The EU’s new Packaging and Packaging Waste Regulation (PPWR), which entered into force in February this year and will apply from August 2026, sets an unmistakable direction for sustainability reporting: companies must prove reuse, track lifecycle performance, and document the real impact of their transport packaging.

For supply chain and logistics operations that are heavily dependent on returnable transport items (RTIs), returnable transport packaging (RTPs), and reusable load carriers (RLCs), this means sustainability compliance is now a core requirement.

And this comes at a time when packaging regulations, circular-economy targets, and ESG frameworks are tightening across global markets. Eurostat data shows that the EU generated 79.7 million tons of packaging waste in 2023 despite policy efforts over the last decade.

The PPWR legislation is the latest revision to the Packaging and Packaging Waste Directive (PPWD) to more efficiently prevent packaging waste and reduce the environmental impact it causes. The primary goal: All packaging placed on the EU market must be reusable or recyclable by 2030. It covers the entire lifecycle of RTPs/RTIs: from design and production to use, reuse/refill/return, and final recycling or disposal.

PPWR shifts packaging from a nationally interpreted directive to a fully enforceable EU-wide regulation, meaning logistics teams can no longer rely on estimated reuse rates or informal records. Returnable assets such as pallets, crates, roll cages, bulk bins, and cold-chain containers will now have to be treated as sustainability contributors. Under PPWR, Extended Producer Responsibility (EPR), and Corporate Sustainability Reporting Directive (CSRD), these assets now fall directly within the scope of sustainability reporting. Reuse cycles must be validated, loss events must be accounted for as waste, material composition must be transparent, and recyclability must be demonstrated with evidence.

The challenge is that most organizations lack the visibility over their returnable asset fleets to meet these expectations. Reverse-logistics loops remain opaque; partner-site movement is rarely tracked, and idle or underutilized RTIs often go unnoticed. McKinsey’s research highlights that logistics contribute to at least 7% of global GHG emissions. The result is sustainability reports that are incomplete, unverifiable, or disconnected from the actual performance of RTI fleets.

