Asset tracking and management today is about far more than deploying asset trackers.

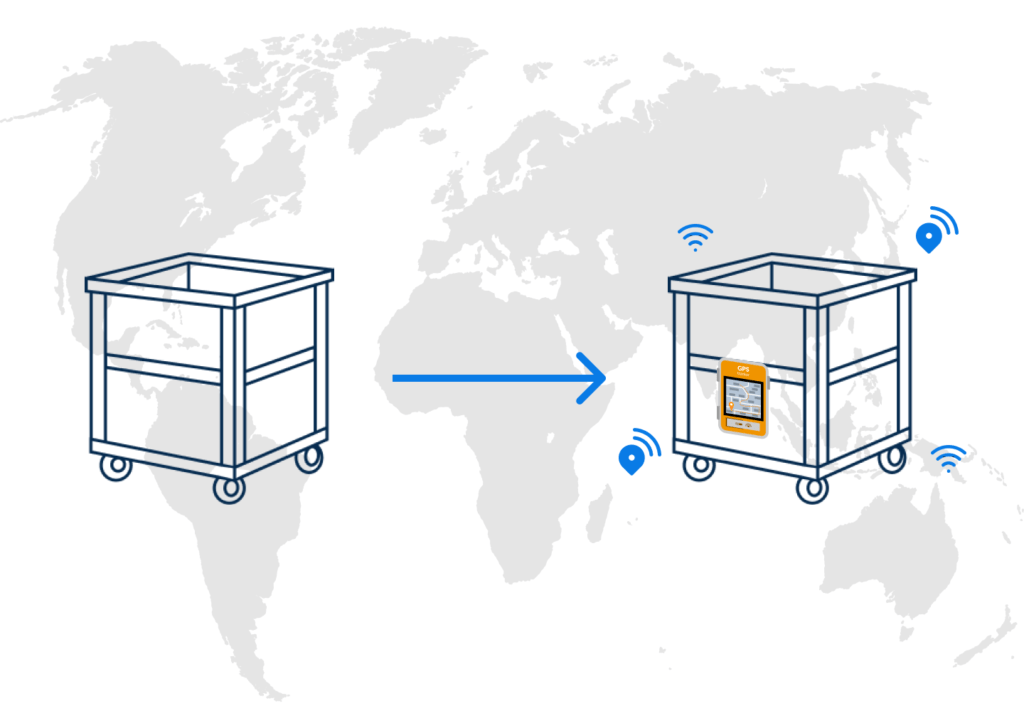

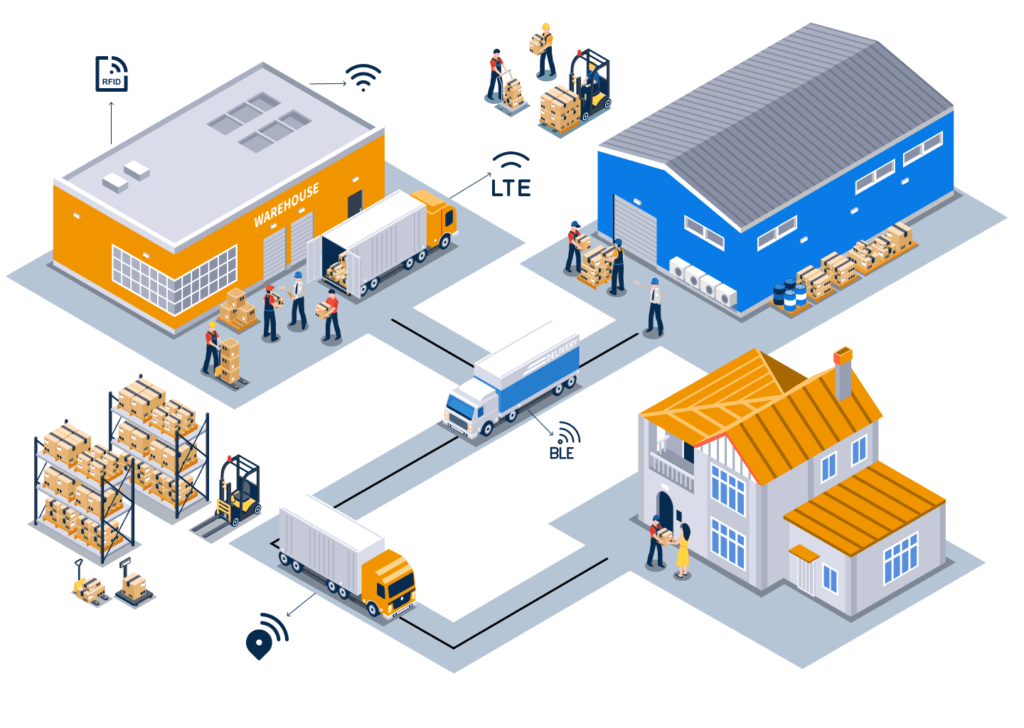

Trackers for returnable assets or reusable load carriers (RLCs) have existed for years and have evolved significantly, moving from simple GPS trackers, BLE beacons, or plain RFID tags into IoT-enabled devices with multiple capabilities.

Modern RLC trackers can now track and locate assets both within internal facilities and while in transit, providing near real-time data and feedback loops that were not possible with earlier generations of tracking technology..

For many logistics teams, this already represents a major improvement over manual registers, barcode scans, or periodic audits.

