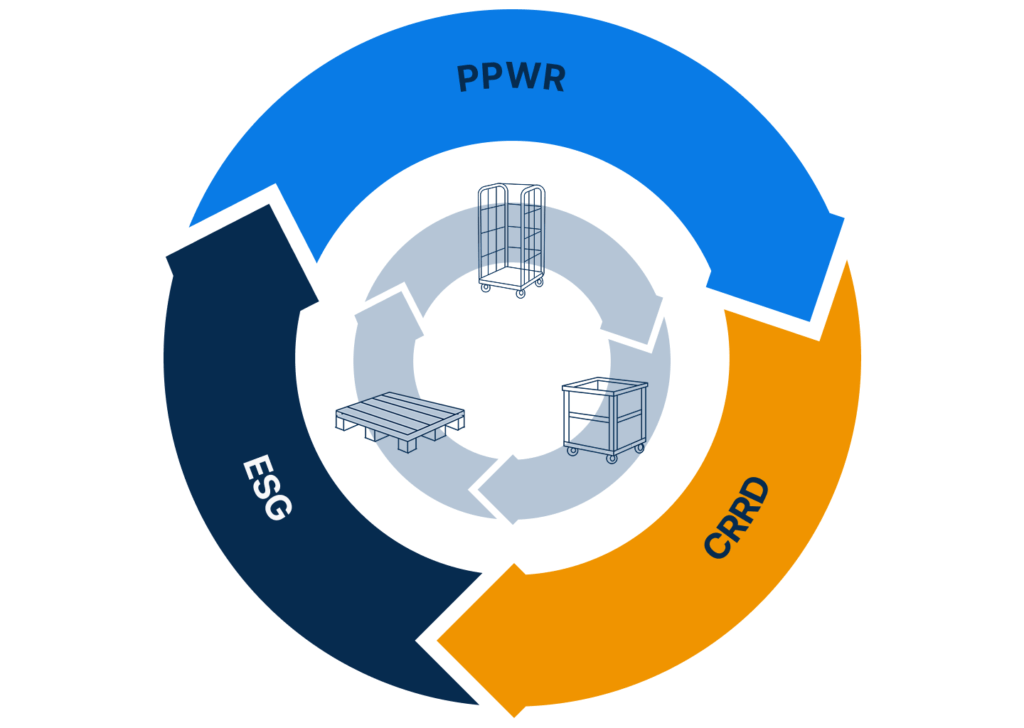

Returnable asset management is no longer just an operational concern. Under emerging global sustainability regulations, returnable assets are now classified as regulated packaging and transport units, placing them directly within the scope of compliance and sustainability enforcement.

The EU Packaging and Packaging Waste Regulation (PPWR) explicitly shifts regulatory focus from packaging intent to measurable reuse, traceability, and lifecycle accountability. The regulation introduces mandatory reuse targets for transport packaging and requires companies to demonstrate actual reuse cycles, not just policy commitments.

This regulatory shift means plastic pallets, roll cages, and specialized carriers are no longer passive logistics assets. Companies will need asset-level evidence to support sustainability and compliance claims, especially for returnable assets used across multiple partners. But many logistics networks still manage returnable assets across fragmented systems, third-party warehouses, and manual reconciliation processes.

Without end-to-end visibility, organizations cannot reliably prove reuse counts, custody transitions, or asset recovery rates. This gap directly undermines compliance with EU PPWR reuse thresholds and broader sustainability in logistics requirements.

McKinsey’s analysis on logistics digitization underscores this challenge, noting that fragmented handovers and disconnected asset data are a major source of waste, reporting inaccuracy, and compliance exposure across multi-party supply chains.

In this regulatory environment, returnable assets will quietly become a latent compliance risk. Loss, undocumented reuse, or inconsistent tracking weakens sustainability disclosures and increases audit risk. In this blog, we’ll examine how sustainability regulations apply directly to RTI fleets, where logistics teams typically fall short, and what it takes to align asset visibility with compliance and sustainability obligations.

How Do Sustainability Regulations Apply to Returnable Assets?