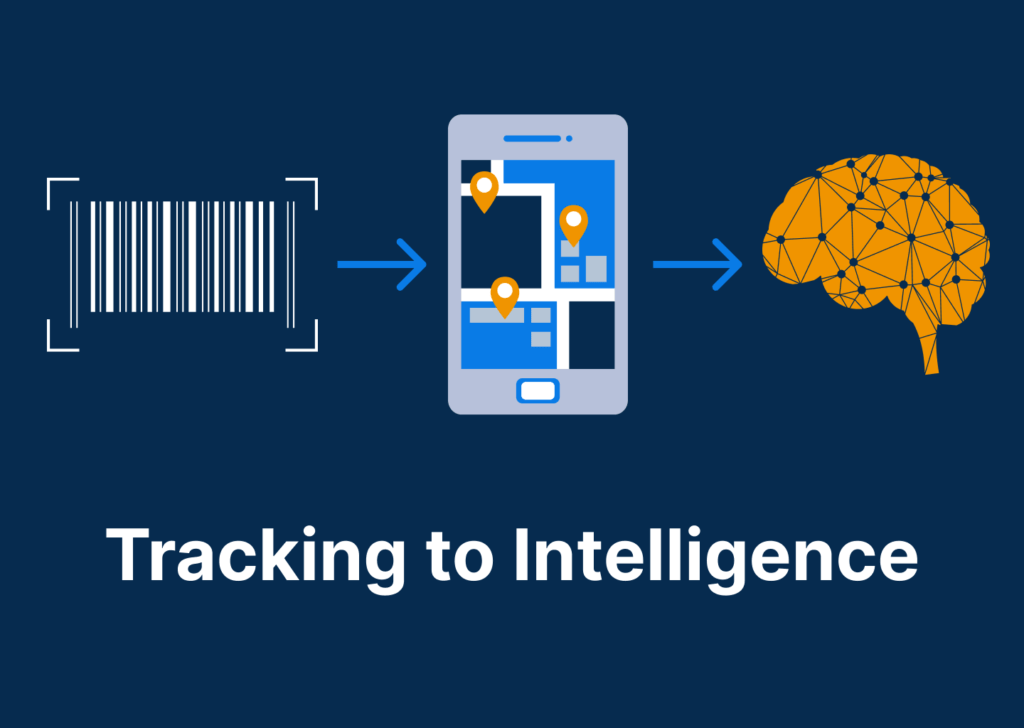

Achieving compliance now depends on observability: the ability to track, document, and analyze every movement, reuse cycle, and lifecycle event across the entire RTI ecosystem. This requires more than manual reconciliation or basic scanning. It demands a data foundation that links tracking technologies with analytics, integrates with WMS/TMS/ERP systems, and creates audit-ready records for regulators, customers, and ESG reviewers. In the sections that follow, we’ll break down the most common gaps in RTI sustainability compliance and how a tracking-first, analytics-led approach closes them.

Why Sustainability Reporting for RTI/RTP Fleets Is Lacking

Most logistics teams acknowledge that the reporting around returnable assets and RTI/RTP fleet utilization often remains incomplete, inconsistent, or sometimes entirely missing. The reason is simple: most organizations do not collect the asset-level data required for compliance and sustainability reporting. Even when they collect asset data, most organizations use spreadsheets, which are ineffective and error-prone.

Without traceability across reuse cycles, reverse-logistics flows, loss patterns, and maintenance events, sustainability metrics have historically often relied on estimates rather than verifiable evidence.

A major gap stems from how sustainability compliance has been approached. Under earlier frameworks, companies could aggregate data and report high-level outcomes. PPWR, however, requires material-level and reuse-cycle reporting, pushing companies to document the actual lifecycle performance of their returnable assets. Which means most logistics operations still lack the infrastructure needed for this level of documentation.

Returnable assets frequently move through multi-tier supplier networks, partner warehouses, customer sites, and 3PL hubs where scanning practices vary widely. Reverse-logistics flows remain one of the least digitized segments of supply chains, which results in untracked reuse cycles, unknown dwell times, and inaccurate loss classifications. PPWR’s design-for-recycling and recyclability targets require companies to maintain full material transparency and lifecycle traceability, something manual logs and spreadsheets cannot support at scale.

Another major blind spot is the lack of reporting around loss and underutilization. Lost RTIs/RTPs and idle stock both carry a measurable carbon cost: replacement manufacturing, usage spikes, and added transport emissions. Packaging waste in the EU has increased steadily over the last decade, largely due to fragmented returnable asset tracking, insufficient reuse, and poor return-flow efficiency. Without visibility into how often RTIs/RTPs are reused, repaired, lost, or prematurely scrapped, organizations cannot accurately demonstrate compliance with PPWR, EPR, and CSRD frameworks.

Sustainability compliance for RTIs/RTPs breaks down because the data foundation breaks down. Without serialization, telemetry, and integrated observability, organizations cannot deliver the asset-level insight required for regulatory reporting, ESG disclosure, or circular-economy measurement. This is where digital tracking and predictive analytics platforms become essential: they transform what has traditionally been invisible operational equipment into verifiable sustainability assets.

Where Current Systems Fail to Support RTI/RTP Sustainability Compliance

Sustainability reporting for reusable asset fleets does not sit in isolation. It’s tightly coupled with a growing stack of regulatory expectations that are pushing packaging and transport systems toward circular supply chains.

For returnable assets, including plastic pallets, roll cages, containers, and drums, guidance from legal and industry analyses highlights mandatory reuse thresholds: from 2030, at least 40% of such packaging must be reusable, increasing toward 70% by 2040, with 100% reuse required for movements between sites of the same company within a member state. These targets implicitly demand granular insight into RTI/RTP fleets: how many units are in circulation, how often they are reused, where they are lost, and when they are replaced.

Under EPR, producers and brand owners must fund the full cost of collecting, sorting, treating, and recycling packaging waste. Compliance standards are increasingly being modulated based on recyclability grades and recycled content, meaning that poorly managed RTI/RTP systems with high loss/low reuse rates carry a direct financial penalty. Packaging that goes missing in the field or is prematurely scrapped counts as packaging waste, influencing both cost and reported environmental impact. For logistics teams managing reusable asset fleets, this makes loss, underutilization, and poor return flows not just operational issues but regulated cost drivers.