The next layer builds on this foundation through analytics. Today’s asset tracking platforms increasingly provide insights such as current asset location, historical routes, dwell times, idle asset identification, and utilization patterns.

These metrics help logistics teams answer operational questions they deal with daily:

- “Where are the assets accumulating?”,

- “Which location has more idle assets?”,

- “How long an asset has been idle?”, and

- “Are fleets being underused or overstretched?”

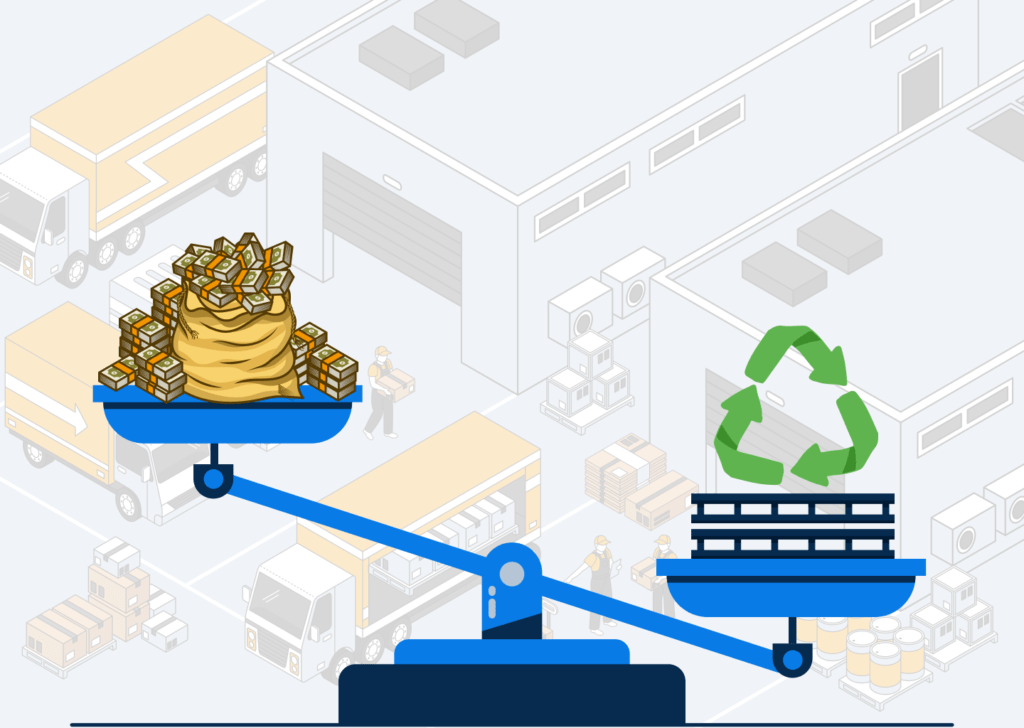

However, despite this progress, returnable asset management still falls short of delivering consistent operational and financial outcomes.