Sustainability regulations do not apply uniformly across all logistics assets. Their scope, obligations, and reporting requirements vary based on asset material, function, and reuse intent. For logistics teams managing mixed RTI fleets, this is where compliance complexity begins.

The Looming Compliance Gaps in Managing RTIs

Across returnable assets usage, the compliance gap is consistent: regulations assume asset-level visibility that most logistics operations do not currently have. Assets move across third parties, cross borders, and circulate for years, yet data remains fragmented across WMS, TMS, spreadsheets, and partner reports.

McKinsey’s research (cited earlier) highlights that fragmented handovers and disconnected data flows are why organizations fail to convert operational activity into compliance-ready evidence. As sustainability regulations mature, this mismatch between regulatory expectations and operational reality becomes a material compliance risk.

Plastic Pallets

Plastic pallets fall squarely under the definition of reusable transport packaging in the EU PPWR. The regulation mandates minimum reuse targets and requires organizations to demonstrate that pallets are actually reused across multiple cycles.

Under PPWR, companies must:

- Track reuse cycles of transport packaging

- Prove recovery and return rates

- Report reductions in single-use equivalents

Plastic pallets, because of their durability and widespread circulation across partners, are expected to face higher scrutiny than disposable packaging due to their measurable reuse potential. Failure to document plastic pallet reuse performance can invalidate sustainability claims, even if pallets are technically reusable.

Roll Cages

Roll cages occupy a more complex regulatory position. While often treated operationally as handling equipment, regulators increasingly view them as transport packaging units when used repeatedly to move goods between facilities, retailers, and distribution hubs.

Legal analysis from Fieldfisher highlights that reusable transport aids like roll cages may fall within the PPWR scope when they:

- Circulate beyond a single facility

- Support distribution rather than internal handling

- Are used across multiple legal entities

This creates a compliance risk where roll cages are widely reused but not formally tracked as regulated packaging assets. Without visibility into movement, custody, and reuse frequency, organizations struggle to substantiate compliance during audits.

Specialized Carriers

Specialized carriers, such as temperature-controlled containers or industry-specific transport units, introduce additional regulatory layers. Beyond PPWR, these assets may be subject to:

- Sectoral compliance requirements (pharma, chemicals, food)

- Extended Producer Responsibility (EPR) obligations

- Materials management and sustainability disclosure under CSRD

EU sustainability frameworks increasingly require companies to link operational data to ESG reporting, including asset reuse, lifecycle impact, and waste reduction outcomes. In practice, this means specialized carriers must be treated as traceable compliance objects.