At the same time, wider ESG and climate frameworks are pulling returnable assets and packaging into Scope 3 emissions, which especially matter to FMCG companies. CSRD further strengthens expectations for value-chain transparency and lifecycle data, requiring large companies in the EU to disclose detailed, verifiable information on how their activities, including transport and packaging systems, affect environmental performance. In practice, this means RTI/RTP fleets must be visible enough to support defensible calculations of reuse-driven emission savings, material avoidance, and waste reduction.

As regulators and stakeholders look for tangible improvements, returnable transport systems are an obvious lever. But without strong RLC tracking and observability, most RTI/RTP fleets cannot provide the data needed to demonstrate real progress, leaving logistics teams exposed to compliance risk, escalating EPR fees, and gaps in ESG reporting.

Returnable Asset Management Failure Points Logistics Teams Miss

Most logistics systems were never built to track the full lifecycle of returnable transport items. As regulations demand asset-level data, traditional processes fall short because they cannot document reuse cycles, return flows, condition changes, or loss events. The result is sustainability reporting that is incomplete and often unverifiable.

1. Lack of Serialized Identification

- Many returnable assets circulate without unique IDs.

- No serialization means no measurable reuse cycle, no loss attribution, and no defensible lifecycle data.

2. Fragmented IT Systems

- WMS, TMS, ERP, and pooling systems remain siloed.

- Return movements, dwell times, and handling events do not synchronize across platforms.

3. Manual Processes Create Reporting Gaps

- Spreadsheets, emails, and physical audits dominate RTI reconciliation.

- These cannot support the granularity, frequency, or audit reliability required under PPWR, EPR, or CSRD.

4. No Integrated Condition or Maintenance Tracking

- Damage, contamination, repairs, and scrappage events often go unrecorded.

- Companies cannot justify end-of-life decisions or compute waste from premature disposal.

5. Reverse Logistics Is Still Opaque

- Returnable assets move across partner sites with inconsistent scanning and no unified observability.

- Leads to untracked losses, prolonged idle time, and inaccurate reuse counts.

Another major pain point for organizations is limited in-house expertise in data alignment, observability, and compliance. Logistics teams often lack the technical expertise required to integrate asset tracking data across WMS, TMS, ERP, pooling, and 3PL systems.

Observability implementation across a supply chain tech stack requires specialized skill sets that most in-house teams do not possess. There is a high market demand but low availability of professionals who understand returnable asset tracking technologies, data enrichment processes, legacy system integrations, and regulatory reporting principles of regulatory frameworks. As a result, even teams with access to asset telemetry struggle to transform raw data into audit-ready, compliance-grade sustainability compliance.

What Accurate Sustainability Reporting Requires & How Observability Enables It

Accurate sustainability reporting for returnable asset fleets depends on capturing complete, verifiable lifecycle data. To meet sustainability reporting expectations, reporting systems must be built around asset-level traceability rather than aggregated operational summaries.

A complete reporting model starts with serialization and digital identification, enabling every plastic pallet, roll cage, or specialized container to be recognized as a unique asset. This foundational step allows logistics teams to track reuse cycles, return flows, dwell times, damage events, and scrappage decisions with precision. Accurate sustainability reporting also requires material-level documentation, including recyclability grades, recycled content, and end-of-life handling, all critical components under PPWR’s design-for-recycling and traceability criteria. Beyond basic tracking, reporting must reflect cycle counts, loss attribution, repair events, idle inventory volumes, and return delays, because these factors directly influence carbon savings, circularity metrics, and EPR-related costs.

This level of detail is only possible when observability is embedded into asset management. Observability links tracking telemetry, system integrations, and data enrichment to create a unified lifecycle record for each RTI. By integrating WMS, TMS, ERP, pooling systems, and partner-site data, an observability layer reconstructs the full journey of every asset: where it moved, how long it stayed idle, when it was reused, and when it required maintenance or replacement.

When enhanced with analytics and AI, observability enables circular supply chains at scale that have end-to-end visibility. Machine-learning models can project asset lifespan, identify reuse bottlenecks, and quantify the emissions impact of extending or shortening asset life. Predictive analytics also help teams right-size returnable asset fleet sizes, reduce unnecessary procurement, and avoid overinvestment, all of which contribute to measurable sustainability improvements. Most importantly, observability transforms operational data into audit-ready sustainability outputs, including reuse-cycle verification, carbon-savings calculation, waste-generation records, and compliance reporting.