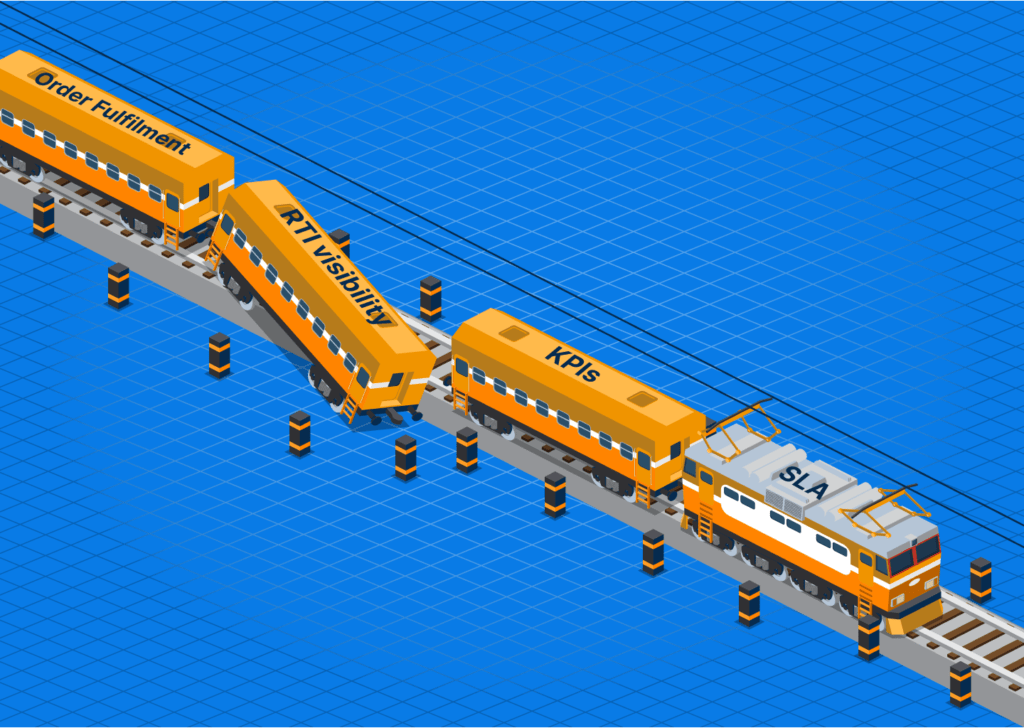

There are four major gaps in the current asset tracking and management approach:

First, while asset trackers often combine multiple technologies, they are still not optimized to perform reliably across all environments, particularly when assets move between indoor facilities, outdoor yards, and long-haul transport routes.

Second, the data captured by many rlc trackers remains too coarse, focusing on location events without sufficient context around handling, condition, or asset state.

Third, analytics capabilities are often limited to descriptive reporting rather than deeper observability. Most systems tell teams what happened, but not why it happened or what is likely to happen next. The use of observability concepts and AI-driven models to correlate movement, dwell time, condition, and behavior across the asset lifecycle remains early and fragmented.

Finally, even when data and analytics exist, poor integration with existing WMS, TMS, ERP, and partner systems prevents these insights from translating into measurable efficiency gains on the ground.

This gap between tracking technology and true asset management is where most returnable asset programs stall, leading to the five major structural problems that logistics teams face.

Moving from asset trackers to comprehensive asset tracking & management requires addressing all four of these missing pieces together, not in isolation.

That shift is what defines the next phase of returnable asset tracking and management.

The Reality of RLC Trackers Today

Asset tracking and management for returnable assets has moved beyond basic identifiers, but most asset trackers in use today are still designed around limited assumptions.