Compliance & Sustainability in Logistics

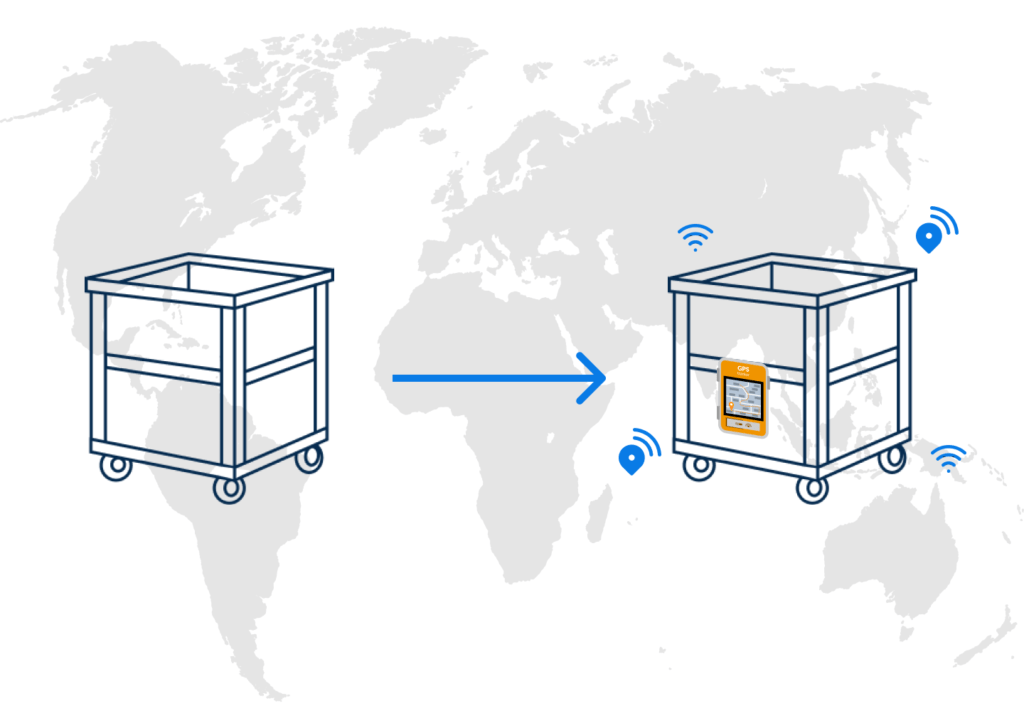

Asset tracking systems were designed to answer operational questions such as where are your assets.

Sustainability regulations such as EU PPWR, however, demand a very different level of proof. They require continuous, asset-level evidence across the entire lifecycle, not intermittent location updates.

