilot programs transition smoothly into long-term, production-grade systems.

At the foundation is a multi-technology tracking architecture. SensaTrak combines BLE, RFID, Wi-Fi, GPS/LTE, and sensor-based telemetry so assets remain visible across warehouses, yards, transit lanes, partner sites, and return loops. This removes the single-technology dependency that often breaks down when pilots expand into mixed environments.

The second differentiator is deep system integration. SensaTrak does not operate as a standalone dashboard. Asset data is continuously synchronized with WMS, TMS, ERP, maintenance systems, and 3PL platforms. This alignment ensures that location, condition, and availability data directly inform planning, execution, and exception handling.

SensaTrak also introduces observability over the tracking system itself. Device health, data latency, coverage gaps, and integration performance are monitored continuously. This allows teams to identify degradation early, resolve issues proactively, and maintain data trust as fleets and networks grow.

Predictive analytics and custom AI integrations complete the solution by converting end-to-end visibility into action. The platform highlights idle assets, delayed returns, abnormal dwell times, and loss patterns across routes and partners. Predictive models help logistics teams right-size fleets, plan maintenance, comply with sustainability regulations, and reduce overinvestment in returnable assets.

SensaTrak pairs technology with expert-led implementation and governance support. Deployment frameworks, partner protocols, escalation paths, and performance benchmarks are defined upfront, ensuring that everything remains consistent across sites and third parties. This closes the gap that causes many secure supply chain pilot programs to stall once initial supervision is removed.

By treating the pilot program as an operational system rather than an experiment, SensaTrak enables supply chains to scale visibility, control risk, and sustain returnable asset management outcomes long after the pilot phase ends.