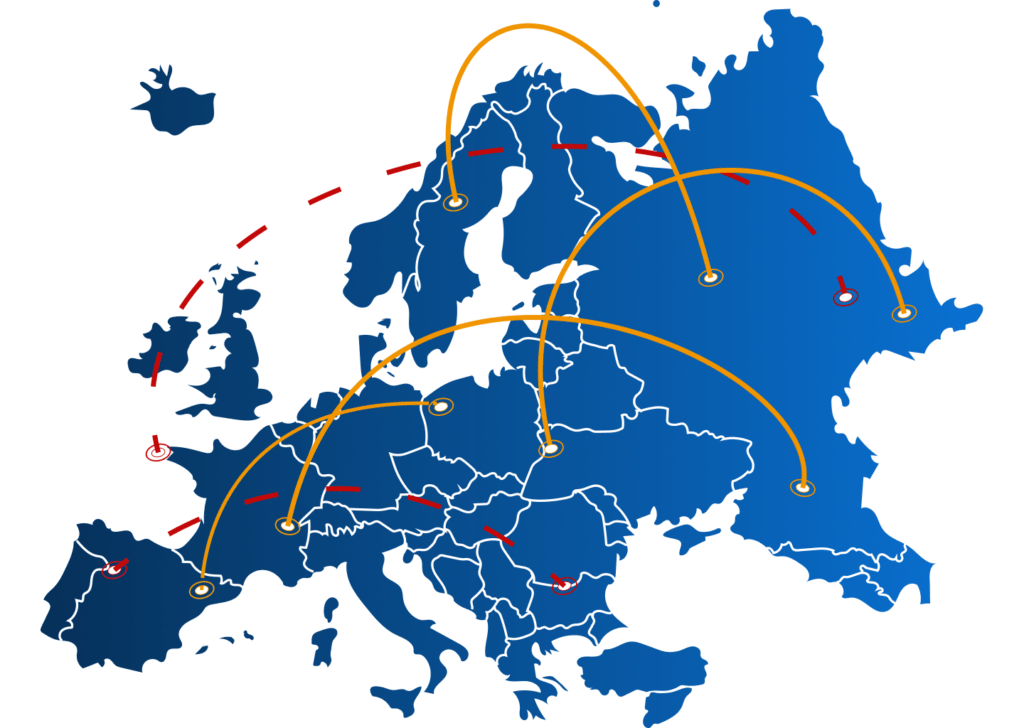

Many rlc trackers are built to give real-time location but not for continuous asset tracking and monitoring across long reuse cycles, multiple partners, and mixed logistics environments.

As a result, organizations struggle to translate tracking data into meaningful asset management outcomes.

Hardware durability and battery life remain core constraints, especially for RLC trackers deployed on pallets, roll cages, and other returnable assets. These assets experience frequent handling, shock, outdoor exposure, and extended idle periods.

Short battery cycles, device failures, and maintenance dependencies introduce data gaps that break continuity across the asset lifecycle, undermining long-term asset tracking and management programs.

Connectivity further limits the effectiveness of asset tracking solutions. In the harsh conditions that returnable assets go through, tracking data is delayed or transmitted intermittently, which means asset visibility often arrives after operational decisions have already been made.

Even when location data is available, most asset trackers provide limited operational context. Location-only asset tracking does not reveal whether returnable assets are idle, wasted, damaged, or misused.

Without deeper monitoring of asset state and usage, logistics teams struggle to explain losses, underutilization, or premature write-offs. Partial deployments and sampling of RLC trackers further distort planning and hide real cost drivers.

SensaTrak’s asset trackers are designed for long, reuse-heavy asset cycles rather than short, point-to-point shipments. The asset trackers combine BLE, LTE, Wi-Fi and GPS and are built to operate reliably across mixed environments including warehouses, yards, transit routes, and cross-border movement.

The trackers capture not just location, but temperature, humidity, shock and tamper alerts for a complete picture.

They are engineered for extended battery life, resilient hardware, and intelligent data handling that prioritizes continuity over raw signal volume.

Analytics: Asset Visibility Without Intelligence

Today’s asset visibility is fragmented. Logistics teams can see where these assets were last detected, review historical movement, identify basic dwell times, and flag idle assets.

On paper, this is progress. But then, the analytics largely remain descriptive, offering visibility into what happened rather than indicators of potential anamolies from historic data.

This gap becomes clear in day-to-day operations. Asset tracking and monitoring dashboards often surface location and route history, but they rarely explain why assets are accumulating at specific sites, which handoffs are causing delays, or how asset behavior differs across partners and regions.

The data exists, but it is not structured to answer operational questions that logistics teams care about. For example, knowing that a pallet or roll cage has been idle for ten days is useful only if teams can understand whether that delay is expected, acceptable, or a signal of loss or misuse. Most current analytics do not provide this context. They report metrics, but they do not surface patterns, exceptions, or emerging risks early enough to act on them.

Another limitation is that these insights are often built on incomplete data sets. Sampling-based tracking, delayed transmissions, and inconsistent coverage mean that insights are derived from partial visibility.