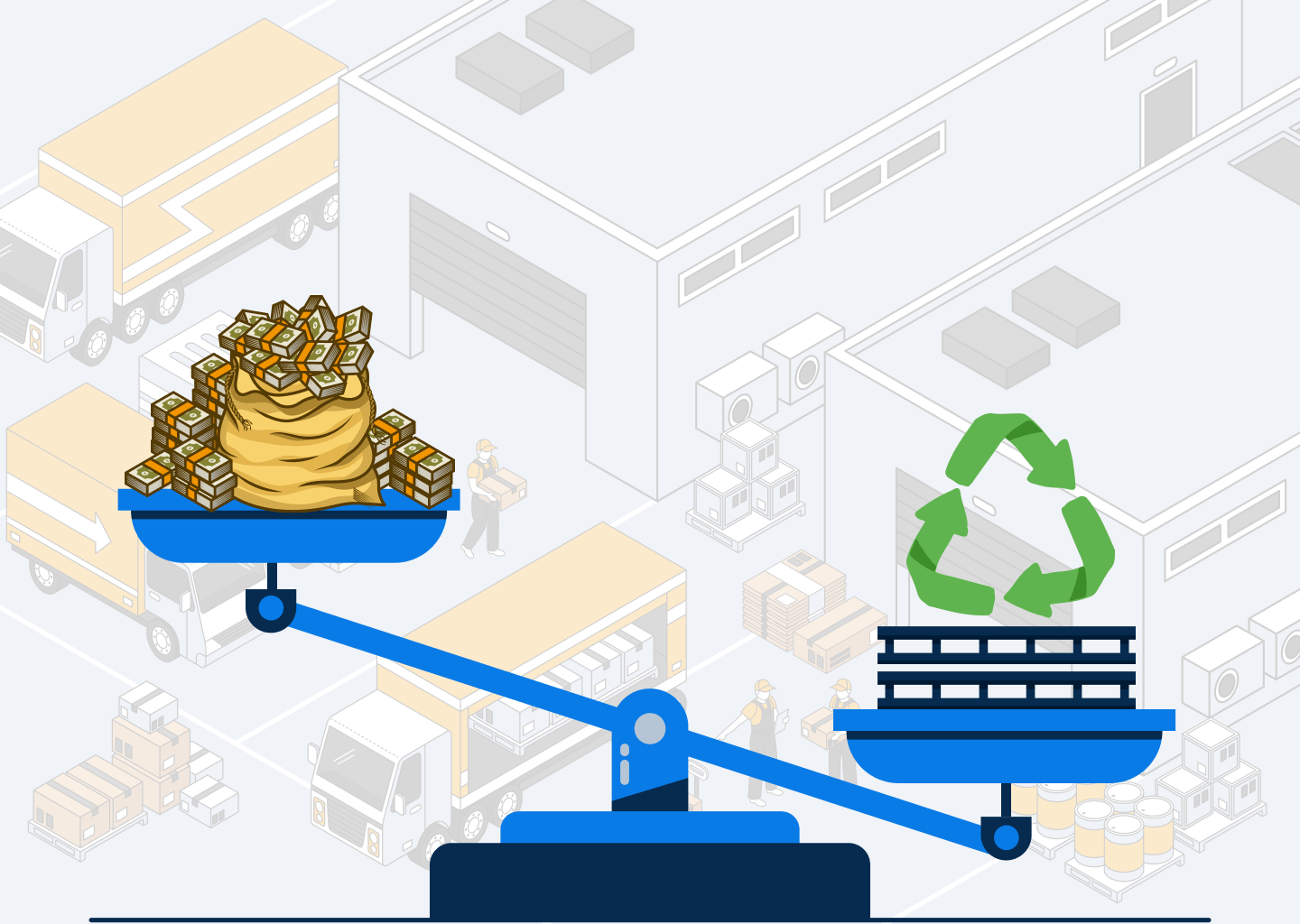

This mismatch is the core reason why many logistics teams struggle to translate tracking investments into compliance-ready reporting. The earlier approach is concerned with operational efficiency. Now the ask is efficiency with sustainability compliance.

Tracking Data Is Rarely Linked to Compliance Context

Sustainability compliance requires evidence that returnable assets remain fit for reuse, are repaired when damaged, and are removed from circulation responsibly.

Most legacy asset tracking solutions treat condition, maintenance, and movement as separate workflows, often managed across different systems or partners. This fragmentation prevents logistics teams from answering basic compliance questions, such as

- Was the asset reused in compliant condition?

- How many reuse cycles occurred before repair?

- When did the asset exit the circular loop?

Disconnected Systems Undermine End-to-End Visibility

Compounding issues further, asset tracking data often lives in isolation from WMS, TMS, ERP, and sustainability reporting systems. As a result, logistics teams must manually reconcile data to create ESG or regulatory reports. KPMG’s supply chain outlook highlights that sustainability compliance increasingly depends on integrated, end-to-end visibility rather than post-hoc reporting assembled from disconnected systems.

Disconnected logistics systems and non-standardized data handovers are primary reasons sustainability metrics cannot be operationalized at scale. This means organizations may track assets but cannot demonstrate control.

Sustainability Regulations Now Expect Observability

Current sustainability regulations implicitly assume observability: the ability to continuously understand asset behavior, not merely record discrete events. This includes:

- End-to-end visibility across partners

- Historical lifecycle records

- Automated evidence generation for audits

- Real-time exception detection

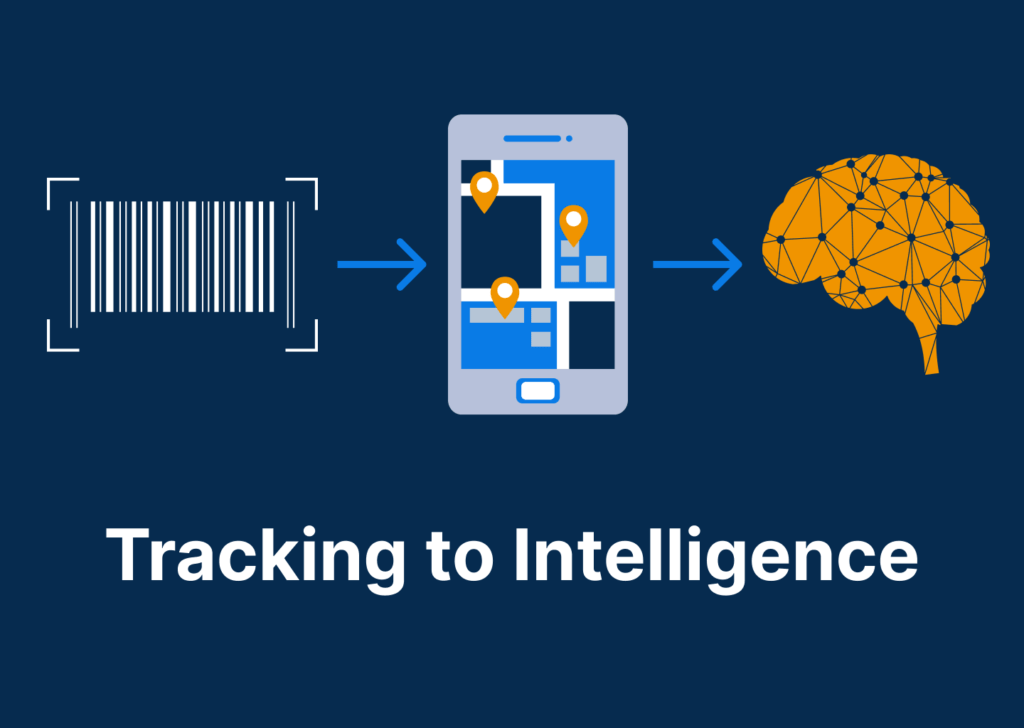

Gartner predicts that logistics KPIs, including sustainability metrics, will increasingly rely on AI-supported analytics because traditional reporting approaches cannot keep pace with regulatory complexity. Existing asset tracking systems were never designed for this role. This is why returnable asset management that meets regulatory compliance now requires a shift from tracking to observability.

How SensaTrak Enables Compliance-Ready, Sustainable Returnable Asset Management

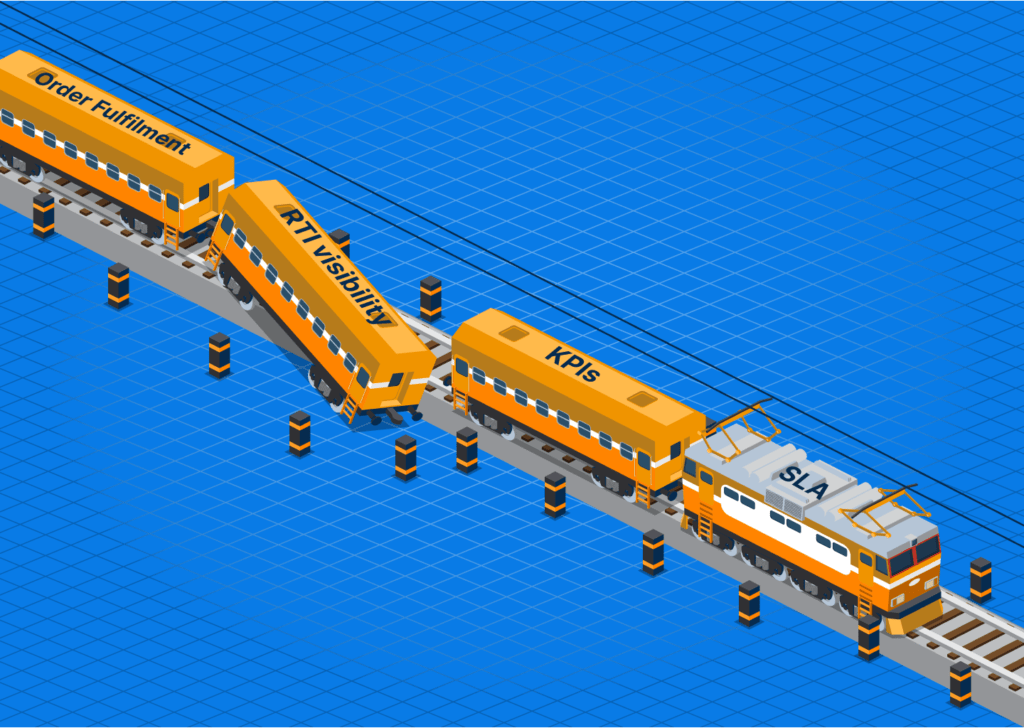

For meeting sustainability & compliance requirements under EU PPWR and other global regulations, merely tracking your assets isn’t enough. It requires the right insights, systems integration, and better reporting that captures the right metrics for audit readiness.

This is where returnable asset management shifts from a logistics function to a more compliance management role. SensaTrak is designed specifically to address the disconnect between returnable asset operations, predictive analytics, and compliance-ready evidence.

We operate as an observability layer for returnable assets, turning movement, condition, and lifecycle data into easily verifiable reports about sustainability and compliance outcomes. Our solution can be scaled gradually with the operations, so the implementation doesn’t break, and you can ensure compliance at 10k or even at 100k assets.