In essence, accurate RTI/RTP sustainability compliance is the result of having the infrastructure to observe, validate, and interpret asset behavior across every movement zone. Without serialization, telemetry, analytics, and integrated lifecycle visibility, reporting remains incomplete. With observability, organizations gain the evidence, transparency, and asset circularity insight regulators now expect.

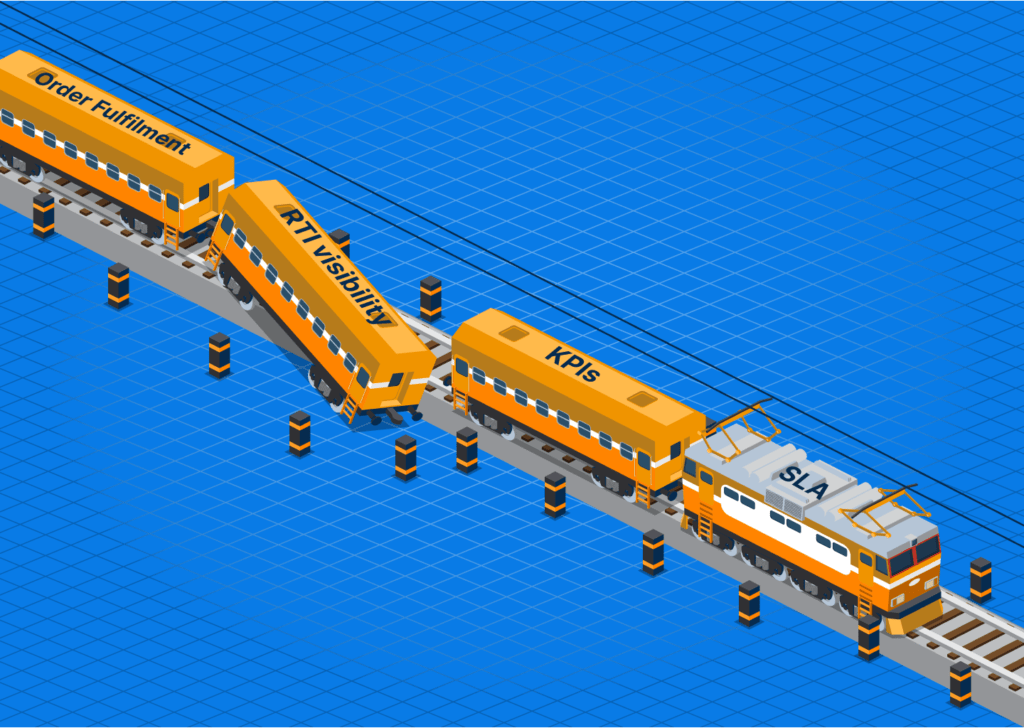

How SensaTrak Enables Reliable RTI/RTP Sustainability Compliance

SensaTrak closes the visibility and data-quality gaps that make sustainability reporting difficult. By combining serialized tracking, an observability-led approach, and a predictive analytics platform, SensaTrak creates a unified lifecycle record for every returnable asset. This allows logistics teams to capture the essential data required under PPWR, EPR, and CSRD without disrupting operational workflows.

Our platform integrates seamlessly with existing WMS, TMS, ERP, and 3PL systems, reconstructing asset movement across warehouses, transit lanes, and customer sites. Predictive analytics further enrich lifecycle insights by forecasting asset degradation, identifying underutilization, and highlighting inefficiencies that inflate carbon and cost. SensaTrak transforms raw tracking data into audit-ready outputs: verified reuse-cycle logs, waste-generation reports, carbon-savings calculations, and circularity indicators aligned with regulatory expectations.

For organizations facing growing compliance pressure, SensaTrak provides the capability that legacy systems cannot: a transparent, evidence-based view of the entire RTI/RTP ecosystem. With observability, every asset movement becomes measurable, every reuse cycle becomes verifiable, and every sustainability metric becomes defensible. This gives logistics teams not only a clearer operational picture but also a reliable foundation for meeting regulatory, customer, and ESG obligations.