This is why observability is important. Traditional asset tracking analytics focus on reporting states. Observability, by contrast, focuses on understanding behavior over time by correlating signals across the asset lifecycle.

SensaTrak’s platform is designed with this distinction in mind.

Instead of treating location, dwell, and movement as isolated metrics, it connects them to asset state and usage patterns, enabling logistics teams to move from passive visibility to informed decision-making.

It creates not just more visibility, but a more intelligent systems where assets are monitored and proactively managed to reduce operational losses.

Integration Gaps That Break Asset Tracking and Management

In most logistics environments, asset tracking and monitoring platforms operate in isolation, while operational decisions continue to be made inside WMS, TMS, ERP, and partner systems.

For returnable assets, this fragmentation is especially damaging. Location and movement data from RLC trackers may exist, but not connected to shipment records, inventory states, yard operations, or customer handoffs.

Very often, logistics teams manually reconcile tracking data with operational systems to understand asset availability, delays, or shortages.

Without seamless system integration, tracking data remains underutilized. Teams may know that an asset is delayed or idle, but they consequently always react with a delay.

SensaTrak addresses this by treating integration as a core design requirement. Our platform is built to connect asset monitoring signals with WMS, TMS, and ERP environments, allowing insights to surface within the workflows logistics teams already use.

This closes the loop between visibility and action, building much better feedback loops between the data & signals, asset insights and the operational actions taken to remedy situations.

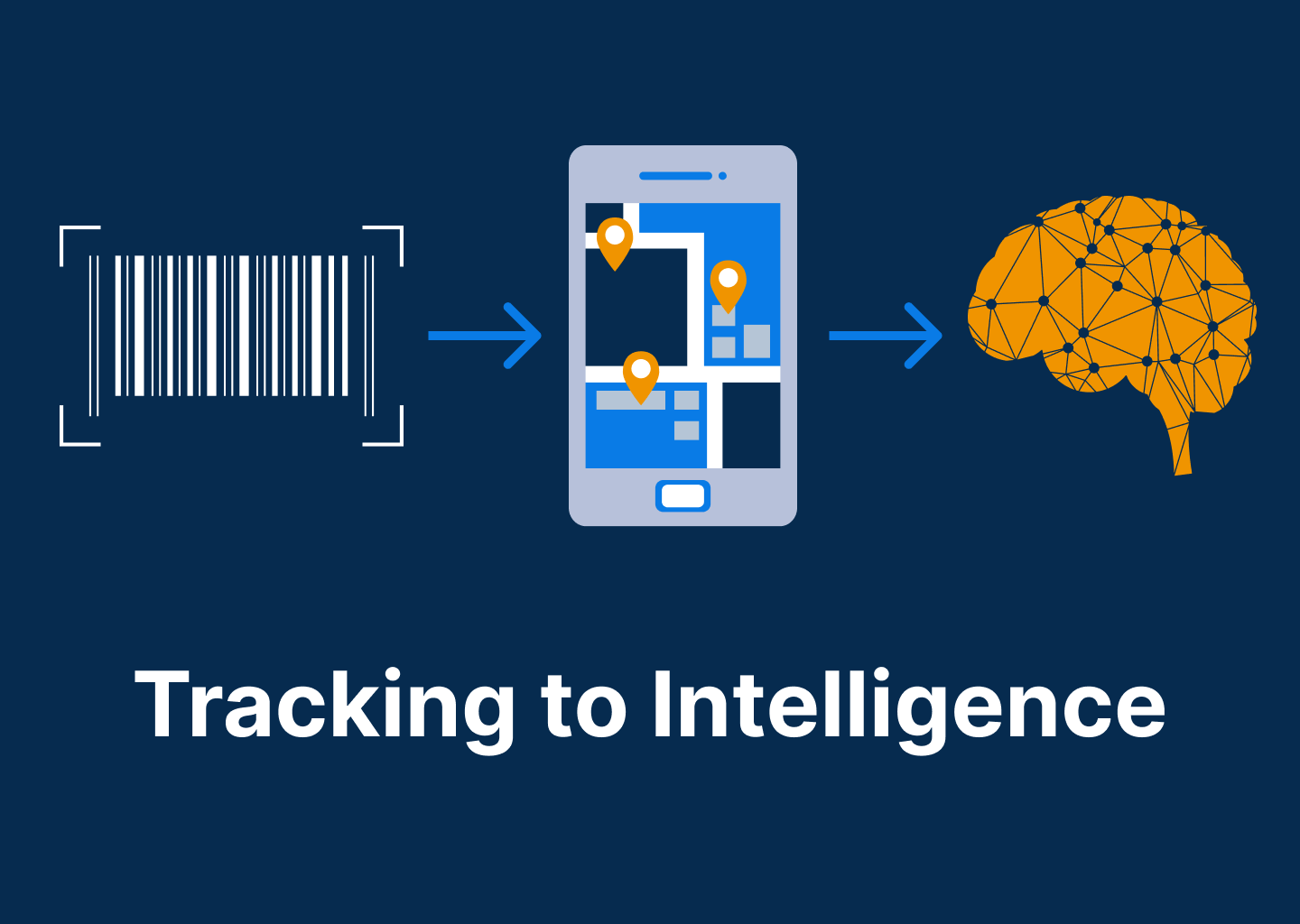

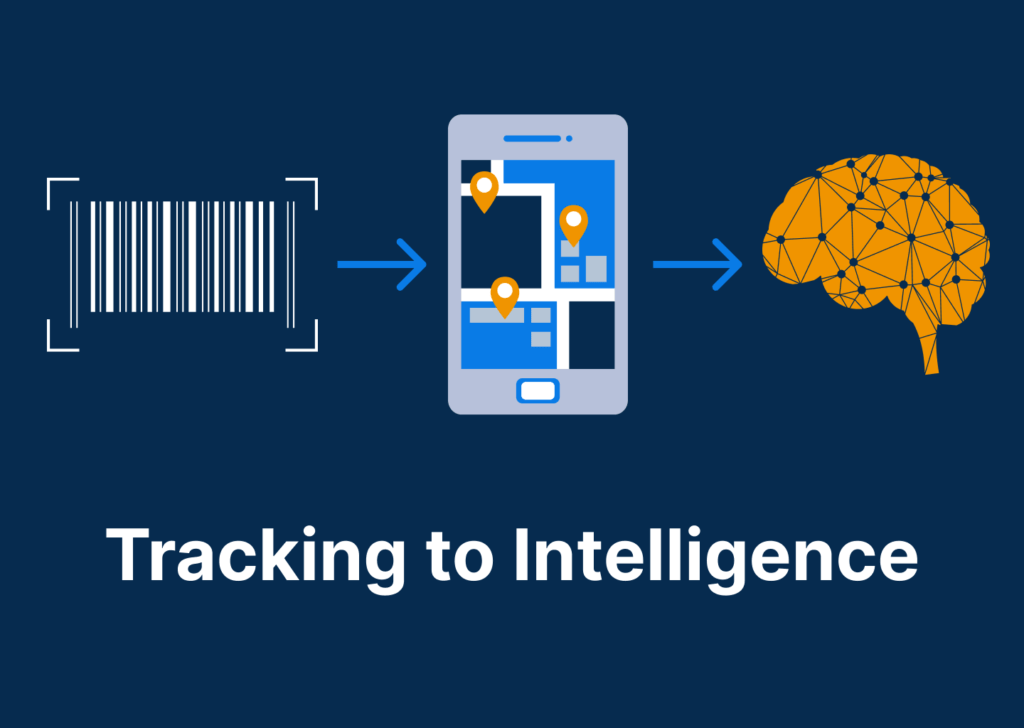

From Asset Tracking to Asset Intelligence

When asset trackers, analytics, and integrations operate in silos, asset tracking and management remains fragmented. Trackers confirm movement, analytics describe past states, and operational systems continue to function independently.

This setup delivers only visibility but not full control over your assets.

Asset intelligence begins when these layers work together.

Tracking data must be continuous enough to follow assets across environments.

Analytics must move beyond reporting to explain behavior, surface exceptions, and support timely decisions.

Integrations must ensure that insights flow directly into WMS, TMS, and ERP workflows where actions are taken.

By fixing the problems in these three aspects of returnable asset management, SensaTrak offers more intelligent operations and a better RoI from your returnable assets investment.